In the last week, Stellar (XLM) has seen a significant increase of approximately 34%, showcasing robust bullish energy. Currently, the coin is trading in a crucial range, with potential resistance at $0.47 and support at $0.41. As investors watch and wait, they are eager to see what the next step will be for Stellar.

As a crypto investor, I’ve noticed that the recent surge in value has been fueled by a golden cross formation. However, the signals from the Commodity Channel Index (CCI) and Daily Moving Average (DMI) suggest that the upward trend might be weakening. If Stellar Lumens (XLM) manages to breach the resistance at $0.47, it could potentially aim for $0.51 or even reach as high as $0.60. But if it fails to maintain support at $0.41, there’s a risk of a significant correction occurring.

XLM Remains in an Uptrend, but Sellers May Take Over

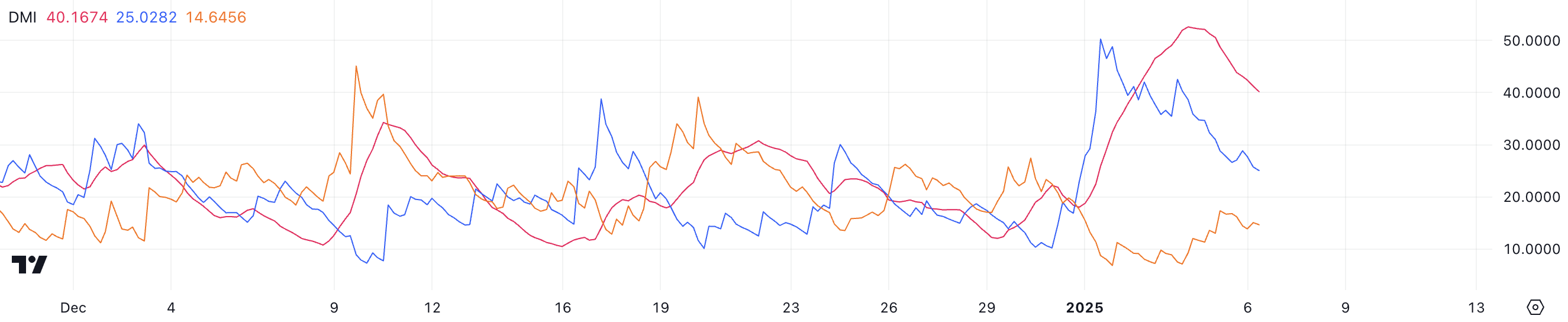

right now, the Average Directional Index (ADX) for XLM is at 40.1, showing a robust trend. However, it has dropped from 52.6 just two days ago. The ADX scores the strength of a trend between 0 and 100, with readings over 25 signifying strong trends, and values below 20 suggesting weak or non-existent momentum.

Regardless of the recent drop, the ADX (Absolute Strength Index) continues to stay above the 25 level, signaling that Stellar’s uptrend persists, even if the pace of growth seems to be slowing down a bit.

In the past two days, the indicator that shows buying pressure (the +DI) has decreased from 40.3 to 25, whereas the one measuring selling pressure (the -DI) has increased from 7.9 to 14.6.

This transition indicates that although buyers continue to hold sway, they are gradually losing influence as sellers start to make headway. If this pattern persists, the upward trend for XLM may become less pronounced, possibly leading to a stabilization or even a reversal of direction, unless the buying pressure significantly increases.

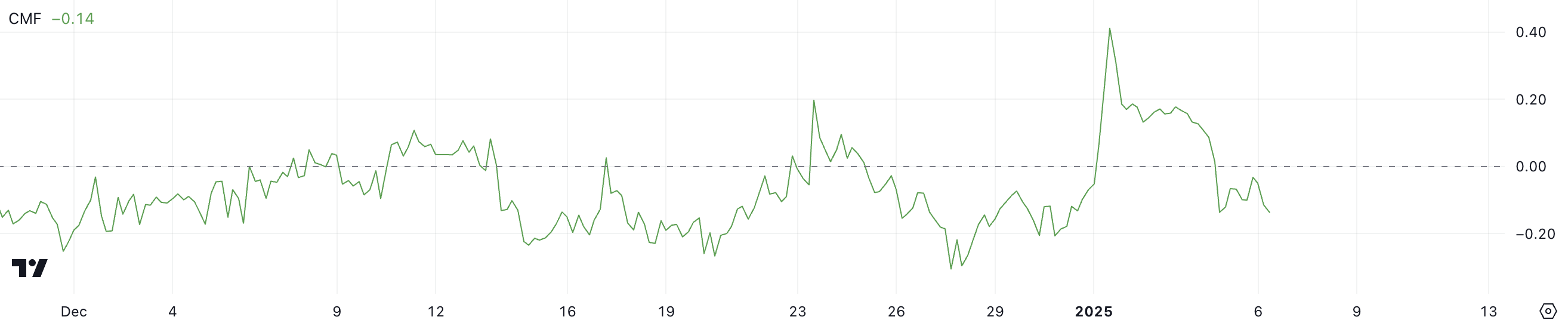

Stellar CMF Is Down From Its Highest Value In One Year

For Stellar (XLM), the Chaikin Money Flow (CMF) stands at -0.14, signifying a notable change from its yearly high of 0.41 on New Year’s Day. This peak was the highest CMF value recorded in the past twelve months. The Chaikin Money Flow gauges the inflow and outflow of funds into an asset by considering both price and volume. A CMF above 0 indicates a dominant buying trend, while values below 0 signal a predominant selling trend.

A shift from significant investments to more withdrawals, as indicated by the stellar move into negative territory, suggests a change in investor attitudes or market sentiment.

The drop we’re seeing indicates that demand to sell XLM is greater than the demand to buy it at the moment, potentially causing its price to decrease in the near future. Moreover, as the Chaikin Money Flow (CMF) has plummeted from 0.17 two days ago to its current level, this trend suggests a decline in investor confidence.

If the Cash-to-Market Factor (CMF) stays low or decreases further, the Stellar Lumens (XLM) price may encounter more downward movement. On the flip side, if the CMF recovers and moves back into positive territory, this could indicate renewed investor interest, which might help to stabilize or even raise the XLM price.

XLM Price Prediction: Can Stellar Reclaim $0.60 In January?

The EMA (Exponential Moving Average) lines for XLM have recently signaled a ‘golden cross’ on January 1st, which has been instrumental in its recent price increases. At the moment, XLM is being traded between a level of $0.47 acting as resistance and a support at $0.41. Previous attempts to surpass this resistance have found it challenging, serving as an obstacle.

Should the $0.47 barrier be surpassed, it’s possible that the Stellar price may climb to around $0.51. If the bullish trend continues to gain strength, it could even challenge the resistance at $0.60.

Despite indications from the CMF and DMI pointing towards a potential softening of the upward trend, if the $0.41 support level weakens, XLM’s price might experience a substantial decline, possibly reaching as low as $0.35 or even dipping to $0.31.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-01-06 19:46