As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself both intrigued and cautiously optimistic about Stellar’s recent price surge. The rapid increase in XLM‘s value over the past week is certainly impressive, reaching levels not seen since December 2021.

In the last 24 hours, Stellar’s (XLM) value has skyrocketed by more than 20%, and it has increased an astonishing 124.86% over the past week, hitting $0.30 – a price not seen since December 2021. This dramatic climb is fueled by robust bullish sentiment, as evidenced by technical indicators such as RSI, which persists in the overbought territory.

In simpler terms, the comparatively low Capitalization of Money Flow (CMF) implies that the current upward trend might not be strong enough to continue its growth without additional investments. The future direction of XLM, whether it will reach a $10 billion market cap or experience a possible correction, hinges on how effectively it maintains crucial support levels in the coming days.

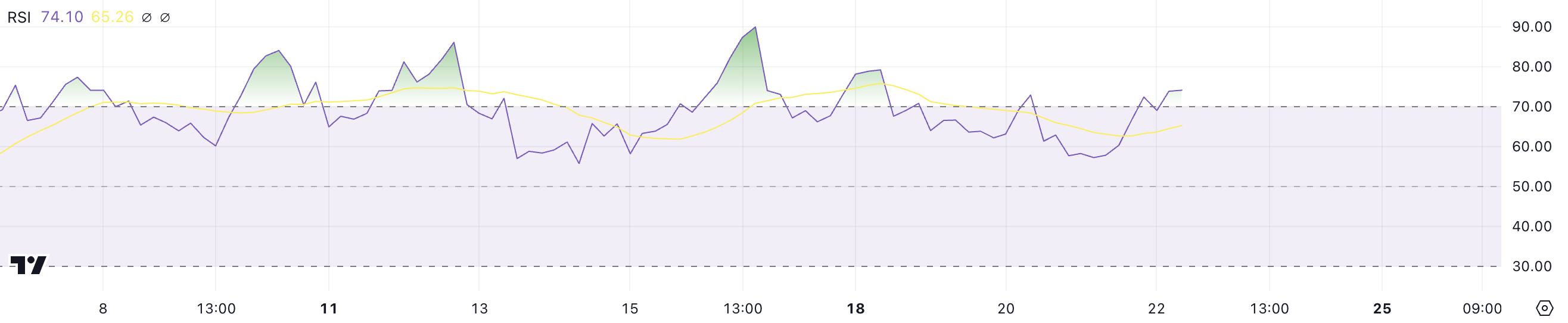

XLM RSI Is In The Overbought Zone

The Relative Strength Index (RSI) of Stellar has surged to 74.10, significantly rising from below 60 a day ago. This rapid rise suggests robust bullish energy, propelling XLM towards the overbought region, where RSI values exceeding 70 suggest elevated buying enthusiasm.

When the Relative Strength Index (RSI) exceeds 70, it usually indicates a potential reversal or correction might occur. However, this level also signifies intense investor optimism fueling the ongoing bullish trend.

The Relative Strength Index (RSI) gauges how quickly prices are changing and how big those changes are. Values over 70 suggest the market is overbought, meaning it might be due for a drop, while values below 30 indicate an oversold state, possibly signaling a potential rise. In Stellar’s past, there have been extended periods when its RSI stayed above 70 for multiple days. During these times, the price kept rising before eventually experiencing a correction.

It implies that though we should be careful, the present state of being overbought doesn’t automatically lead to an immediate reversal. Instead, there might be potential for the rally to continue expanding before it starts to slow down.

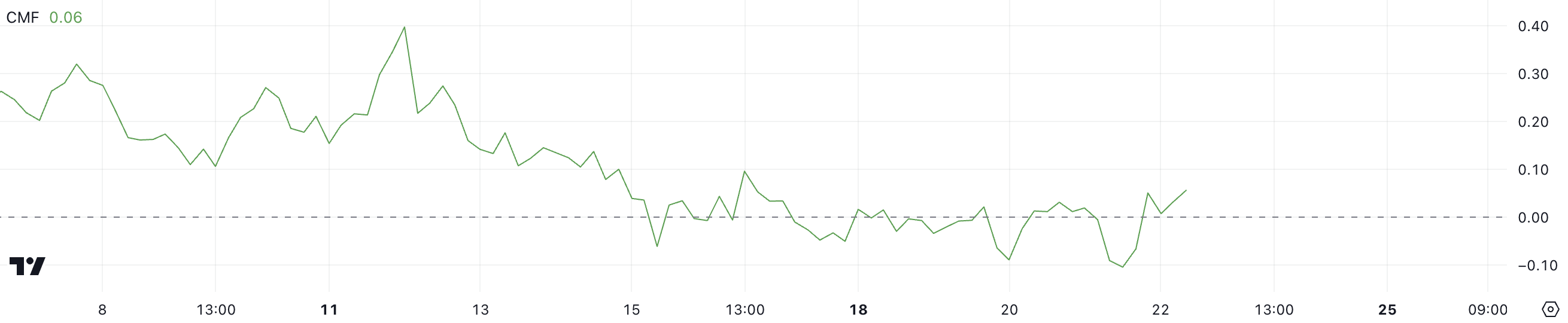

Stellar CMF Is Positive But Not That Strong Yet

Currently, Stellar Lumens (XLM) shows a Capital Movement Factor (CMF) of 0.06, rebounding from -0.10 the day before. This change towards positive numbers suggests that capital is flowing back into this asset, implying renewed buying interest following previous selling actions.

Conversely, the comparatively small CMF suggests that the current inflow is still weaker than during previous times of intense bullish energy.

The Chaikin Money Flow (CMF) calculates both the movement and quantity of funds flowing into or out of a security, where positive scores signify an increase in investment (a bullish trend), while negative figures show a decrease (a bearish one).

Although a positive change in XLM’s Composite Money Flow (CMF) indicates a potential improvement in its short-term trend, it’s worth noting that the CMF is still significantly lower than the peak of 0.40 it reached in mid-November, and it has not sustained levels above 0.10 for an extended period since then.

XLM Price Prediction: Can Stellar Reach The $10 Billion Market Cap Threshold?

If Stellar continues its upward trajectory, it may climb higher with a potential market capitalization of $10 billion. Reaching this level would necessitate a 15.7% rise in the value of XLM, indicating persistent bullish strength and heightened investor enthusiasm.

On the other hand, since the Current Market Factor (CMF) is rather modest, it seems that the present trend might not have enough power to maintain its upward momentum.

If the current trend changes, the price of XLM might initially encounter its most robust nearby support around $0.14. However, if this support level doesn’t hold up, Stellar’s price could plummet by as much as 67%, potentially reaching $0.0994 – a significant decrease from recent peaks.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-11-22 16:39