As a seasoned analyst with over a decade of experience in the cryptocurrency market, I must admit that Stellar’s (XLM) recent surge has been nothing short of impressive. Having witnessed numerous bull and bear markets, I can confidently say that this rally is one for the books.

In just the past month, Stellar’s (XLM) price has skyrocketed by over 400%, making it one of the largest gains in November. Having peaked at $0.63, which is its highest value since the start of 2021, XLM may now experience a period of stabilization as its technical indicators suggest a potential weakening trend.

In spite of recent developments, the upward trend persists, fueled by robust market demand and optimistic feelings. Should XLM recover its pace, it could potentially aim for $0.70, further boosting its impressive rise.

XLM Current Trend Is Losing Its Strength

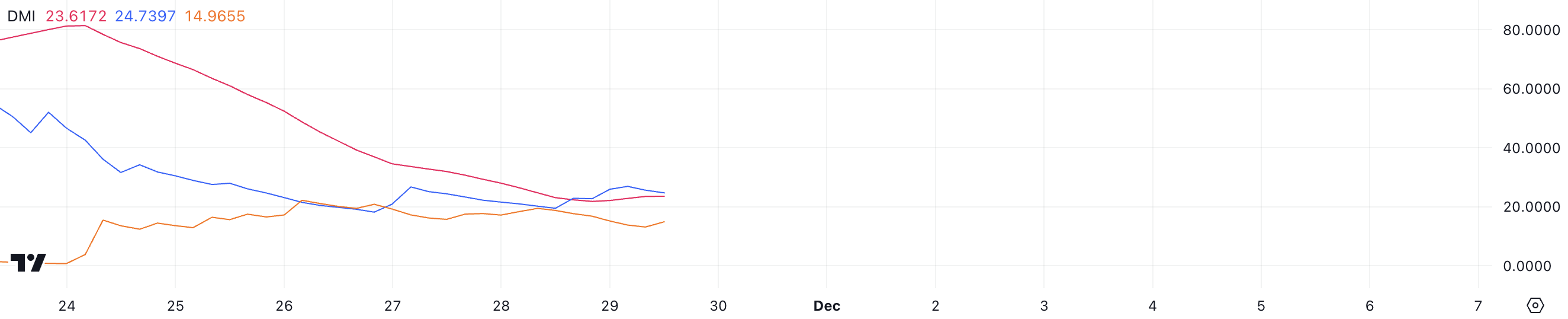

A notable decrease in the ADX value from around 40 to 23.6 on the DMI chart suggests that the strength of the current trend is diminishing. The ADX, which stands for Average Directional Index, assesses the intensity of a trend, ranging from 0 to 100, without specifying its direction. A value above 25 signifies a robust trend, whereas a value below 20 indicates a weak or non-existent trend.

Even though the price of XLM continues to rise, the decreasing Average Directional Movement Index (ADX) suggests that the momentum behind this increase is weakening. This could indicate a pause or even a possible shift in the upward trend, towards consolidation or a slowdown in bullish activity.

As an analyst, I’m observing a favorable trend in XLM’s market movement. Specifically, the Positive Directional Indicator (D+) stands at 24.7, while the Negative Directional Indicator (D-) is at 14.9. This suggests that the bullish momentum remains strong, as the buying pressure currently overshadows selling pressure, a condition that supports the continuation of the uptrend.

To restore its power, the ADX should rise over 25 again, indicating increased momentum. If it doesn’t, the Stellar price might only experience moderate growth or a time of stability.

Stellar CMF Has Been Negative for 3 Days

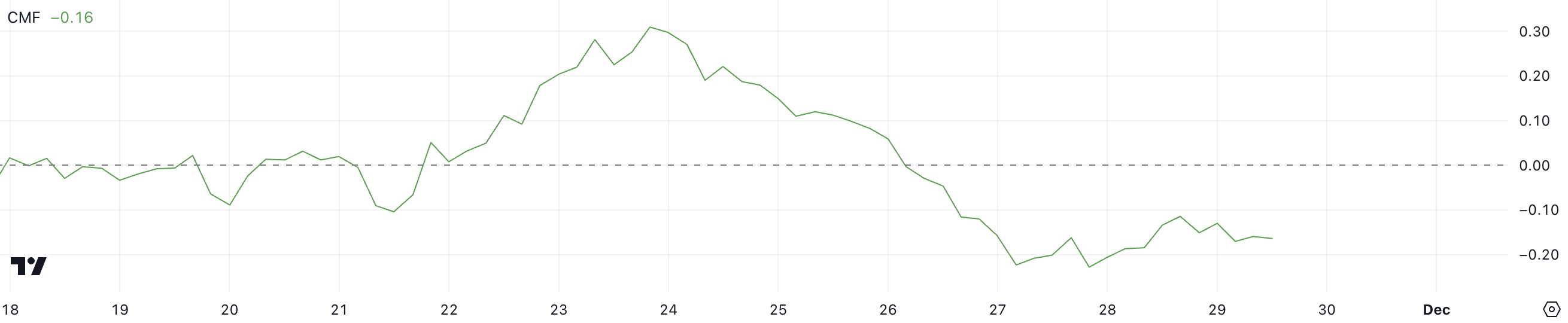

Currently, the Chaikin Money Flow (CMF) of XLM is at -0.16, showing a continuous downward trend since November 26, following four consecutive days of positivity. The CMF is a tool that gauges the flow of capital in and out over a specific timeframe; values above zero imply buying pressure, while values below zero suggest selling pressure is dominant.

A CMF value less than zero indicates more selling transactions than buying ones, potentially causing a decrease or halt in the ongoing upward trend.

As a researcher, I observe that at the -0.16 point, the Stellar Cumulative Market Function (CMF) suggests a moderate level of selling pressure. This could potentially dampen its recent bullish momentum. However, it’s important to note that this value indicates a shift in sentiment, but it’s less intense than the more extreme negative levels witnessed during stronger corrections.

If the Capital Movement Function (CMF) continues to decrease, this might indicate a lessening upward momentum and boost the chance for a price decline. On the flip side, should it revisit positive regions, it would underscore increasing buying interest and reinforce further price advancements.

XLM Price Prediction: Can It Reach $0.7 In December?

As an analyst, I’ve noticed a significant surge in Stellar’s price, reaching $0.63 – its highest point since the beginning of 2021. This bullish momentum is truly impressive to witness. Furthermore, XLM has seen a remarkable increase of approximately 433.84% over the past month.

As an analyst, I’m observing the current market trend of XLM, and if it strengthens further, there’s a strong possibility that the price will challenge the existing resistance level. If this happens, we might see XLM reaching $0.70, which represents approximately a 37% increase from its current value.

But if the upward trend weakens and buying pressure decreases, the price of XLM might change direction. Under such circumstances, the token could challenge its crucial support at $0.41, a level that is important for it to preserve its medium-term bullish stance.

Failing to maintain this support might indicate a more significant downtrend, potentially weakening the current optimistic trendline.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-30 01:53