Oh, Stellar (XLM), you had such a glorious run earlier this year, didn’t you? Now, after a solid dip of 16.1% in the past month, 8.2% this week, and another 1.7% in just the last 12 hours, it’s safe to say that Stellar’s luck may be running out. Despite some impressive yearly gains-around 300%, not that we’re complaining-the signs aren’t looking too hot for the token right now. Sellers might have the upper hand. 🙄

For those of you holding on to your Stellar bags for dear life, brace yourselves. The next few sessions might just determine whether Stellar can hold the line, or if it’s heading for a serious faceplant. 🍿

Derivatives Weakness Cuts Support

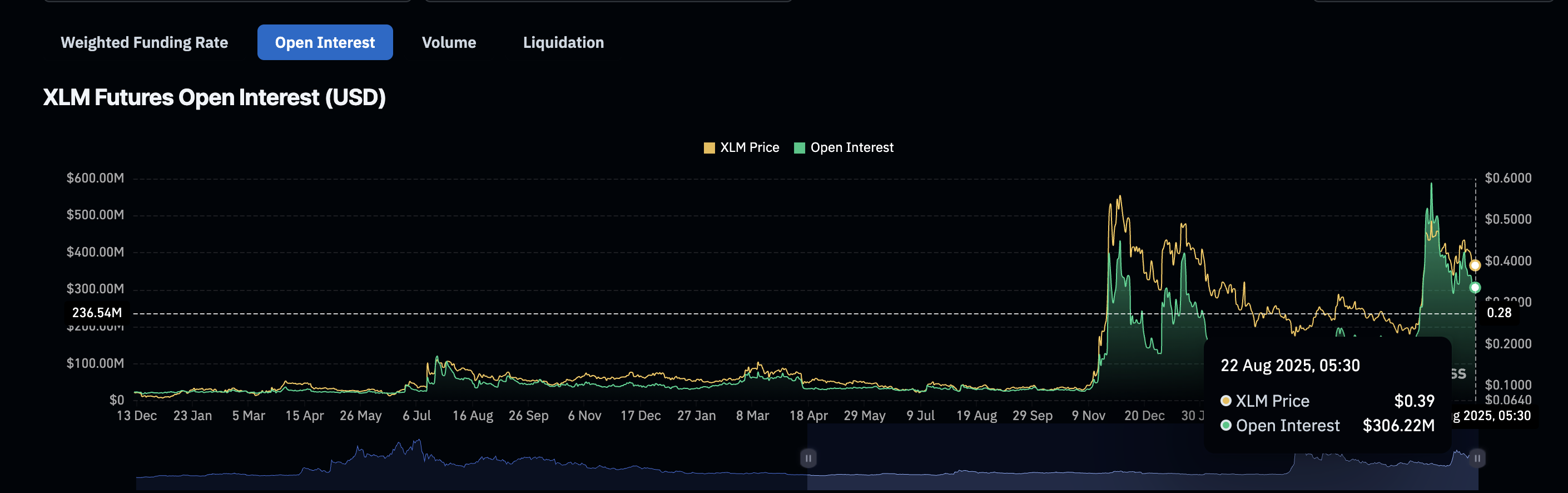

Let’s start with some fun: the derivatives market. It’s like the underdog in a Rocky movie-always looking to take the champion down. When open interest (the value of active futures contracts) is high, traders can swing prices like a wrecking ball. But when that interest drops, well, it’s like someone took the air out of the balloon. 🎈

Back on July 18, Stellar’s open interest hit a thrilling $588.53 million, propelling the price upwards. But, hold your applause! That leverage build-up was swiftly followed by a 50% drop, now sitting at just $306.22 million. With fewer contracts in play, the chances of another bullish squeeze are looking slimmer than a pancake. Pancakes are good, but not for price action. 🥞

Less leverage means more room for spot selling to take over, which sounds about as fun as a rainstorm during your summer picnic. ☔

For more riveting token updates like this one: Want to stay ahead of the crypto curve? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bearish Crossover(s) Build Pressure

Now let’s talk charts, because who doesn’t love some good technical analysis to spice up your day? On smaller timeframes, we’ve got a negative shift in momentum. It’s like the scales tipping just when you thought everything was fine. 😬

The 12-hour Stellar price chart shows the 20 EMA (that red line) slipping below the 50 EMA (orange), and folks, that’s a classic bearish sign. Sellers are starting to take the wheel on this one. 😈

But wait, there’s more: on the 4-hour chart, the 50 EMA is dangerously close to crossing under the 200 EMA (deep blue line). It’s like the 200 EMA is holding the door open for the 50 EMA to slip in and mess everything up. This happened earlier this month, and we saw a dip-could it be déjà vu? 👀

Exponential Moving Averages (EMA) aren’t just any averages. They give more weight to recent prices, so they’re snappier than a fast-food order. A bearish crossover means the market’s shifting into “sellers have control” mode. Fasten your seatbelts. 🔧

Triangle Pattern Points To Stellar Price Breakdown Risk

On the daily chart, Stellar seems to be stuck in a descending triangle pattern, which, surprise surprise, is a bearish continuation pattern. It’s like the price is pushing up against flat support levels, but it’s just not budging. 🏔️

Right now, Stellar’s sitting at $0.39, just above some critical support levels at $0.38 and $0.36. If those give way, don’t be shocked to see a nosedive toward $0.23-a whopping 40% drop from where it is now. Yikes! 😱

So, Stellar is now under pressure from all sides: plummeting derivatives activity, bearish crossovers on short- and mid-term charts, and a triangle pattern that’s just waiting to explode. In short, it’s like a storm cloud is hovering over the price. 🌩️

For those brave enough to buy the dip, here’s the magic number: if the price closes above $0.43, it could break out of the triangle and cancel this whole bearish mess. But until that happens, sellers are still calling the shots. 🤑

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-08-22 19:19