Once, Cleveland-Cliffs (CLF) wandered the steel industry’s periphery, a supplier in a labyrinth of furnaces and mills. Acquisitions, those alchemical transmutations, transformed it into a titan of North American metallurgy. Yet whether this colossus is a “no-brainer” play depends on whether you seek a labyrinth’s heart or a mirror’s clarity.

The Alchemy of Verticality

Cleveland-Cliffs, now a vertically integrated steelmaker, owns its own inputs-iron ore, the lifeblood of its furnaces. Its operations, however, are bound to the ancient rites of blast furnaces, where fire and iron yield profit only when the market’s tides are favorable. Steel prices, those fickle winds, dictate the company’s fate. Prosperity flows in cycles, but so too does ruin, a pendulum of molten iron and red ink.

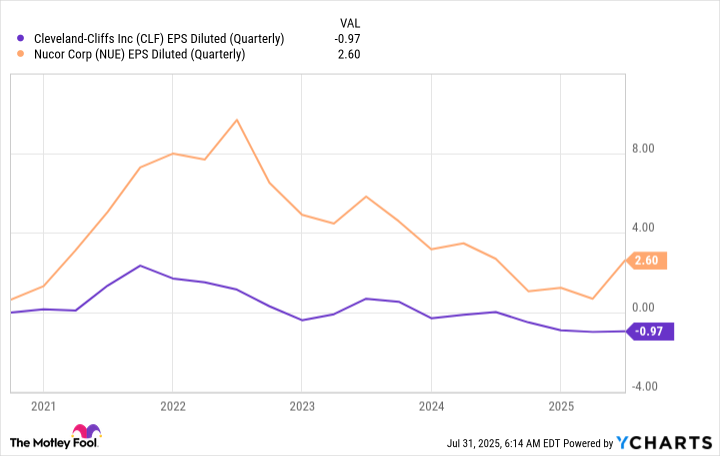

Consider the blast furnace: a relic of industry, its high operating costs a yoke that tightens in lean times. When demand wanes, Cleveland-Cliffs bleeds. Its peers, like Nucor (NUE), navigate the same labyrinth with electric-arc mini-mills-nimble, adaptive, their margins a steady hum through the cycle’s dissonance.

Nucor, a Dividend King crowned by decades of annual hikes, mirrors stability. Its margins, like a well-worn path, resist the labyrinth’s traps. Cleveland-Cliffs, by contrast, is a maze of boom and bust, where the reward for navigating its depths is steeper gains-but the price of misstep, a fall into the abyss.

The Cartographer of Cycles

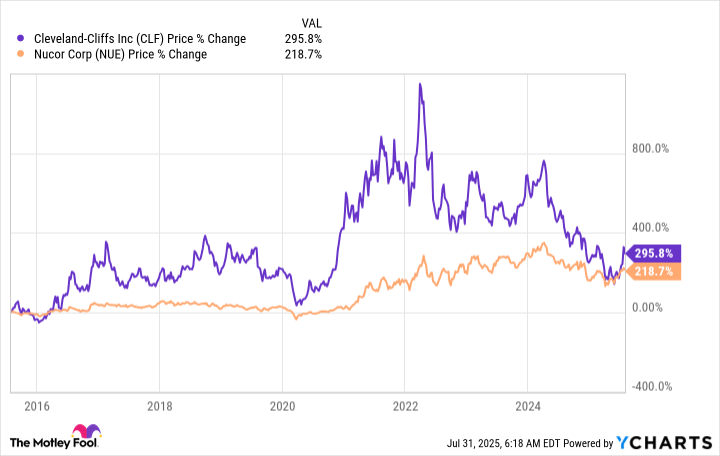

Steel is a cyclical art, its seasons dictated by forces as unknowable as the Library of Babel’s infinite shelves. To invest in it is to chart a course through a shifting labyrinth, where timing is both compass and curse. Nucor, with its steady hand, offers a path for the long-term traveler. Cleveland-Cliffs, however, tempts the gambler who believes they can divine the cycle’s turning.

The stock chart of Cleveland-Cliffs is a map of paradoxes. When the steel market rebounds, its shares soar-yet when the cycle turns, the descent is often sharper. To hold it long-term is to embrace a recursive game: profit in the boom, peril in the bust. The astute investor must decide: Are they a cartographer, or merely a wanderer?

In the end, Cleveland-Cliffs is not a no-brainer play but a riddle posed by the market. It demands a mind attuned to the labyrinth’s rhythms, willing to trade simplicity for the thrill of the unknown. For those who prefer the mirror’s reflection of Nucor’s stability, the answer is clear. But for the bold, the path through Cliffs’ furnace remains-a test of nerve and insight. 🔮

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-06 21:08