As a seasoned crypto investor with a keen interest in the stock market, I’ve witnessed my fair share of ups and downs. Today’s revelation from Starbucks Corp (SBUX) about their disappointing fiscal Q2 2024 results has piqued my curiosity.

In an interview with Jim Cramer on CNBC’s “Squawk on the Street” today, Starbucks Corp (NASDAQ: SBUX) CEO Laxman Narasimhan shared candidly about the company’s underperforming fiscal Q2 2024 results. Yesterday, Starbucks released a comprehensive press statement, offering insights into the intricacies and necessary strategic shifts the company is making to tackle these difficult circumstances.

As a crypto investor, I’d interpret Starbucks’ financial report this way: The coffee giant reported a 2% decrease in its consolidated net revenues, which came in at $8.6 billion. This decline is attributed to a challenging operating environment, according to the company. In terms of earnings per share, GAAP earnings were reported at $0.68, representing a substantial drop from the previous year. The GAAP earnings per share saw a 14% decrease, while Non-GAAP earnings per share experienced an 8% decline.

Key performance highlights from the fiscal second quarter include:

- Global Comparable Store Sales: There was a 4% decline overall, driven by a sharp 6% decrease in transactions but partially offset by a 2% increase in average ticket prices.

- North American Performance: Comparable store sales in North America fell by 3%, with transactions down 7%, though mitigated slightly by a 4% rise in average ticket prices.

- International Markets: International comparable store sales saw a 6% decrease, with an 11% decline in China due to significant drops in both ticket prices and transaction volumes.

The business further grew, adding 364 new stores in total to its global network, resulting in a grand total of 38,951 stores – a combination of those the company directly managed and franchised locations.

The operating margin shrank by 240 basis points to 12.8%, according to GAAP (Generally Accepted Accounting Principles). This contraction was chiefly driven by heightened expenses related to partner wages, benefits, and promotional initiatives in Starbucks stores. In spite of these obstacles, Starbucks remains dedicated to its strategic vision and is actively pushing forward with the “Triple Shot Reinvention with Two Pumps” plan. This initiative aims to reinvigorate the brand and foster long-term growth.

Starbucks’ US customer base for its Rewards loyalty program grew by 6%, reaching a total of 32.8 million active members within the past 90 days. This expansion underscores the robustness of Starbucks’ customer engagement tactics in the face of larger market difficulties.

In a tough economic climate, the Starbucks CEO noted that this quarter’s performance did not fully showcase the strength of our brand, our potential, or the prospects in store for us. He emphasized the thorough strategies and action plans we have prepared to maneuver through current complications.

Rachel Ruggeri, the CFO, likewise emphasized the importance of financial prudence and strategic planning. She underscoreed the corporation’s dedication to managing capital wisely and enhancing operational productivity as they navigate through fluctuating market scenarios.

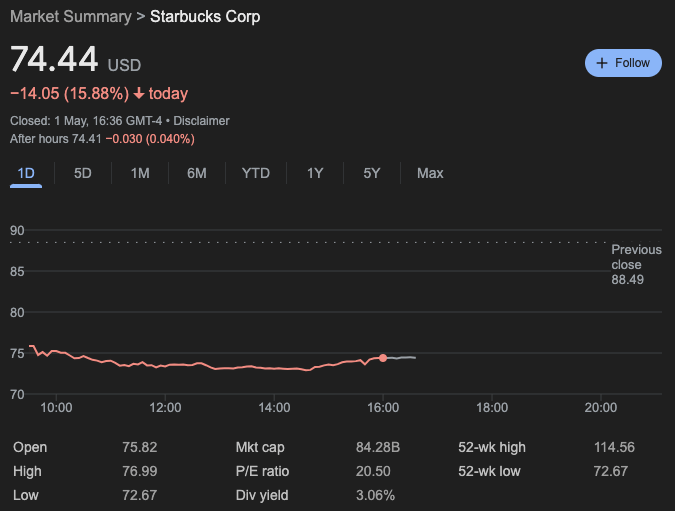

The Starbucks share price closed at $74.44, down 15.88% on the day.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2024-05-01 23:48