The matter of Starbucks, that ubiquitous purveyor of caffeinated beverages, is not merely a tale of commerce, but a reflection of the restless spirit of our age. For years, the company has navigated a sea of shifting tastes and expectations, a vessel steered by a succession of captains, each attempting to chart a course towards enduring prosperity. Four chief executives in as many years suggests a turbulence within, a striving for a stability that has long eluded them. Now, with Brian Niccol at the helm, one observes a tentative calm, a possibility that the ship may yet find its bearing.

It is a curious thing, this human desire for a ‘third place’ – neither home nor work, but a sanctuary in between. Starbucks, in its ambition, once sought to fill this void. Yet, in the relentless march of digitization, the very notion of such a place seemed to fade, a quaint anachronism in a world obsessed with immediacy. Niccol, however, appears to be revisiting this concept, not by clinging to the past, but by reshaping it, by acknowledging the evolving needs of a clientele accustomed to swiftness and convenience. He does not seek to be the third place, but to facilitate the experience of finding one’s own.

The recent financial reports, while not a triumphant fanfare, offer a glimmer of hope. Revenue has increased, a modest 6%, and comparable sales, too, have seen a rise, albeit a gentle one. Yet, the earnings per share have declined, a consequence of Niccol’s ambitious investments. He is, in effect, sacrificing present gain for future promise, a strategy not without risk, but one that speaks to a long-term vision. It is a gamble, certainly, but one that, if successful, could yield a bountiful harvest. One cannot build a lasting estate on fleeting profits alone.

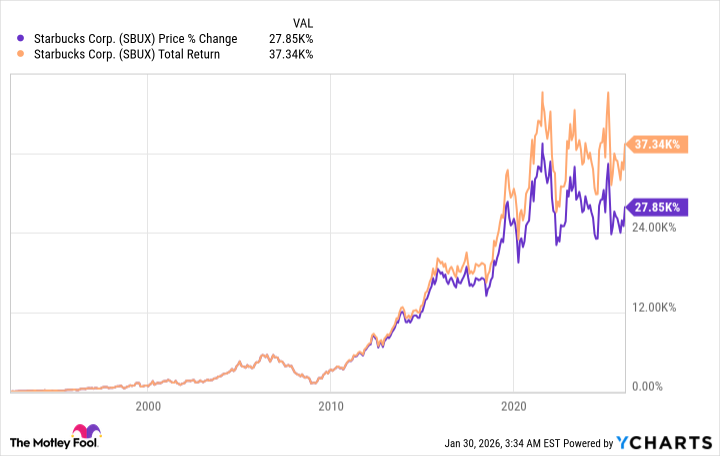

The history of Starbucks is, in its own way, a remarkable one. From humble beginnings, it has grown into a global empire, its stock price soaring by an almost unbelievable 28,000% since its initial offering. Add in the dividends, and the total return exceeds 37,000%. Such figures are not merely numbers; they represent the accumulated hopes and dreams of countless investors, a testament to the power of patient capital. Yet, one must always remember that past performance is no guarantee of future success. The market is a fickle mistress, and fortunes can turn with alarming speed.

The current dividend yield of 2.6%, consistently raised for fifteen years, is a comforting sign for those seeking a steady stream of income. But it is the valuation that gives one pause. The stock trades at a P/E ratio of 78, a figure that suggests a considerable degree of optimism, perhaps even exuberance, is already priced in. It is as if the market, anticipating a glorious future, has already claimed its share of the spoils. To enter at such a price is to risk paying a premium for a promise, a gamble that may not yield a commensurate return.

One observes a certain irony in this situation. Investors, eager to participate in the potential revival of Starbucks, have driven up the price to a level that diminishes the very gains they seek. It is a lesson, perhaps, in the dangers of herd mentality, of allowing emotion to override reason. A wise investor does not follow the crowd, but seeks opportunities where others see only risk or overlook potential value. To wait for a more favorable entry point is not cowardice, but prudence, a recognition that true wealth is built not on speculation, but on sound judgment and patient accumulation. For, in the grand tapestry of commerce, time is the most valuable commodity of all.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR Fate/stay night — best team comps and bond synergies

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 39th Developer Notes: 2.5th Anniversary Update

2026-02-03 13:23