Ah, how treacherous this market can be, dear reader! Here we are, standing at the precipice of a world built on speculation, greed, and the fragile hope of tomorrow’s riches. In such a world, where certainty is but a distant mirage, one name has carved itself into the annals of the financially astute: Stanley Druckenmiller. A man whose mind seems to grasp at the shifting currents of the market, ever aware of the tempest swirling about him, yet still, he sails. For over forty years, his investments have remained unscathed by the icy fingers of loss, even during the Great Recession, when others stumbled into the abyss. His fund posted a gain, a mere 11%, but in that cruel year, it was enough to keep him afloat while the masses were drowning.

And so, as I ponder his next move, I cannot help but wonder what drives this man? What cruel alchemy of reason and madness guides his hand in these ventures? Today, he still manages his personal wealth through the Duquesne Family Office. The world watches, the masses yearning to know what he will purchase, what he will discard, for his decisions are considered gospel in the world of high finance. A gaze here, a glance there-each move is scrutinized, for the man has found success in every corner of the market. He has danced with artificial intelligence, and he has embraced the slow, measured rhythm of more mundane bank stocks. But now-now, there is something stirring. A new desire, a new pursuit.

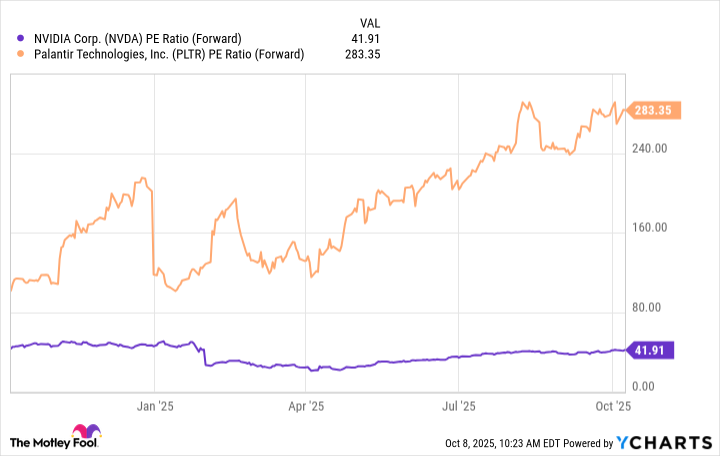

In the wake of success, Druckenmiller has begun to sell the very giants he once embraced. Nvidia, the towering behemoth of artificial intelligence, and Palantir Technologies, the secretive architect of data-driven decision-making, have fallen from his grasp. These stocks, once shining stars, have grown far too bright. They have become unbearable to the touch, their valuations swollen beyond reason. Ah, and it is here, in this moment of inflationary excess, that the very nature of human folly is revealed. His sale of Nvidia, which he now admits was a ‘big mistake,’ speaks volumes. How easily we succumb to the allure of lofty valuations, only to find ourselves licking our wounds when the market takes its inevitable turn. Yes, Druckenmiller has learned this painful lesson, but who among us has not? We all must, in our own time, come face to face with the abyss of irrationality.

The Pivot to Pharma: A Glimmer of Hope in the Shadows

But let us not linger too long in the dark corners of regret, for Druckenmiller’s attention has shifted to something else entirely. And what is this? What is this mysterious force that pulls his gaze away from the promising digital realm? Teva Pharmaceuticals. A humble name in comparison to the dazzling giants of AI, yet perhaps in its very humility lies its strength. Teva, with its sprawling network of generic drugs and its persistent pursuit of new treatments, has caught the eye of this seasoned investor. And we, the humble observers, must ask: What does Druckenmiller see in this troubled world of pharmaceuticals? Is it merely a retreat from the madness of the digital world, or is there a deeper promise here, one that whispers of salvation in a market where nothing is certain?

In the past year, his investments in Teva have been far from modest. A purchase of nearly 16 million shares-worth a staggering $267 million by the end of Q2 2025-signals a commitment that few can match. This is not mere speculation; this is a gamble on the future of healthcare, on the human body itself. Teva is a leader in the production of generic drugs, a company that is not content with merely maintaining its position but is actively seeking growth. Their treatments span a wide range of diseases, from neurodegenerative disorders to migraines, from cancer to asthma. The scope is vast, the stakes higher still.

But, as always, there is a shadow. The market has a way of rewarding the brave, yet also punishing those who misstep. Teva’s pivot to a growth strategy-a strategy to develop treatments for schizophrenia, migraines, inflammatory bowel disease, and rheumatoid arthritis-holds great promise. But promises are fragile things. Who is to say what the future will bring? Who can predict the fate of these drugs still in their late-stage trials? And yet, Druckenmiller, that master of calculated risk, sees something in Teva that others do not. Perhaps he sees a company poised for greatness, or perhaps he sees merely an opportunity to wrestle with the same forces that have shaped his past decisions. A chance to rise again, perhaps. A chance to stake a claim in a market that is far from rational, but where, nonetheless, there is hope.

And so, as the world watches, Druckenmiller’s fate intertwines with Teva’s. It is a story of risk, of hope, of the human desire to tame the chaos of the market. UBS, that august institution, has raised its price target on Teva, forecasting a rise in revenue. And yet, still, the question remains: Is it enough? Can Teva, with its portfolio of drugs and its late-stage pipeline, truly meet the expectations that have been set? Only time will reveal the answer. But in the meantime, Druckenmiller moves forward, guided by a faith in Teva’s valuation, which remains remarkably modest compared to the lofty heights of its competitors. At less than eight times forward earnings, Teva presents a compelling case for those who are not blinded by the intoxicating allure of high multiples.

And so we are left with a question that has plagued the hearts of investors for as long as there has been a market: In a world where nothing is certain, where every move is fraught with peril, what is it that truly guides us? Is it reason, or is it something far more irrational? And in the end, does it matter? Perhaps it is enough to believe that there is always something to gain, even in the midst of loss. That, perhaps, is the greatest lesson Druckenmiller has taught us all.

🧐

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-10-13 11:12