Finance

What to know:

- In a display of remarkable fortitude, DeFi’s total value locked (TVL) has dipped only 12% from a rather inflated $120 billion to a still-impressive $105 billion, whilst the broader crypto market plunges into despair, largely thanks to a cruel diet of falling asset prices rather than an exodus of jittery users.

- Ether, that ever-enthusiastic participant in the DeFi jamboree, continues to flood the scene with 1.6 million ETH added in the past week alone. It appears yield farmers have not yet decided to throw in the towel, much to the surprise of those expecting a stampede.

- Onchain liquidation risk remains as muted as the reaction at a dull dinner party, with only $53 million in perilously positioned assets – a sure indication that collateralization is now the rule rather than the exception, painting a portrait of a more seasoned DeFi sector than in the raucous days of yore.

Amidst the broader market malaise and a cascade of forced liquidations tumbling across the crypto landscape like a poorly organized domino setup, DeFi’s TVL has exhibited an unexpected resilience. Traders seem intent on squeezing out a yield or two, even as bearish sentiment shrouds the crypto market like a damp fog.

For context, over the past week, luminaries of the crypto world such as BTC, ETH, XRP, and SOL have taken a somber stroll down to multi-year lows, with ETH suffering a staggering 21% haircut in just seven days. One assumes the ether enthusiasts are taking it all in stride, possibly while sipping tea.

However, this decline has not precipitated a mass exodus from DeFi protocols. The total value locked slipped from $120 billion to $105 billion – a mere 12% drop, which, given the circumstances, could be likened to a strategic retreat rather than a panicked rush for the exits.

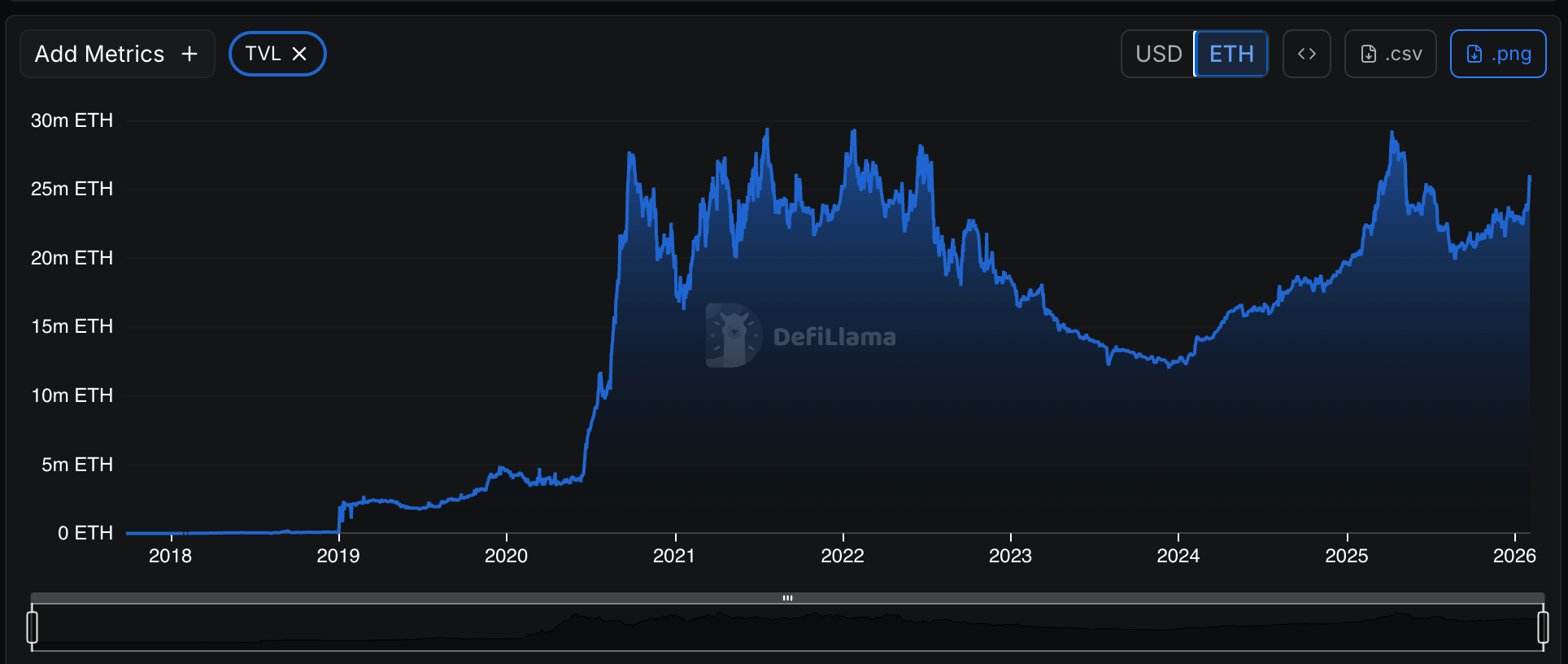

This modest dip is attributable to the unfortunate state of asset prices rather than a horde of yield farmers rushing off to greener pastures. Indeed, the ether committed to the DeFi domain has jumped from 22.6 million ETH at the year’s start to a robust 25.3 million, with a cheeky 1.6 million ETH being added in just the last week, according to the ever-observant DefiLlama.

Onchain Liquidations Muted

Reflecting on times past, we recall how February of last year found the crypto market in a similar tailspin following Donald Trump’s ascension to the presidency. Back then, the DeFi market, with all the fragility of a newly assembled flat-pack wardrobe, teetered on the brink with a staggering $340 million in onchain liquidations poised to wreak havoc.

This latest episode, however, presents a more composed picture; the DeFi market is better collateralized, with merely $53 million in liquidatable positions hovering within 20% of the current price. The positions on the algorithmic interest rate protocol Compound would only face danger if ETH were to plummet below the lofty heights of $1,800, although the true peril lurks between $1,200 and $1,400, where a cool $1 billion worth of liquidatable positions resides, as revealed by our diligent friend DefiLlama.

Resilience Shows Maturing Sector

In previous cycles, the DeFi market resembled a house of cards, collapsing under the slightest of breezes. In 2022, investors succumbed to the siren call of overly generous yields on the Terra blockchain, seduced into staking the ill-fated algorithmic UST stablecoin, only to witness the entire ecosystem crumble like a soggy biscuit months later as the market took a nosedive.

This calamity led to contagion across the entire DeFi spectrum, with TVL nosediving from a rather grand $142 billion to a paltry $52 billion between April and June of that ill-fated year.

This time, however, we find ourselves in a decidedly different atmosphere. The downside risk appears almost laughable, yields remain steadfast, and inflows are quietly trickling in – suggesting a sector maturing against a backdrop of institutional adoption and the delightful chaos of broader market volatility.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- HSR Fate/stay night — best team comps and bond synergies

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top gainers and losers

2026-02-03 15:19