Ah, the noble stablecoin! Once a mere trifle in the realm of crypto, it now beckons the attention of our esteemed traditional financial institutions. But lo! New regulations from the grand halls of Europe and the US may just transform these digital coins into something of real-world utility! 🎩✨

Yet, dear reader, these very regulations present a conundrum for our stalwart issuers, Tether and Circle. At present, Tether’s USDT and Circle’s USDC reign supreme in the stablecoin marketplace, but whispers abound that their reign may soon be challenged! 🏰👑

Experts Ponder the Viability of Tether and Circle’s Grand Schemes Amidst New Rules

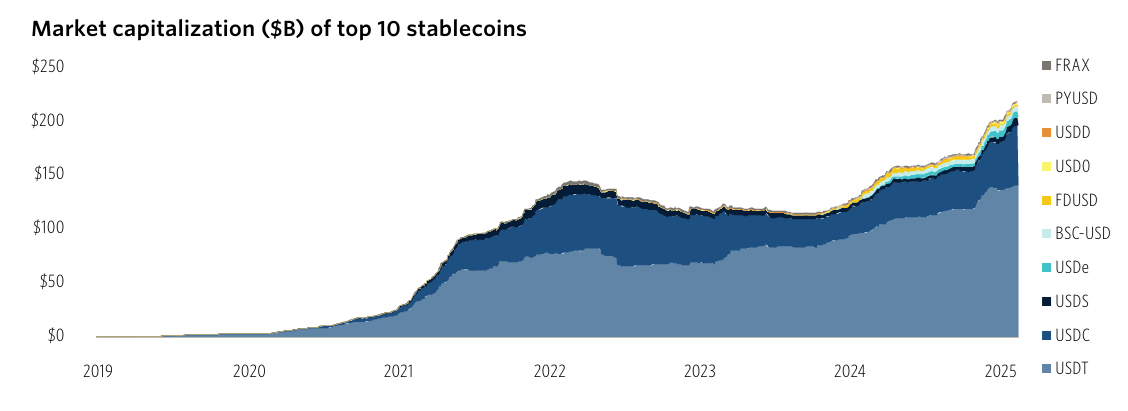

A recent report from the wise sages at PitchBook reveals that the top ten stablecoins boast a market capitalization of around $220 billion—an impressive leap from a mere $120 billion just two years prior! Tether, the mighty titan, claims a staggering 65% of this treasure, while USDC clutches another 25%. 🤑

However, our astute analyst, Robert Le, warns us that such concentration is fraught with peril! Indeed, fiat-backed stablecoins dominate the scene, comprising a whopping 95% of the total supply. What could possibly go wrong? 🤔

“Ah, but beware the specter of centralization! When a single entity, like Tether or Circle, holds the reins of minting and burning tokens, we must question their motives! What if they decide to halt redemptions or freeze funds under the watchful eye of regulators? The innocent holders may find themselves in quite the pickle!” quoth Robert Le, the sage of PitchBook.

As the legal landscape shifts, US regulators are crafting rules for stablecoins, with several bills—FIT21, GENIUS, and STABLE—dancing in the legislative limelight. The US is poised to unveil stablecoin-specific legislation next year, promising to legalize these coins while tightening the screws on issuers with higher reserve standards and mandatory audits. Meanwhile, the EU’s MiCA regulations demand that stablecoins meet banking-like standards. In a clever maneuver, Tether has chosen to sidestep the European market to avoid such compliance! 🏃♂️💨

Traditional Finance Firms Set Their Sights on the Stablecoin Bonanza

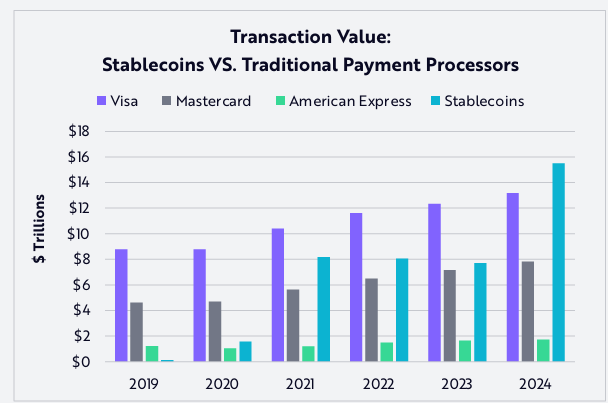

According to the oracle Ark Invest, by 2024, the annual transaction volume of stablecoins will soar to $15.6 trillion—an astonishing 119% of Visa’s volume and 200% of Mastercard’s! Yet, the number of stablecoin transactions remains a mere whisper at 110 million per month, a paltry 0.41% of Visa’s and 0.72% of Mastercard’s. What a curious paradox! 🤷♂️

This suggests that the average stablecoin transaction is worth far more than those of our beloved Visa and Mastercard. 🤑💳

With demand surging, traditional financial institutions are racing to concoct their own stablecoins. Major banks like BBVA and Standard Chartered are pondering their own entries into this digital fray. PayPal has already unveiled PYUSD, while Visa is busy crafting the Visa Tokenized Asset Platform (VTAP) to assist banks in their stablecoin endeavors. Not to be outdone, Bank of America (BoA) has pledged to launch a stablecoin, should the new US regulations allow it! 🏦💸

Meanwhile, titans of investment like BlackRock, Franklin Templeton, and Fidelity are offering tokenized money market funds, which may very well rival USDC and USDT in this grand spectacle! 🎭

“We foresee a future where every major financial platform or fintech app will scramble to launch its own stablecoin, hoping to ensnare users in their seamless payment ecosystems. Yet, we believe that only a select few trusted issuers—those with regulatory blessings, esteemed brands, and proven technological prowess—will capture the lion’s share of this burgeoning market!” – A prophetic prediction from PitchBook.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-13 13:46