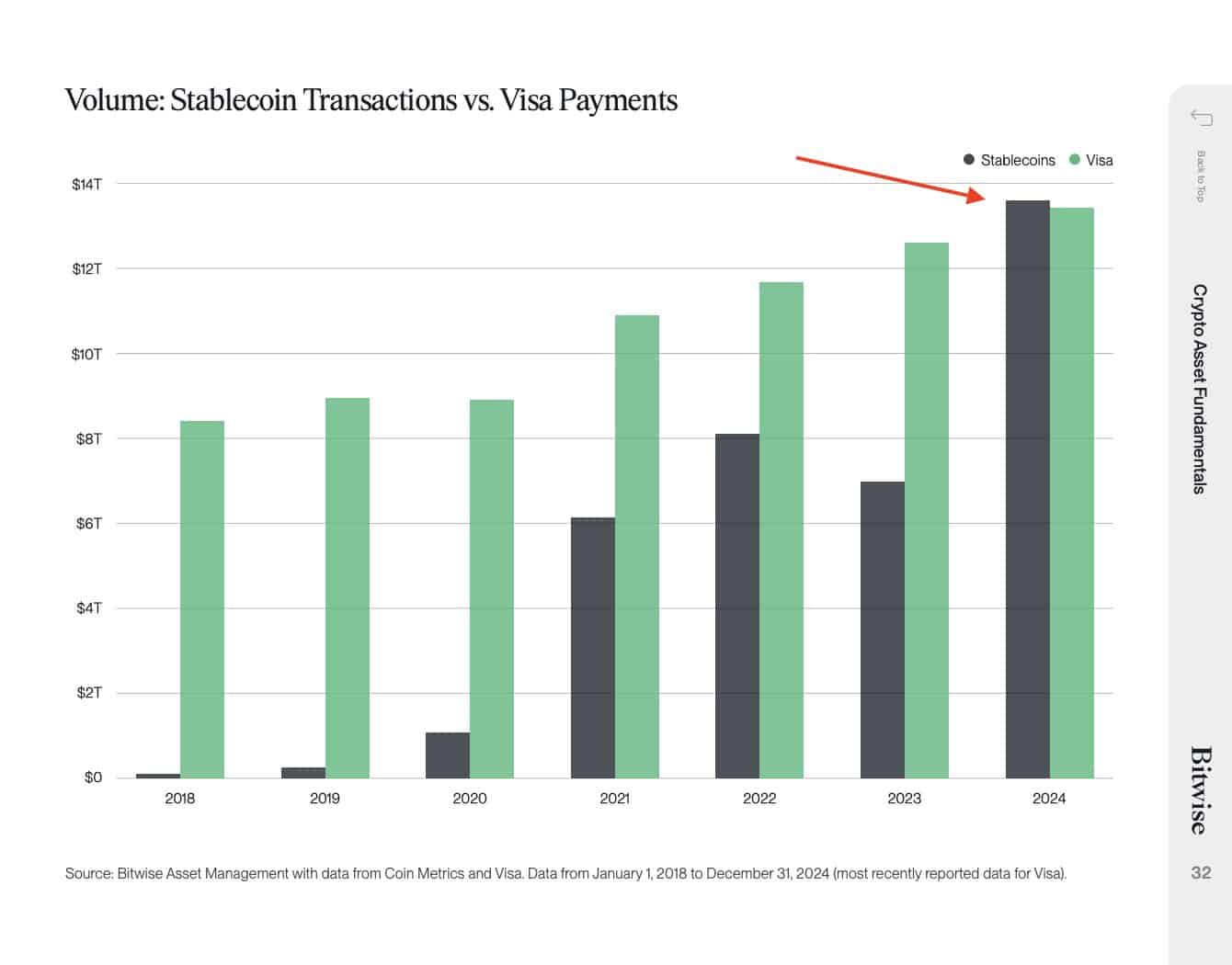

- Stablecoins have gallantly crossed the threshold of $233 billion in market capitalization, whilst the processed volume has soared to an astonishing $27.6 trillion in transactions for the year 2024—outpacing even the esteemed Visa.

- Alas, the altcoin market finds itself in a quagmire, suggesting that capital is seeking refuge in the stable assets during these tempestuous times.

It is with great delight that we observe the stablecoin market achieving a most remarkable milestone, as its total market capitalization has indeed crossed the illustrious sum of $233 billion. How splendid! 🎉

This remarkable ascent in the stablecoin market cap occurs whilst the broader altcoin market languishes under considerable pressure, steadily declining upon the weekly charts. One cannot help but ponder—are we witnessing a burgeoning affection for stablecoins, or merely a mass exodus from the volatile realms of crypto assets? 🤔

From Fringe Utility to Financial Backbone

In days of yore, stablecoins were but trifles, employed primarily for swift trades and the art of arbitrage. Yet, fast-forward to the present day, and they have transformed into the very backbone of crypto finance. How times do change! 🕰️

Indeed, stablecoins alone have facilitated a staggering $27.6 trillion in volume in 2024, eclipsing even the transactions processed by Visa during the same period. Almost all of this volume was settled upon the Ethereum chain, thus solidifying its dominion over stablecoin trading. A most impressive feat! 💪

The figures speak volumes; stablecoins are no longer mere curiosities but are becoming the very foundation of digital value transfer. Who would have thought? 😄

Are Stablecoins a Safety Net?

The burgeoning market capitalization of stablecoins is not merely indicative of their wider usage; it also serves as a reflection of the prevailing investor sentiment. In times of great volatility or downturns in the crypto market, investors often find themselves rotating their capital from the erratic altcoins into the more stable havens of USDT, USDC, and DAI. A wise choice, indeed! 🧐

Stable tokens provide a sanctuary whilst still permitting one to partake in the grand world of cryptocurrencies without the necessity of venturing into more perilous territories. How convenient! 🏰

This behavioral trend becomes particularly pronounced during bear cycles, where the appetite for risk is overshadowed by the urgent need to preserve one’s capital. The result? An increased inflow into stablecoins and a retreat from the high-beta assets that are altcoins. Quite the spectacle! 🎭

Altcoins are Squeezed as Liquidity Flows

As stablecoins ascend, the altcoins find themselves in a most unfortunate predicament. The total market cap of altcoins has been steadily losing ground for several weeks since early December. A most distressing development! 😱

This phenomenon suggests that the increase in supply may not be indicative of new capital entering the crypto sphere, but rather a mere cycling of capital within the market. How tedious! 😩

As more altcoins are converted into stablecoins, the liquidity available to fuel altcoin rallies diminishes, thereby stifling price action and prolonging recovery times. A rather disheartening dynamic that could amplify the bearish momentum in the altcoin universe. 😬

If stablecoins continue upon their current trajectory, their role in the crypto economy shall undoubtedly expand further. With volumes already surpassing those of Visa in 2024, it is evident that this is but the beginning of a grand adventure. 🌟

Indeed, the forthcoming years may render today’s $27.6 trillion figure to appear rather modest. How thrilling! 🎊

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-04-18 20:15