So, here we are, in the midst of a macroeconomic soap opera, and guess what? The two leading stablecoins, USDT and USDC, are strutting their stuff like they own the runway! 💁♀️ Despite the chaos, their market caps have been growing faster than my collection of shoes on sale!

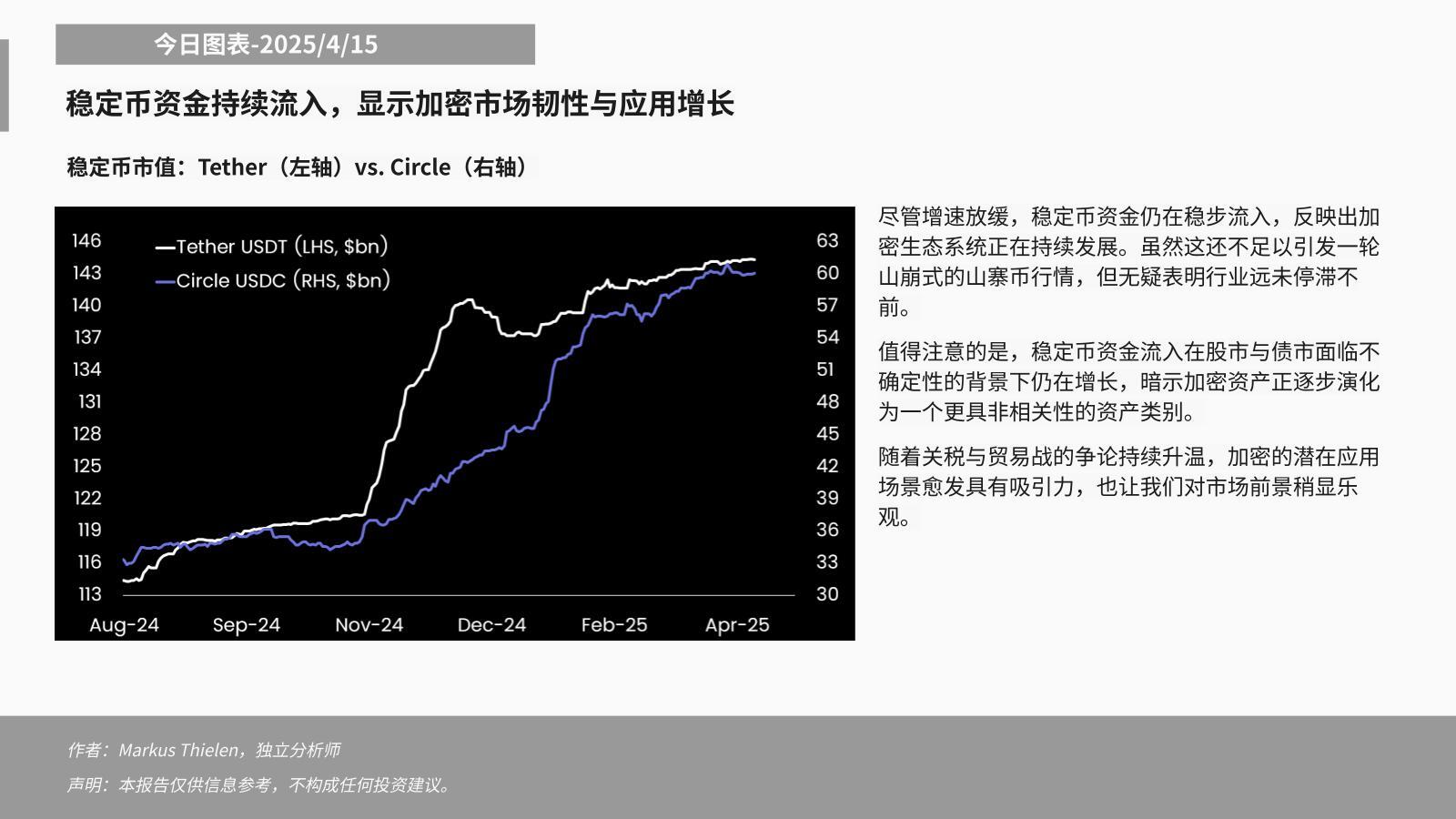

Even with the crypto market resembling a rollercoaster ride (thanks to that pesky trade war), money is still pouring into stablecoins like it’s the last round at the bar. A chart from Matrixport, released on April 15 (mark your calendars, folks!), shows that Tether (USDT) and Circle’s USD Coin (USDC) have been on a growth spurt over the last eight months. Who knew liquidity could be so persistent? It’s like that friend who just won’t leave the party! 🎉

From August to April, USDT’s market cap jumped from about $113 billion to over $143 billion—yes, that’s a whopping 26% increase! And let’s not forget USDC, which went from just over $31 billion to around $60 billion—an impressive 93% increase! Talk about a glow-up! 💅

Matrixport analysts are practically throwing confetti, interpreting these inflows as a sign that stablecoins are becoming the new darlings of the digital economy. Who needs a bull run when you have stablecoins? It’s like being the only one at a party who knows how to dance! 💃

But wait, there’s more! The stablecoin saga unfolds against a backdrop of regulatory drama in the U.S. Just last week, the SEC decided that “Covered Stablecoins” like USDT and USDC aren’t securities. Phew! That’s a relief for issuers, but it’s like a plot twist in a bad rom-com. Meanwhile, the STABLE Act is trying to impose bank-like regulations, while the GENIUS Act is all about keeping innovation alive. It’s like watching two friends argue over who gets the last slice of pizza! 🍕

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-15 14:41