As a seasoned analyst who’s been navigating the crypto markets since their infancy, I have to say that the developments we are witnessing today are truly remarkable. The growth of stablecoins, the rise of ETFs, and the increasing interest from institutions are all strong indicators of a maturing market.

The role of ETFs in particular has been fascinating to watch. It’s like the crypto world finally found its way onto Wall Street, and it’s not just the Bitcoin ETFs that are seeing massive inflows, but also those focused on Ethereum and other digital assets. I remember when we used to joke about “HODLing” our crypto in a piggy bank; now we’re talking about billions of dollars flowing into these funds!

Stablecoins have been another game-changer, especially USDT, USDC, and DAI. They’ve become the on-ramp to decentralized finance, much like a ramp for my old VW Beetle was once the on-ramp to adventure (back when I was younger). The increase in their market capitalization following the 2024 U.S. presidential election is a testament to their growing importance.

The election of Donald Trump as President-elect also played a significant role, much like he did during his reality TV days. His support for pro-crypto officials and crypto-friendly policies have been a breath of fresh air in the regulatory landscape. And let’s not forget the impact of his tweets – they used to move markets; now they’re moving Bitcoin!

In conclusion, 2025 looks promising for the crypto market. If stablecoin adoption continues, if ETF inflows remain strong, and if we get a conducive regulatory environment, then we might just see the crypto market extend further into uncharted territory. So buckle up, folks – it’s going to be a wild ride!

Oh, and remember: In the world of crypto, the only thing certain is uncertainty… and that’s why they call it ‘crypto’currency, not ‘fiat’currency!

These advancements could potentially boost market value and broaden the crypto sphere, even amid ongoing economic uncertainties at a global scale.

Key Drivers of Crypto Growth

Experts at Citi believe that 2025 could mark a significant turning point for digital assets. They highlight several influential factors driving this market growth. Notable triggers include the increasing use of stablecoins to bolster decentralized finance (DeFi) markets and the broadening availability of crypto Exchange-Traded Funds (ETFs). These ETFs simplify entry and increase institutional investment in the digital asset sector.

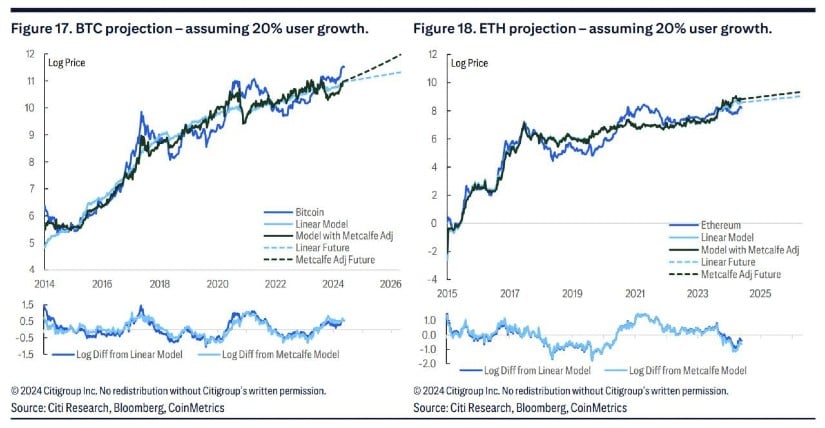

In our opinion, tracking the idea of adoption is crucial for understanding the long-term success of cryptocurrencies, as stated in Citi’s report. The increasing number of Exchange Traded Fund (ETF) activities and the expanding market values of stablecoins are indicators that suggest a maturing crypto ecosystem, according to the firm.

The Role of ETFs and Institutional Inflows

One significant factor fueling the surge in cryptocurrency is the increasing popularity of exchange-traded funds (ETFs), particularly those focused on Bitcoin. These ETFs have been experiencing substantial increases in investment, with reports suggesting that around 46% of Bitcoin’s price movement this year could be attributed to these Bitcoin ETF inflows by 2024. Each billion dollars invested in these ETFs is estimated to generate approximately 4.7% returns. As of November 2024, the total net assets managed by Bitcoin ETFs exceeded $100 billion, indicating a growing institutional interest in the crypto sector.

The acceptance of Bitcoin and Ethereum spot ETFs has reshaped the investment terrain, offering a simpler method for traditional investors to engage with cryptocurrencies. Since their debut in early 2024, these ETFs have drawn billions in investments, adding more fuel to the positive outlook towards Bitcoin and Ethereum.

Stablecoins’ Expanding Role in DeFi

Stablecoins like Tether (USDT), USD Coin (USDC), and Dai (DAI) are playing a significant part in the expansion of cryptocurrency. After the 2024 U.S. presidential election, the combined value of these top stablecoins grew by more than $25 billion, indicating a change in the digital asset market. Financial institution Citi believes that stablecoins will be crucial for the growth of decentralized finance (DeFi), stating that “stablecoins serve as the entry point to DeFi.

With the growing use of stablecoins, it’s expected that more individuals and entities will join Decentralized Finance (DeFi) platforms, leveraging these assets for activities like lending, borrowing, and various financial services. The surge in activity on the Ethereum network, including layer-2 scaling solutions, has fueled this growth significantly. In fact, on-chain activity has skyrocketed by approximately 210% compared to the levels seen in 2023.

Trump’s Election: A Catalyst for Crypto

The election of Donald Trump as President-elect is another important point noted by Citi analysts. His pro-crypto views, including backing for crypto-friendly officials, are seen as a significant source of optimism among investors. This could lead to more pro-cryptocurrency policies during his term and the appointment of key figures in influential agencies, like Paul Atkins, who was appointed as the head of the Securities and Exchange Commission.

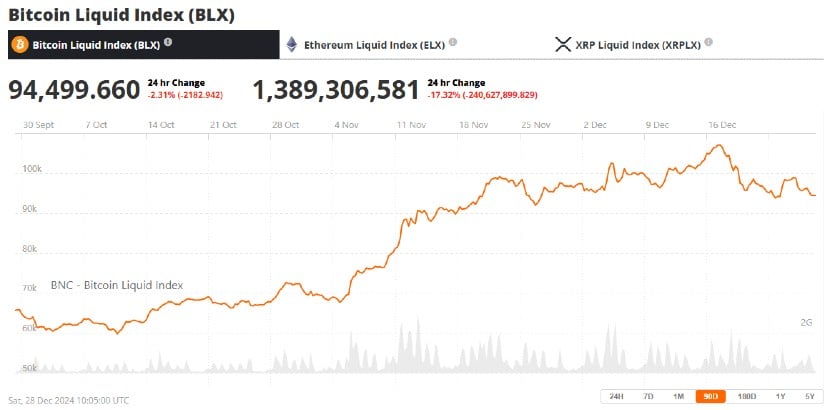

When Donald Trump won the election in November 2024, the prices of cryptocurrencies like Bitcoin soared to an all-time high of $100,000 per coin. This surge was likely due to a favorable regulatory environment and increased institutional interest. Over the next few years, this positive trend could continue, potentially leading to even higher prices for Bitcoin as demand skyrockets.

Sustained Growth Through Adoption and Regulation

Citi analysts emphasize that while the 2025 forecast remains optimistic, continuous growth is contingent upon widespread acceptance across markets. They single out nations like Turkey, Argentina, and Venezuela, struggling with economic uncertainty, as potential hotspots for digital assets demand. Yet, they also caution that evolving regulations could significantly impact the market’s trajectory.

Under Trump’s administration, Citi anticipates a more transparent regulatory landscape. Shifting from an enforcement-driven approach towards one based on legislation could provide the necessary clarity to attract additional institutional investments and individual investors to the sector, offering a sense of stability.

A Promising 2025 for Crypto?

Based on Citi’s predictions, the year 2025 could mark a significant turning point for the cryptocurrency market if factors like increased stablecoin usage, investments in ETFs, and a favorable regulatory climate lead to sustained growth within the sector. Although there are still hurdles to overcome, such as economic conditions and regulatory ambiguity, the integration of these elements suggests that the crypto market is poised for further expansion. In fact, we may be on the brink of a new phase of growth within the blockchain community, with more institutions and individual investors adopting digital assets.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-12-29 11:52