The SPX index saw an additional 15% increase and hit a new high on Monday, making it the leading market performer for the last day with its substantial double-digit price surge.

On the other hand, the increasing pessimism towards cryptocurrencies is causing worry that they may experience a price drop in the near future.

SPX6900 Sees Surge in Short Bets

Starting from New Year’s Day, the price of SPX6900 has been on an impressive run, hitting new record highs every day. On January 5th, the token’s price reached a fresh all-time peak of $1.56. Over the last 24 hours, it has surged by 15%, suggesting that it could continue its upward trend.

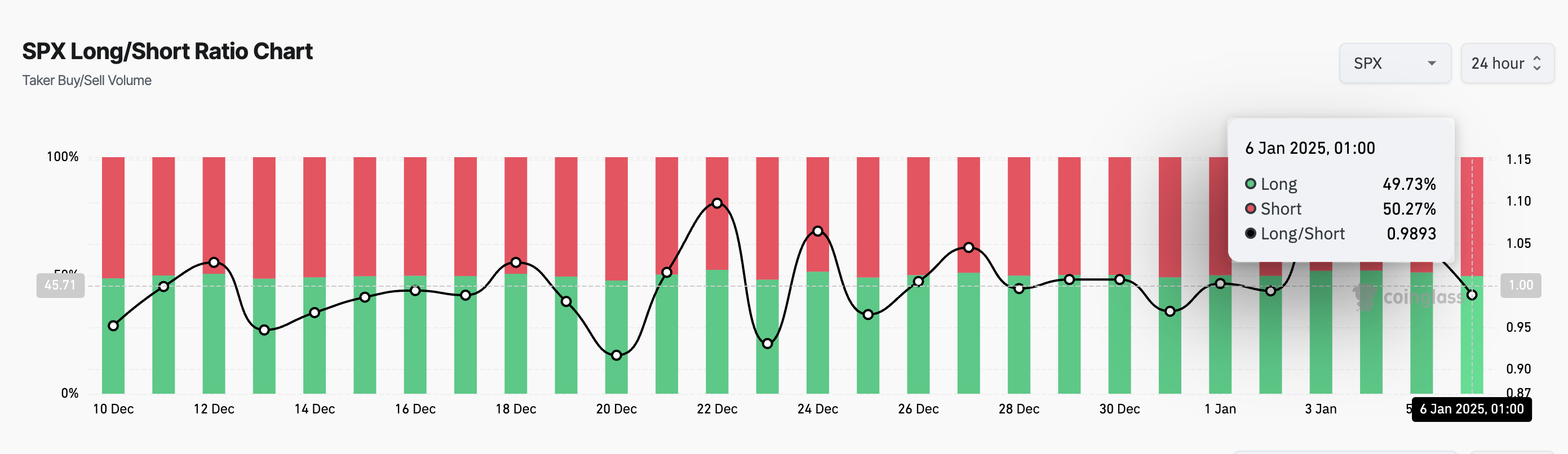

In contrast, increasing pessimism about the altcoin might pose challenges for now. Although its price has surged recently, traders dealing with SPX futures are placing bets that it will decline, hinting at an upcoming drop. This can be seen in its Long/Short Ratio, which stands at 0.98 at this moment.

The Long/Short Ratio of an asset indicates the number of buy positions versus sell positions held by traders in a specific market. For instance, if the ratio for SPX is less than 1, it means more traders are placing bets on the market decreasing (selling short) compared to those who believe it will increase. If short selling continues to be prevalent, this could potentially lead to a drop in the asset’s price due to increased selling pressure.

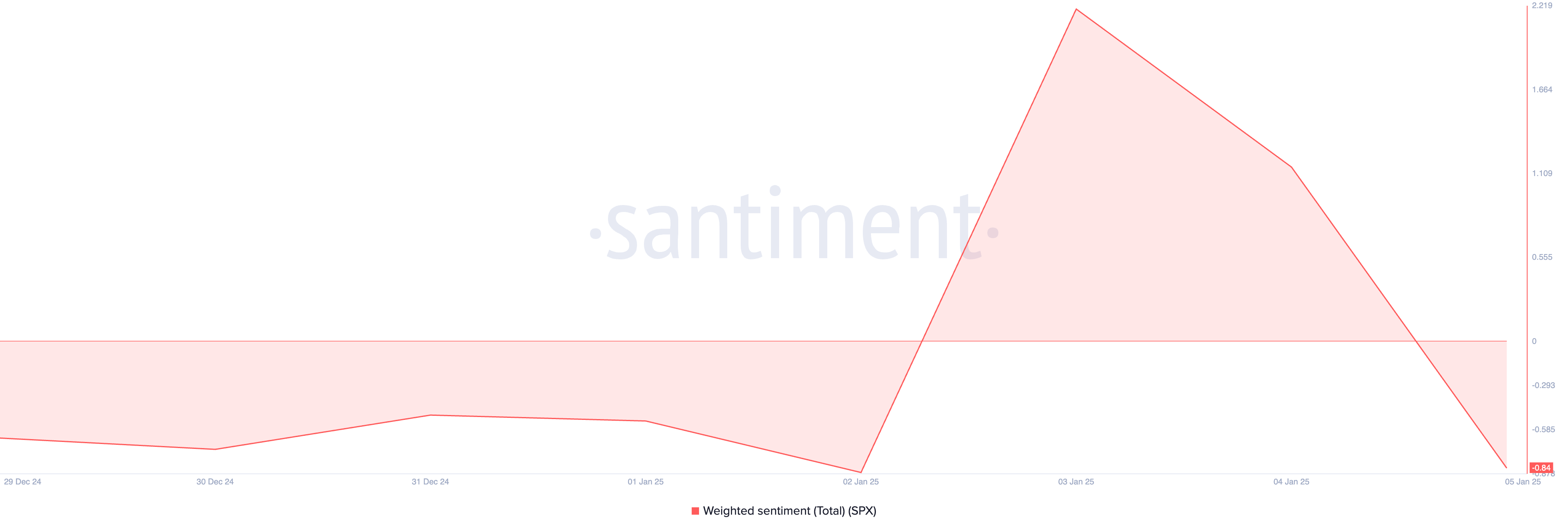

To put it simply, the strong negative feelings about SPX are evident in its weighted sentiment score of -0.84, indicating a growing pessimistic outlook on the asset at this moment.

Expressing it differently: If the value is less than one, it suggests a strong negative bias in the public’s opinion about the asset. This implies that unfavorable comments outweigh favorable ones, potentially influencing the asset’s market price.

SPX Price Prediction: Correction or New High?

In simpler terms, based on the RSI indicator on the daily graph, the SPX index appears to be overextended or overbought, with a reading of 79.33 at the current moment.

As a crypto investor, I keep an eye on the Relative Strength Index (RSI) to gauge market conditions of my assets. This indicator runs from 0 to 100, and when it surpasses 70, it signals that the asset has been overbought and might require correction. On the flip side, if the RSI drops below 30, it suggests the asset is oversold and could potentially experience a rebound.

With an RSI of 79.33 on the SPX, it’s showing signs of being excessively overbought, implying that a possible price drop or change might occur soon. If this occurs, the value could potentially decrease to approximately $1.18.

If the upward trend persists, there’s a possibility that the SPX6900 price might reach a brand-new peak, which in turn could instigate a short squeeze.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-06 16:17