As a seasoned crypto investor with a decade of experience under my belt, I’ve seen bull markets and bear markets come and go. The recent outflows from spot bitcoin ETFs might seem alarming to some, but they’re just another chapter in this rollercoaster ride we call cryptocurrency.

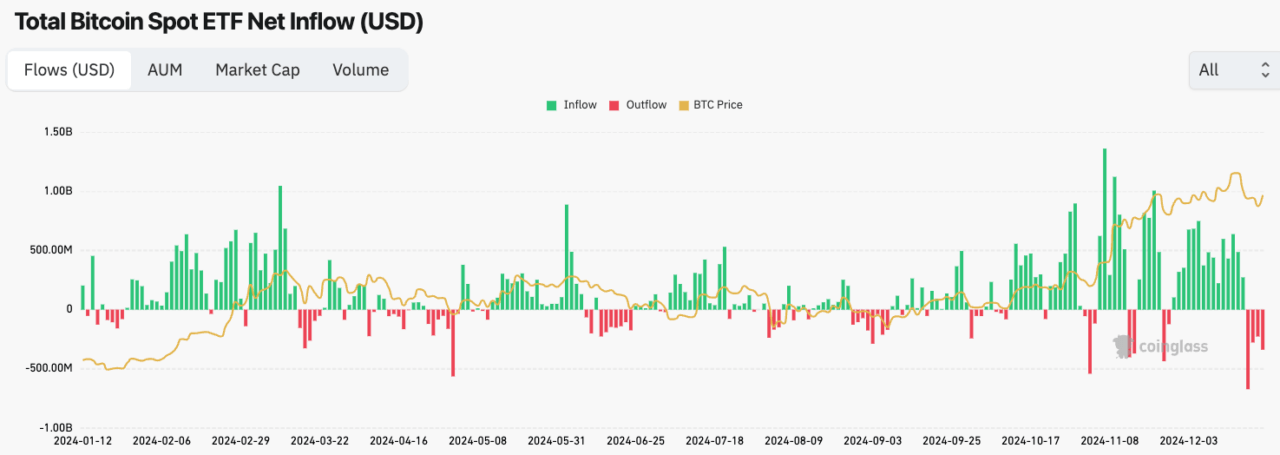

Approved bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) this year have experienced over $1.5 billion in withdrawals during the past four days, according to data. The largest single withdrawal of $671.9 million was made on Dec. 19.

Based on Farside Investors’ data, the largest daily outflow ever for spot bitcoin ETFs concluded a 15-day inflow trend. This occurred during a significant cryptocurrency market sell-off, causing the price of BTC to plummet from over $100,000 to below $93,000 before rebounding again.

In my analysis, the current outflow of funds from cryptocurrency platforms exceeds the previous record set in May, when the value of Bitcoin plummeted by over 10% within a single week, amounting to approximately $564 million.

Over the specified dates, these funds experienced substantial withdrawals totaling approximately $277 million on December 20th, $226.5 million on December 23rd, and a whopping $338.4 million on December 24th.

At a point when MicroStrategy, a Nasdaq-listed business intelligence company, declared they had bought an extra 5,262 bitcoins at an average price of approximately $106,662 per BTC, amounting to roughly $561 million in total expense.

Earlier this month, a business intelligence firm listed on Nasdaq surpassed 400,000 Bitcoins in its holdings after investing $1.5 billion into the leading cryptocurrency. This strategic move towards Bitcoin has sparked similar interest among other companies.

One such company is Marathon Digital Holdings, a cryptocurrency miner that has accumulated 44,394 BTC worth around $4.1 billion, making it the second-largest corporate holder of the cryptocurrency.

Over time, numerous Bitcoin miners, along with Tesla and other corporations, have accumulated Bitcoin in their assets. According to BitcoinTreasuries data, a combined total of approximately 587,470 BTC is now held by publicly-traded companies. This amount equates to around $54.9 billion and represents roughly 2.8% of the entire Bitcoin supply.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-26 14:46