As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous events that have shaped the trajectory of various asset classes. The recent record inflows into Bitcoin exchange-traded funds (ETFs), particularly BlackRock’s iShares Bitcoin Trust, following Donald Trump’s victory in the U.S. presidential elections, is a testament to the growing acceptance and maturity of the cryptocurrency market.

On the day following Donald Trump’s victory in the U.S. presidential election, Bitcoin exchange-traded funds (ETFs) experienced unprecedented daily inflows worth approximately $1.38 billion. This surge in investments came as the value of Bitcoin reached a fresh record high, nearing $77,000.

As a crypto investor, I’ve noticed that the iShares Bitcoin Trust (IBIT) from BlackRock dominated the recent inflows in the market, accounting for approximately 81% of the total investments, with a substantial net inflow of $1.11 billion. This is significantly more than its closest competitor, the Fidelity Wise Origin Bitcoin Fund (FBTC), which only saw an inflow of $190 million during the same period.

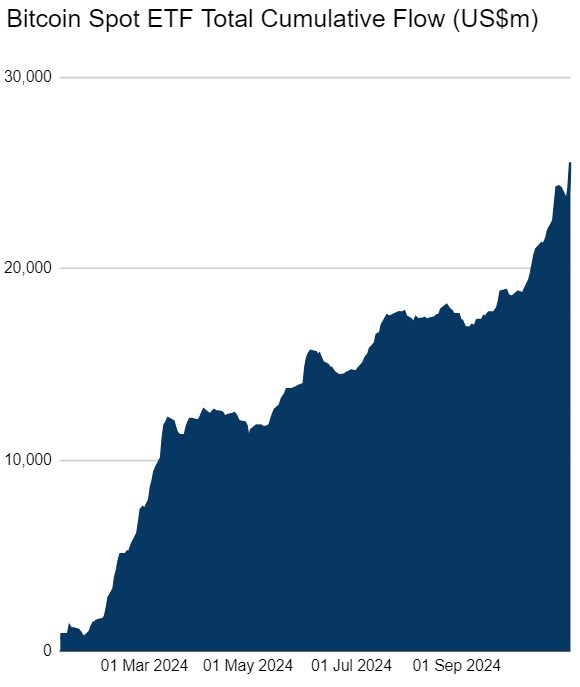

On November 7th, the Bitcoin ETF represented by ARK 21 Shares (ARKB) ranked third with an inflow of approximately $17.6 million. Interestingly, no exchange-traded fund that directly deals with Bitcoin experienced outflows on this day. In fact, when considering all spot Bitcoin ETFs collectively, the current total inflows stand at a substantial $25.57 billion.

The increase in these inflows coincides with a period where the primary cryptocurrency’s price surged over 9% in the last week, reaching an unprecedented peak due to Donald Trump’s win in the US elections, as he is known for his favorable views towards cryptocurrencies.

It was generally anticipated that a victory by Trump would likely increase Bitcoin’s value, given his expressed enthusiasm for the cryptocurrency industry. This optimism stemmed from the possibility of an improved regulatory landscape due to reduced uncertainty and the appointment of pro-cryptocurrency officials in influential positions.

As a researcher examining Bitcoin’s market trends, it’s interesting to note that its price often surges following U.S. presidential elections. For instance, within 90 days after the 2012 election, Bitcoin experienced a return of approximately 87%. Similarly, in 2016 and 2020, the returns were around 44% and 145%, respectively.

According to an article from CryptoGlobe, the prediction market Polymarket witnessed a trading volume of over $3 billion during the presidential elections, with wagers on Donald Trump exceeding $1.29 billion.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-11-08 13:36