As a seasoned researcher with over two decades of experience in financial markets and technology, I find this development both fascinating and not entirely surprising. The surge in Bitcoin ETFs is a testament to the growing acceptance and institutionalization of cryptocurrencies, a trend I’ve been closely watching for years.

U.S.-listed Bitcoin exchange-traded funds (ETFs) are about to reach a significant landmark. These ETFs could soon become the largest Bitcoin owners globally, even surpassing the quantity owned by Bitcoin’s inventor, Satoshi Nakamoto.

Additionally, they are catching up to gold ETFs in total net assets.

Bitcoin ETFs on The Verge of Surpassing Satoshi Nakamoto’s BTC Stash

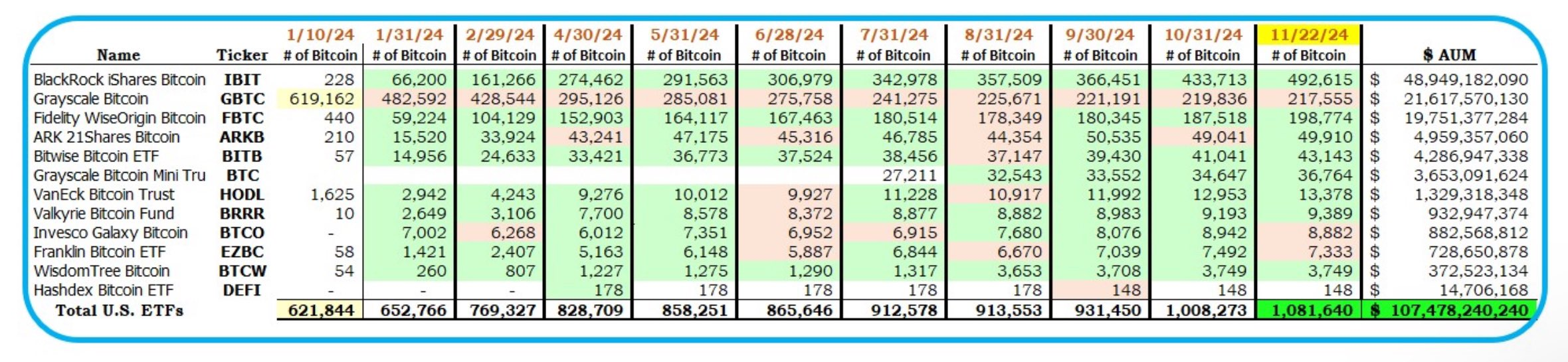

Over the past few months since their debut in January, U.S. Bitcoin ETFs have experienced substantial growth. As per crypto analyst HODL15Capital’s estimates, these funds currently control approximately 1.081 million Bitcoins, which is almost as much as Satoshi Nakamoto’s presumed stash of around 1.1 million.

It’s thought that the mysterious inventor of Bitcoin, known as Satoshi Nakamoto, is estimated to possess around 5.68% of all existing Bitcoins. If these assets are worth more than $100 billion and if Nakamoto is still alive and a solitary entity, they would rank among the world’s wealthiest individuals.

Meanwhile, Eric Balchunas, a Senior ETF Analyst at Bloomberg, noted that Exchange-Traded Funds (ETFs) are almost reaching the point where they surpass Nakamoto’s market value. He forecasted that if the current rate of investments persists, this milestone could be achieved by Thanksgiving.

According to Balchunas, U.S. spot ETFs are almost at the point where they will surpass Satoshi as the world’s largest holder. His prediction of Thanksgiving for this milestone seems plausible. If the next three days continue to follow the trend of the previous ones in terms of flow, it’s a certainty.

Over the past week, investments flowing into these ETFs increased by approximately 97% to reach $3.3 billion over the last five trading days, primarily due to BlackRock’s iShares Bitcoin Trust (IBIT) contributing about $2 billion. This significant rise aligns with the debut of options trading for these financial products, an event that some attribute to attracting a larger number of institutional investors.

Additionally, Bitcoin Exchange-Traded Funds (ETFs) are rapidly approaching the dominance of Gold ETFs, currently managing a total of $120 billion in assets. As per Balchunas’ analysis, Bitcoin ETFs have amassed $107 billion and are poised to surpass the assets managed by gold ETFs potentially before the end of this year (Christmas).

2024 saw an extraordinary run for Bitcoin as my investments in it skyrocketed. Starting from January, it had climbed a staggering 160%, hovering close to the $100,000 milestone. Moreover, its market capitalization of $1.91 trillion now outshines that of silver and even towers over industry giants such as Saudi Aramco, a state-owned oil company.

Nevertheless, Bitcoin has yet to surpass gold, which maintains its position as the globe’s most valuable asset, boasting a market cap exceeding $18 billion.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-11-25 01:50