As a seasoned crypto investor with over a decade of experience navigating the digital asset market, I find myself both intrigued and cautiously optimistic about the recent trends unfolding in the Bitcoin and Ethereum ETF landscape.

Over the years, I’ve witnessed numerous bull and bear cycles, and the current outflows are nothing new to me. However, what sets this period apart is the sheer scale of these withdrawals from some of the most prominent funds, such as Fidelity’s Wise Origin Bitcoin Fund (FBTC) and Grayscale’s Bitcoin Trust (GBTC).

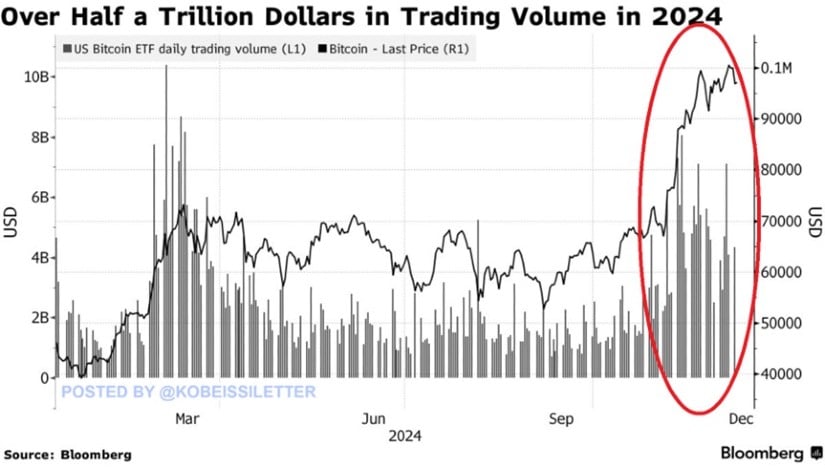

The market’s volatility, driven by fluctuating cryptocurrency prices and year-end portfolio rebalancing, has understandably instilled a sense of apprehension among investors. Yet, I am encouraged by the resilience demonstrated in earlier months, with Bitcoin ETFs reporting an impressive $35.66 billion in net inflows throughout 2024.

Moreover, the fact that December was an excellent month for Ethereum ETFs, with over $2 billion net inflows, is a testament to investors’ enduring interest in Ethereum-based products. As an investor who has ridden the waves of both Bitcoin and Ethereum, I firmly believe that these assets are poised for future growth as the market matures.

In the spirit of transparency, let me share a light-hearted observation: just as the crypto market’s volatility can be unpredictable at times, so too is the weather in my hometown – sometimes it’s sunny and warm, other times it’s stormy and cold. But like the resilient trees that grow there, I stand tall and steady, ready to weather any storm that comes my way.

In closing, while the recent downturn may have shaken some investors, I remain optimistic about the long-term prospects of Bitcoin and Ethereum ETFs. As the market stabilizes, renewed inflows are anticipated, driven by technological advancements, increased regulatory clarity, and growing institutional interest. So, let’s buckle up and brace for the ride – who knows what the next bull run might bring!

12 Bitcoin ETFs collectively withdrew approximately $426 million on December 30, 2024, marking the continuation of a two-day trend where a total of $723 million has been withdrawn, as per data from SoSoValue.

Key Withdrawals from Major Funds

In a recent development, Fidelity’s Wise Origin Bitcoin Fund (FBTC) recorded the most significant withdrawal of funds, totaling $154.64 million. This was closely followed by Grayscale’s Bitcoin Trust (GBTC), which also saw withdrawals worth approximately $134.5 million. Interestingly, BlackRock’s iShares Bitcoin Trust (IBIT), hailed as the “best ETF launch in 2024,” experienced its tenth outflow since it began, with $36.52 million being withdrawn. Other funds such as Bitwise’s BITB, Grayscale’s Bitcoin Mini Trust, and ARK 21Shares Bitcoin ETF also experienced substantial withdrawals.

On that particular day, Valkyrie’s Bitcoin Strategy ETF (BRRR) experienced relatively modest outflows totaling $10.96 million. No other Bitcoin ETFs reported any inflows for the day.

Ethereum ETFs Follow the Trend

On December 30th, the flow of investments in Ethereum spot ETFs continued to decrease, marking four consecutive days of withdrawals. The overall sector experienced net losses of approximately $55.4 million. Notably, Fidelity’s Ethereum Fund suffered the most with outflows amounting to $20.41 million. Following closely were Grayscale’s Ethereum Trust and Mini Ethereum Trust, which saw outflows of $17.36 million and $13.75 million respectively.

During December, Ethereum ETFs experienced a significant surge in investment, recording more than $2 billion in net inflows. This suggests that investor enthusiasm towards Ethereum-related financial products remains strong.

Year-End Summary for Bitcoin ETFs

The strong outbursts highlight the worry among investors due to volatile cryptocurrency market values. As of press time, Bitcoin was trading at $92,458 and saw a minor decrease of 1% on December 30th. Similarly, Ethereum dropped in value to $3,353, demonstrating a 9% fall over the past month.

Investor apprehension arises primarily from continuous market fluctuations and the approach of year-end portfolio adjustments. However, analysts perceive the latest withdrawals not as a sign of waning long-term faith in Bitcoin and Ethereum, but rather as a temporary response.

In 2024, despite a general downturn, Bitcoin Exchange-Traded Funds (ETFs) managed to attract an astounding $35.66 billion in investments, surpassing initial predictions. Leading the pack was BlackRock’s IBIT with a staggering $37.31 billion inflow, followed closely by Fidelity’s FBTC and ARK’s 21Shares Bitcoin ETF with $11.84 billion and $2.49 billion respectively.

Optimistic Long-Term Outlook

Market analysts continue to hold a positive view regarding the future potential of Bitcoin and Ethereum ETFs in the long run. According to one analyst, the current outflows are simply a normal part of market fluctuations, highlighting the strong underlying foundations of these digital assets. As the market settles down, experts expect new investments to flow in, motivated by ongoing technological innovations, improved regulatory guidelines, and heightened institutional interest.

The latest pullbacks demonstrate the unpredictable nature of the crypto market. Yet, the substantial investments made earlier in the year show that enthusiasm for digital currencies remains steady. As the market evolves, both Bitcoin and Ethereum appear poised for further advancement.

Read More

2025-01-02 19:17