As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-evolving digital asset landscape, I must say that the recent inflows into spot Bitcoin ETFs have caught my attention. The staggering $10 billion influx since Donald Trump’s election win is nothing short of remarkable. As someone who remembers when Bitcoin was barely a blip on the radar and a $10 billion market cap seemed like a distant dream, this growth is truly awe-inspiring.

Since Donald Trump’s victory in the U.S. presidential election, there has been approximately $10 billion poured into Bitcoin exchange-traded funds (ETFs), as a surge of investors have moved towards the cryptocurrency market following the election results.

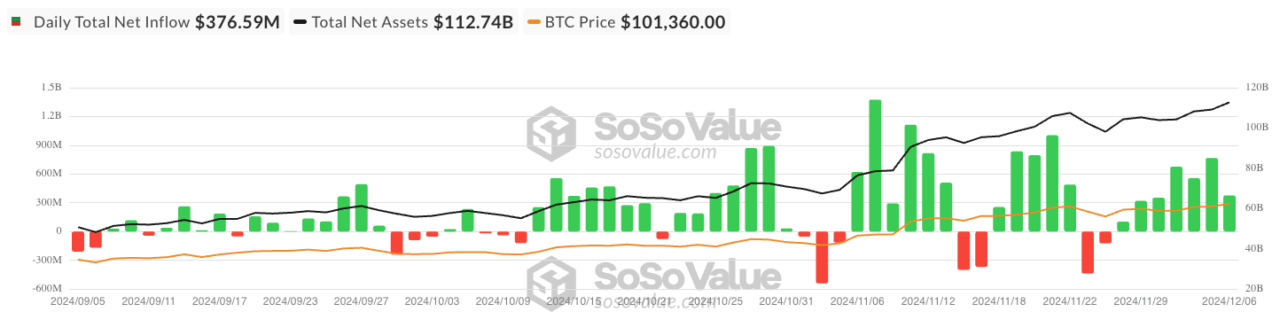

On the heels of the November 5th election, Bitcoin ETFs from significant financial institutions like BlackRock and Fidelity Investments saw a combined inflow of approximately $9.9 billion, as reported by Bloomberg. This surge in investments brought their collective assets up to roughly $113 billion.

Based on figures from SoSoValue, the combined value of Bitcoin ETFs stands at approximately $112.7 billion, making up about 5.62% of the entire market capitalization of Bitcoin. This growth occurred during a broader surge in the cryptocurrency market, pushing the price of Bitcoin to nearly $100,000 before a subsequent drop, with the current trading value being around $98,000.

Over the last 30 days, the price of the flagship cryptocurrency is nevertheless up by more than 28.5%. The total market capitalization of the cryptocurrency space, over the same period, rose by around $1 trillion.

In a notable move, President Trump appointed David Sacks, previously the COO of PayPal, as the new advisor on AI (Artificial Intelligence) and Cryptocurrency within the White House. This role is expected to see Sacks shaping the Administration’s policies in these two vital sectors, which are essential for maintaining America’s competitive edge in the future.

Recently, Bitcoin’s price increase has prompted more investors to boost their holdings. Specifically, MicroStrategy, a publicly-traded business intelligence company and one of the largest corporate owners of Bitcoin, recently purchased 15,400 more coins for approximately $1.5 billion. This equates to an average price of roughly $96,000 per coin.

For the first time ever, MicroStrategy’s Bitcoin holdings surpassed 400,000 units, a milestone reached by strategic movement. This year alone, they have yielded an impressive 38.7%, and a staggering 63.3% since the beginning of the year. Currently, their Bitcoin stash amounts to 402,100 coins, which they purchased for approximately $23.4 billion.

As an analyst, I find myself observing a strategic maneuver that coincides with a period where significant Bitcoin investors (referred to as ‘whales’) are capitalizing on the recent downward trend in Bitcoin’s price by continually adding more BTC to their holdings. This follows a significant movement where short-term holders transferred approximately $4 billion worth of Bitcoin to exchanges, potentially indicating a desire to sell.

Based on insights from analyst Cauê Oliveira at CryptoQuant, significant Bitcoin investors (referred to as ‘whales’) seized the opportunity presented by widespread selling due to fear, adding approximately 16,000 BTC to their reserves, worth close to $1.5 billion, within a single day following increased sales from short-term holders.

In a recent post, the analyst pointed out that the given data is mirrored in the institutional wallets connected within the network, but also implied an increase in Bitcoin accumulation, as the coins held on cryptocurrency exchanges by users and not yet withdrawn are not included in the count.

According to him, the increase in whales (large investors) hasn’t been significant enough yet to suggest a common trend of buying dips (buying when prices fall), which he noted is still predominantly seen among institutional investors.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-09 17:48