The present age, so devoted to innovation and the pursuit of novel conveniences, finds itself increasingly reliant upon certain materials – minerals, to be precise – whose acquisition has become a matter of some delicacy. These elements, essential to the functioning of modern contrivances – those electric carriages, wind-powered mills, and even the instruments of national defense – are now the subject of a quiet, yet determined, competition. It is a truth universally acknowledged, that a nation in possession of a secure supply of such resources, must be in want of little from abroad.

Amongst those venturing into this promising, if somewhat untamed, territory is TMC The Metals Company. The company proposes a solution as bold as it is unconventional: the extraction of polymetallic nodules from the abyssal plains of the ocean floor. A recent surge in the company’s valuation, a matter of considerable speculation amongst investors, suggests a certain enthusiasm for this ambitious undertaking. Indeed, the market, ever susceptible to a captivating narrative, appears eager to embrace any prospect that promises to alleviate the anxieties surrounding supply chains.

One ought, however, to approach such ventures with a degree of circumspection. While the potential rewards are undeniably significant, the path to realizing them is fraught with challenges, not unlike a young lady navigating the complexities of the marriage market.

The Depths of Opportunity

TMC’s intention is to address the growing demand for these critical minerals through exploration of the deep sea. The company’s ambition is to collect, process, and refine polymetallic nodules – formations containing substantial concentrations of nickel, copper, cobalt, and manganese – from the Clarion-Clipperton Zone, a remote expanse of the Pacific Ocean. It is a locale far removed from the centers of commerce and polite society, and therefore presents its own peculiar difficulties.

The prospect of establishing a domestic reserve of such materials is, of course, appealing. Indeed, it has been asserted – by the company’s representative before a committee of the House – that these nodules contain a greater abundance of critical minerals than any land-based deposits. Such claims, while undoubtedly intended to impress, require careful scrutiny, lest one be led astray by excessive optimism.

Hurdles and Regulations

The pursuit of this venture, however, is not without its obstacles. Regulatory requirements, as one might expect, are considerable. An executive order issued recently, with the laudable aim of bolstering domestic mineral supplies, directs the Department of Commerce to expedite the permitting process. This is a welcome development, though one suspects that even the most efficient bureaucracy will prove a formidable opponent.

TMC is currently engaged in the necessary applications for exploration and commercial recovery, working in concert with the relevant authorities. There is, however, a lingering uncertainty regarding international legal frameworks. The International Seabed Authority has yet to finalize regulations governing exploitation, and the question of whether the United States can issue permits in international waters remains a delicate one. One must consider the potential for disputes and the necessity of maintaining amicable relations with other nations.

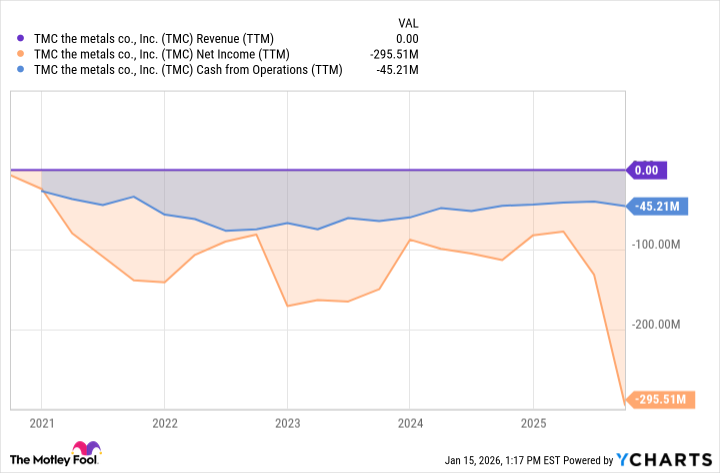

Furthermore, the company’s financial situation demands attention. Despite its ambitious plans, TMC continues to operate at a loss, a circumstance which necessitates ongoing investment. The possibility of further financing, whether through debt or equity issuance, could dilute the holdings of existing shareholders, a prospect that ought to give pause to even the most adventurous investor.

A Venture for the Discerning Investor

The Metals Company finds itself at a precarious juncture. While the company possesses a foundation of technical expertise and benefits from a favorable political climate, it remains in an early stage of development, and is not yet generating revenue. One may anticipate considerable volatility in its valuation, a circumstance which may prove unsettling to those of a more cautious disposition.

While the prospect of addressing the United States’ shortage of critical minerals is alluring, the investment remains highly speculative. Should one choose to pursue this venture, it is advisable to maintain a modest position and ensure it forms part of a well-diversified portfolio. For, as with all matters of finance, prudence and a measured approach are virtues to be cultivated.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 13:03