The pursuit of capital gains, as any sensible investor knows, is rarely a matter of profound ingenuity. More often, it’s a question of identifying the inevitable, and positioning oneself accordingly. Currently, the prevailing wind favours those engaged in the manufacture of silicon – a substance which, one gathers, underpins the modern obsession with ephemeral digital distractions. The current enthusiasm, while doubtless temporary, presents opportunities for the discerning.

Assuming one has, after the usual depredations of modern life, a modest surplus – a thousand dollars, perhaps – it is not entirely unreasonable to consider ventures beyond the merely safe. The following observations concern two companies which, while not guaranteeing fortune, offer a degree of speculative allure.

Taiwan Semiconductor: The Inevitable Monopoly

The demand for semiconductors, driven by the insatiable appetite for ever more complex devices, continues apace. Bank of America, an institution not known for its modesty, predicts a surge in industry revenue – a figure approaching a trillion dollars by 2026. One suspects they are not far wrong. This, naturally, benefits those who actually make the things.

Taiwan Semiconductor Manufacturing, or TSM as it is known in the increasingly vulgar shorthand of the markets, is, quite simply, dominant. It manufactures processors for Apple, Nvidia, AMD, Broadcom, Qualcomm – a catalogue of names which, while perhaps not household, certainly control the levers of modern technology. They churn out an astonishing 12,000 types of chip for over 500 customers. The sheer scale of the operation is, frankly, intimidating. Counterpoint Research places their market share at 72%, a figure which suggests something approaching a monopoly. Such dominance, while rarely applauded by regulators, is remarkably good for profitability.

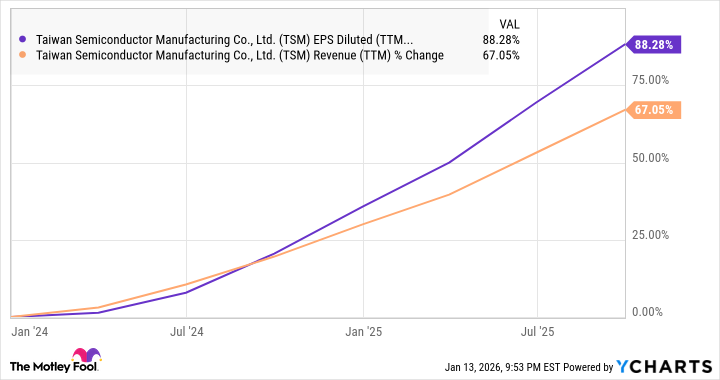

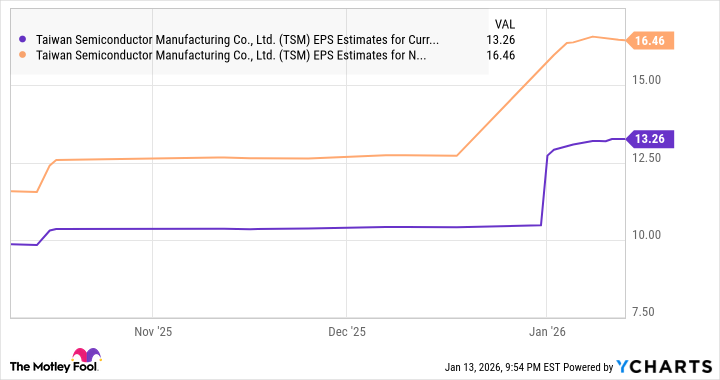

TSMC’s earnings jumped 49% in 2025, leaving the rather pedestrian gains of the S&P 500 trailing far behind. Analysts predict continued growth of 20% or more in the coming years. Indeed, the company’s fabrication lines are, by all accounts, fully committed. Customers, it seems, are willing to pay a premium for timely delivery – a situation which any seasoned observer will recognise as a recipe for substantial profits. Should TSMC sustain a 35% earnings growth rate, its bottom line could approach $19.07 per share within two years. The U.S. technology sector, with its average earnings multiple of 44, hardly seems averse to rewarding such performance. A doubling of the share price, therefore, is not entirely fanciful.

Micron Technology: Riding the Memory Wave

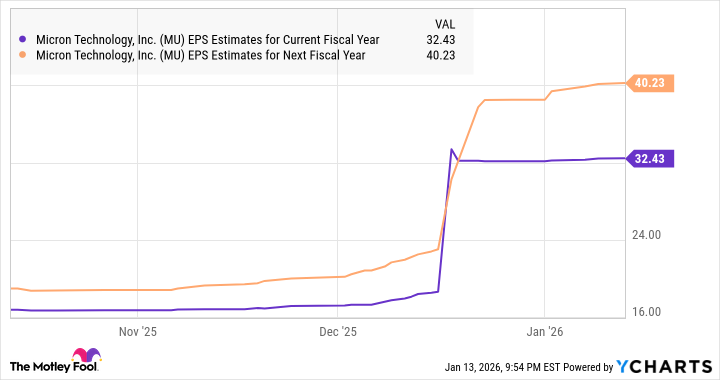

Micron Technology, another beneficiary of the prevailing technological mania, has experienced an even more dramatic surge in earnings – a staggering 291% increase in the current fiscal year. This, of course, is driven by the insatiable demand for memory chips, particularly those required by the increasingly ubiquitous artificial intelligence data centres. TrendForce anticipates a 50-55% jump in DRAM prices this quarter – a figure which, while perhaps unsustainable, suggests a considerable degree of pricing power.

Memory chips are, apparently, sold out for 2026. One suspects this is a recurring phenomenon, a perpetual state of shortage manufactured by the industry to maintain margins. The shortage, predictably, is expected to continue through 2028 – a convenient excuse for continued price increases. Micron’s earnings are expected to rise in the next fiscal year, and beyond.

Micron currently trades at a forward earnings multiple of just 11, a fraction of the Nasdaq-100’s 26. Should the market accord it a more reasonable multiple of 20, and earnings reach the estimated $40.23, the share price could soar to over $800 – more than double its current level. For those with a thousand dollars to spare, and a taste for the speculative, Micron presents a rather tempting proposition. One should, of course, remember the inherent volatility of such ventures. But then, life itself is a gamble, is it not?

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2026-01-17 17:43