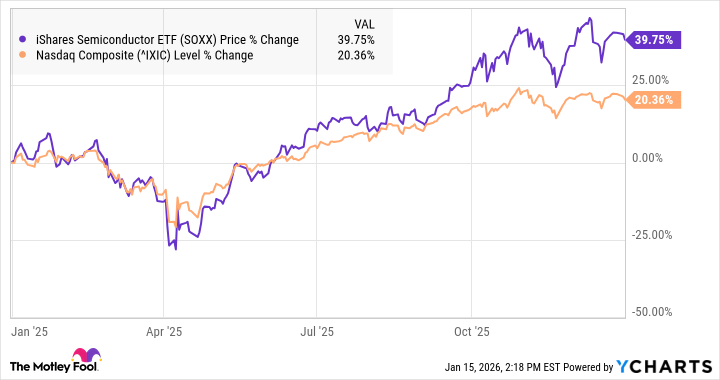

Right. The iShares Semiconductor ETF (SOXX +1.56%). It’s been… a year. A really, really good year, apparently. Up 40%, they say. Forty percent! It’s enough to make one feel vaguely irresponsible for spending so much on oat milk lattes. Still, one has to live, doesn’t one? And apparently, so does Nvidia (NVDA 0.29%), Advanced Micro Devices (AMD +1.79%), and Broadcom (AVGO +2.53%). They seem to be doing very well for themselves, driving this whole surge. It’s almost… unfair.

Looking at the chart, it’s… well, it’s rather intimidating. It looks a bit like my attempts at yoga – a lot of upward movement followed by a slightly panicked dip. Units of Cryptocurrency Lost: 3. Hours Spent Staring at Line Graphs: Approximately 87. Number of Times I’ve Considered Becoming a Goat Farmer: 5.

It turns out the SOXX isn’t entirely unlike the Nasdaq Composite, which, frankly, is a relief. If it had been completely different, I’d have started to suspect some sort of elaborate hoax. Apparently, most of the SOXX holdings are also on the Nasdaq, including the aforementioned Nvidia and Broadcom. It’s all very… interconnected. And slightly terrifying.

There was a wobble in March, naturally. Tariffs, a weakening economy… the usual suspects. But then came “Liberation Day” (a rather dramatic name for a tariff announcement, don’t you think?), and things bounced back. The AI trade, they said. It’s like everyone suddenly remembered that robots are the future. Which is both exciting and deeply unsettling.

The top three holdings now? Micron (Nasdaq: MU), Nvidia, and AMD. Micron, in particular, has had a good run, thanks to this demand for high-bandwidth memory chips for AI. Sales and profits soared. The stock tripled. It’s enough to make one question one’s life choices. Should I have invested in high-bandwidth memory chips? Probably.

What’s the Forecast? (And Will I Actually Stick to It?)

They say the SOXX has been an outperformer, and that we’re in a “golden age” for semiconductors. Which sounds… nice. It’s just that “golden ages” tend to end, don’t they? Usually with a lot of dust and regret. Still, the advent of AI has only accelerated demand for chips. So, there’s that.

Over the last year, the ETF jumped 1,160%. One thousand, one hundred and sixty percent! I’m starting to feel positively inadequate. It looks poised to continue beating the market, because semiconductors are apparently central to everything. Everything! My toaster probably contains semiconductors. It’s a conspiracy, I tell you.

Taiwan Semiconductor Manufacturing just reported strong quarterly results, showing that chip demand continues to soar. Which is… good. I think. It’s all a bit much to process before lunchtime.

And the SOXX rebalances once a year, rotating stocks in and out. Apparently, that gives it an advantage over individual stocks. It’s like… portfolio feng shui. I’m intrigued. I might try feng shui-ing my apartment. It couldn’t hurt.

Year-to-date, the SOXX is already up 11.8%. Eleven. Point. Eight. It’s a good sign. Unless, of course, it’s a false dawn. Barring a collapse in the AI boom (which, let’s be honest, feels entirely possible), the SOXX looks like a winner. I’m cautiously optimistic. Which, for me, is practically euphoria.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 10:33