As a seasoned analyst with extensive experience in the global financial markets, I must say that the recent turbulence in South Korea’s cryptocurrency market was an intriguing spectacle to observe. Having closely monitored the dynamic interplay between politics and finance across various regions, this episode underscores the growing influence of political stability on the crypto markets, especially in high-adoption regions like South Korea.

The unforeseen announcement of martial law by South Korea’s President Yoon Suk Yeol led to turbulent conditions in the country’s cryptocurrency markets. This resulted in a clear distinction between the price fluctuations of cryptocurrencies globally and those specifically in South Korea.

For approximately an hour, Bitcoin dropped to around $79,000, while XRP was trading at $1.89 on Upbit. This unexpected dip in prices attracted a surge of users to the exchanges, who quickly placed buy orders to acquire these digital tokens at unusually low prices during this bull market.

A Brief Chaos in South Korea’s Crypto Market

The political predicament started unfolding on Tuesday night when President Yoon announced martial law, leading the military to try and gain access to the parliament. He defended this action by stating it was essential to counteract “opposition forces supportive of North Korea that threaten our state.

This statement caused a temporary economic disruption throughout the nation. Consequently, the value of the South Korean Won increased relative to the U.S. Dollar, thereby offering a fleeting chance for users with USDT (Tether) to capitalize on crypto arbitrage.

During Tuesday night trading, Bitcoin experienced a significant drop of more than 30% on South Korean exchanges like Upbit. In contrast, its decline was minimal at just 2% in international markets. This disparity indicates frenzied selling by local traders and a nearly 3% increase in the USD/KRW exchange rate.

As per data from Lookonchain, a substantial amount of approximately $163 million in USDT was transferred exclusively into Upbit, due to several large whales making significant USDT purchases. Yet, legislators, including Han Dong-hoon, the party leader, swiftly contested martial law, aiming to reestablish economic stability and order.

The opposition in Parliament successfully blocked the martial law declaration, as legislators voted against it early on Wednesday morning. This move by parliament seemed to calm financial markets, with Bitcoin bouncing back to $95,167 at 17:30 UTC on Wednesday, having briefly reached $96,000.

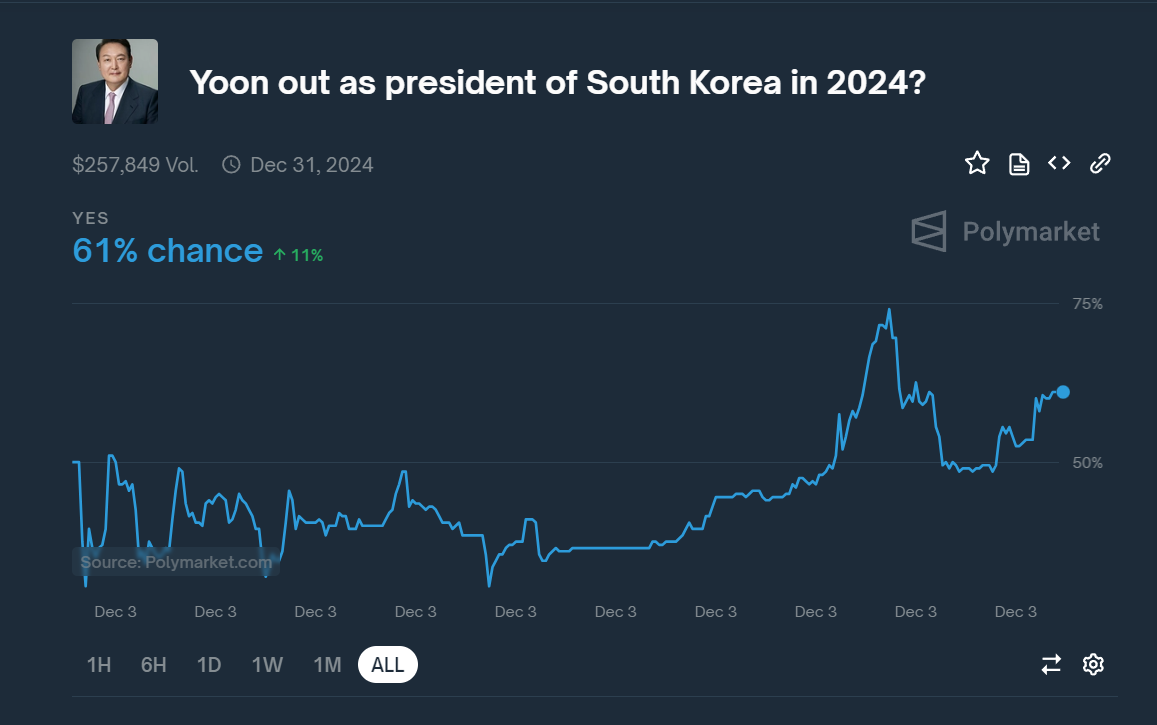

Prediction Markets React

Crypto prediction markets are experiencing an influx of political uncertainty, as evidenced by Polymarket’s creation of a betting pool regarding President Yoon’s possible resignation. This market is focused on whether Yoon will step down from office between December 2nd and December 31st, 2024. As of 17:30 UTC Wednesday, approximately $257,000 in wagers have been made, with a 61% likelihood assigned to the prediction of Yoon’s resignation.

The episode highlights the growing interconnection between political stability and cryptocurrency markets, particularly in regions with high crypto adoption, like South Korea.

As a crypto investor based in South Korea, I’ve noticed an uptick in local activity within our cryptocurrency market this year, even amidst regulatory hurdles. Just recently, as BeInCrypto reported in October, the country experienced a significant surge – a 67% increase to be exact – in daily trading volume, reaching a staggering 6 trillion won.

Nevertheless, cryptocurrency exchanges, specifically Upbit, have consistently encountered regulatory challenges. In November alone, financial regulators identified approximately 600,000 possible Know Your Customer (KYC) breaches on the platform. These alleged violations could jeopardize Upbit’s license renewal, despite their pledge for transparency.

Regulatory bodies have started examining whether Upbit has a dominant position in South Korea’s cryptocurrency trading scene, as well as accusations linking the platform to manipulative practices like pump-and-dump schemes that take advantage of regulatory loopholes, drawing criticism.

Concurrently, approximately 35% of cryptocurrencies listed across multiple South Korean trading platforms were removed, many of which lasted no more than two years. This de-listing led to substantial financial losses for investors as a result of reduced liquidity and drastic price drops in coins that became unavailable.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- PENGU PREDICTION. PENGU cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-04 00:08