The proliferation of exchange-traded funds offers a superficially simple solution for investment. Rather than the laborious task of individual stock selection, these funds aggregate holdings, ostensibly reducing risk through diversification. The premise is sound enough, though it does not necessarily absolve the investor of due diligence. One must still ask: diversification from what, and towards what?

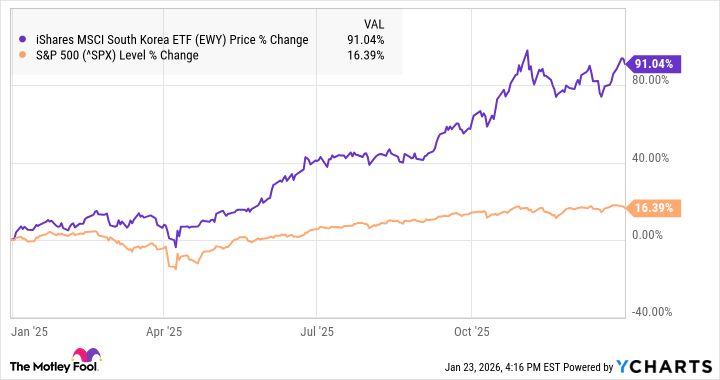

While many such funds dutifully track the broad American market – the S&P 500 being the most prominent example – opportunities exist beyond these well-trodden paths. The search for value, however, demands a willingness to look beyond the familiar. Recent performance of the iShares MSCI South Korea ETF (NYSEMKT: EWY) warrants, if not celebration, at least a dispassionate examination.

The fund recorded a substantial gain of 92% in the preceding year, a figure that, in the current climate of inflated valuations, is noteworthy. Year-to-date, as of January 23rd, it has added another 19.3% to its value. Such rapid appreciation inevitably invites skepticism. Is this genuine growth, or merely the consequence of a delayed correction?

The Korean Advantage – and Its Limits

The surge in South Korean equities is largely attributable to the global demand for memory chips. SK Hynix and Samsung, dominant players in this market, have benefited disproportionately from the artificial intelligence boom. This is not to suggest that the connection is spurious, but rather that it introduces a significant concentration risk. The fortunes of the EWY are, to a considerable extent, tethered to a single sector.

A weaker Korean won has also provided a tailwind, boosting export competitiveness. Furthermore, the fund had, prior to this recent run, been comparatively undervalued. As of January 23rd, the EWY traded at a price-to-earnings ratio of 17, substantially below the S&P 500’s 28. This disparity, while shrinking, provided a degree of margin for error. Recent policy initiatives, including improvements to corporate governance and a reduction in dividend tax rates, may further support valuations, though such pronouncements should be received with customary caution.

Composition of the EWY

Samsung and SK Hynix collectively account for 45% of the fund’s holdings – Samsung at 26.8% and SK Hynix at 18.3%. This concentration is a matter of concern. While diversification within the fund exists, it is largely overshadowed by the dominance of these two entities.

Hyundai Motor, a significant player in the electric vehicle market and owner of Boston Dynamics, offers a degree of diversification. However, even this holding is subject to the inherent volatility of the automotive industry. Other notable constituents include Kia, Hanwha Aerospace, and Naver, the Korean equivalent of Google. These companies, while possessing merit, do not fundamentally alter the risk profile of the fund.

A Prudent Assessment

The EWY’s recent performance is undeniably impressive. However, investors should not mistake momentum for intrinsic value. The fund’s exposure to the memory chip sector, while currently advantageous, carries significant risk. This sector is notoriously cyclical, and a downturn could swiftly erase recent gains.

It is also worth noting that international diversification, while often advocated, is not a panacea. The iShares MSCI World ETF outperformed the S&P 500 last year, demonstrating that opportunities exist beyond the American market. However, this outperformance does not guarantee future success.

The EWY, therefore, represents a speculative investment. Those seeking to diversify away from the U.S. at a time of inflated valuations may find it appealing. However, they should do so with a clear understanding of the risks involved. The allure of recent gains should not blind one to the potential for future losses. A cautious approach, as always, is the most prudent course.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-24 08:04