SoundHound AI (SOUN) has become a name whispered with equal parts reverence and bewilderment in the stock market’s shadowed corridors. Like a mechanical oracle spouting prophecies in a cacophony of algorithms, its shares have ascended on wings of pure speculative fervor. Yet the road to AI dominion is paved not with quarterly earnings, but with the bones of those who mistook a comet’s flash for a permanent sun.

The company’s essence lies in its uncanny ability to transmute sound into meaning-a digital ventriloquist that hears the world’s whispers and answers back. Its voice recognition sorcery, deployed in automotive dashboards and fast-food kiosks, now slithers into healthcare and finance like a serpent shedding its skin. Seven of the top ten financial titans clutch its services like a talisman, though one wonders what dark bargains were struck in marble-boardroom backrooms.

The Quarter That Roared Like a Wounded Bear

Revenue leapt 217% year-over-year-a number so grotesque it defies reason, like a fire bursting from a camp lantern. The company raised its annual forecast to $169 million, a gesture as meaningful as rearranging deckchairs on a steamship hurtling toward a waterfall. Operating losses, meanwhile, ballooned to $78 million: a leviathan gnawing through its own hull, convinced it swims toward glory.

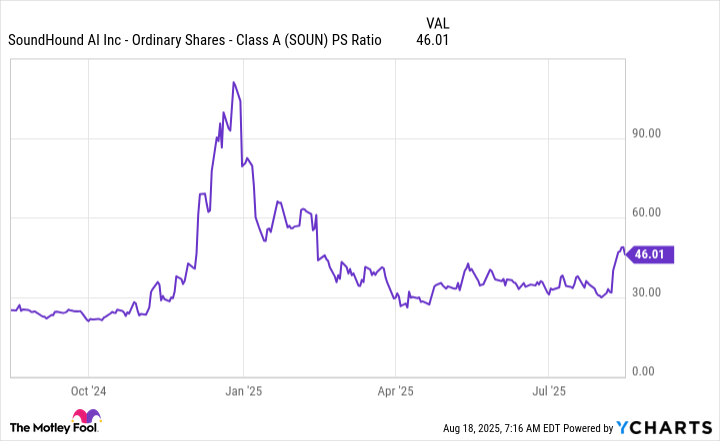

Analysts, those modern court jesters in tailored suits, chant “29% growth by 2026!” as if repeating a spell to ward off market goblins. But acquisitions cloud its financial mirror-was that revenue earned or merely kidnapped from smaller fry? The stock trades at 46x sales, a valuation that makes even tulips blush. Its software may be the Messiah of middleware, or merely another charlatan in a carnival of code.

The Devil’s Own Price

Here lies the rub: investing in SoundHound AI is like purchasing a map to a treasure buried beneath a glacier. The terrain shifts hourly. A competitor might birth a superior AI tomorrow-a Frankenstein’s monster of sharper wit and fewer glitches-relegating SoundHound to the purgatory of obsolete patents. Or it might become the invisible hand guiding every bank’s whisper and hospital’s murmur, its tentacles threaded through civilization itself.

Profits? A distant rumor. The company pirouettes on the tightrope between empire-building and insolvency, its balance sheet a ghost story yet unwritten. To own this stock is to wager at a table where the chips are made of moonlight and smoke. If compelled to gamble, let it be with no more than 1% of one’s coffers-a lottery ticket scribbled on the back of a napkin.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-22 14:38