SoundHound AI, a name that trips lightly off the tongue, is one of those companies that seems to exist more in the realm of possibility than present achievement. A small thing, really, with a market capitalization of $3.6 billion, but one that carries within it the weight of expectation. It’s a pure play in this artificial intelligence game, which, as these things go, means it could either blossom into something substantial or simply fade into the background noise. One imagines the engineers, diligently coding, hoping for the former, while the market, ever fickle, prepares for both.

The promise, of course, is grand. To bridge the gap between human interaction and the cold logic of machines. A worthy ambition, certainly. They’ve had some success, linking audio recognition to generative AI, finding niches in places like restaurant drive-thrus and the increasingly complex dashboards of automobiles. It’s a start, though one wonders if the true test lies not in the technology itself, but in the willingness of people to converse with a disembodied voice when a simple human connection would suffice.

They speak of call centers, of replacing human agents with efficient, tireless algorithms. A vision of streamlined service, perhaps, but also of countless individuals quietly displaced. The irony is not lost on one. The French insurance company, the top financial institutions – they are, after all, merely testing the waters, aren’t they? A cautious embrace of the future, while still keeping a hand firmly on the present. Revenue rose 68% in the last quarter, a respectable figure, but one that feels… fragile. Like a delicate bloom, easily withered by a sudden frost.

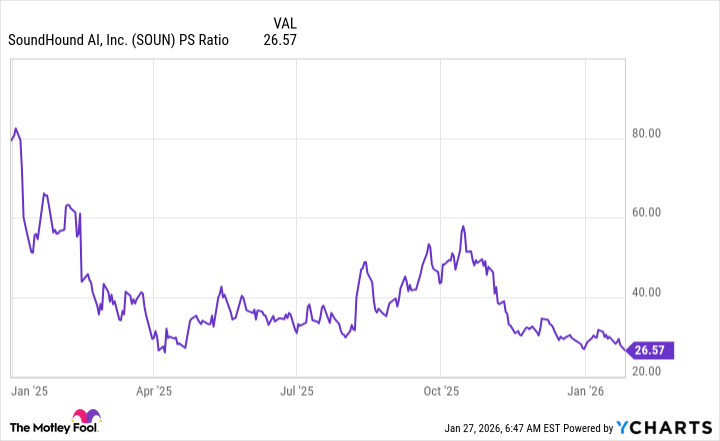

The stock, after a recent dip, is trading at 27 times sales. Not exorbitant, but not inexpensive either. A gamble, really. A small wager on the possibility of something more. The analysts predict growth, of course. They always do. But predictions, one has learned, are often little more than polite fictions.

A Persistent Absence

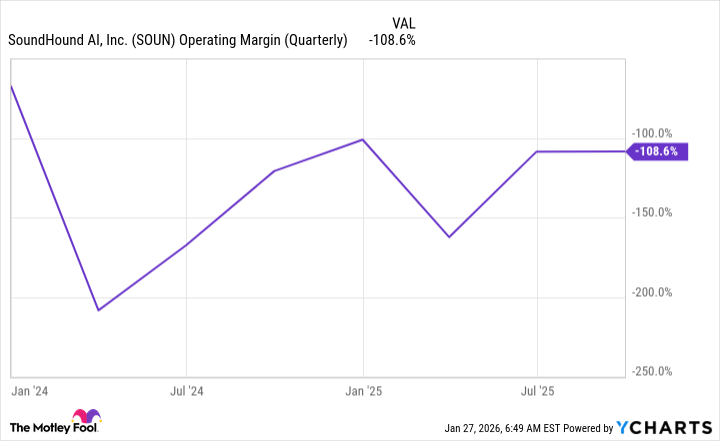

Profitability remains, shall we say, elusive. They are sacrificing present gains for future potential, a strategy not uncommon in this age of boundless ambition. But there are limits, aren’t there? A point at which the market, with its inherent impatience, will demand a return on its investment. The operating margin, consistently in the red, is a stark reminder that this is, at present, a venture fueled more by hope than by hard currency. They spend twice as much as they earn, a chasm that must, eventually, be bridged.

If they can deliver on their promises in 2026, if they can tame the losses and begin to show a path toward sustained profitability, then perhaps this stock will indeed deliver the “supercharged returns” that investors so eagerly anticipate. But if the market remains skeptical, if the doubts linger, then this small company may find itself adrift, another casualty in the relentless churn of the modern economy. It is a high-risk, high-reward proposition, and one cannot help but wonder if the rewards will ever truly materialize. The future, as always, remains unwritten, a vast and indifferent expanse. And so, the story continues, a quiet drama unfolding in the dimly lit corridors of commerce, filled with unrealized dreams and the faint echo of what might have been.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 9 Video Games That Reshaped Our Moral Lens

2026-02-02 13:12