SoundHound AI (SOUN) finds itself in quite the conundrum. With a year that could make even the most steadfast investor need a stiff drink, the company has weathered a storm in 2025, its shares tumbles down about 20% despite the robust growth that percolated through the quarters. Yet, just when one might think all was lost, a flicker of hope emerged with the results of its latest quarterly endeavors.

On an August day that could only be described as serendipitous, SoundHound’s stock soared by over 26% following the revelation of its second-quarter results. What, you may wonder, ignited such fervor among investors? Let us embark on an exploration of these promising clouds gathering about this oft-beaten AI stock, which some bear the gall to say could possibly double its worth by this time next year.

Voice AI is on the Rise-And So is SoundHound

SoundHound hastily crafts a platform that allows businesses from all walks-be it cars, inns, or hospitals-to engage with various voice-powered entities like chatbots and the like. The company’s innovation has quickly gained favor, making its way into the realms of automotive, hospitality, healthcare, retail, financial services, and e-commerce. Now that’s spreading yourself out over a fine sheet of butter on warm bread!

This burst of activity drove revenue skyward, tripling to an astonishing $43 million in the last quarter alone! Quite the feat, considering they managed to shave their adjusted loss per share down by a mere penny to $0.03, even as their research and development expenses ballooned by 64%, along with a staggering 180% increase in sales and marketing costs. Surely, a marvel for the ages!

Wall Street, in its infinite wisdom, had been content with a mere $33 million in revenue and a allowably larger loss of $0.09 per share. But SoundHound breezed past those modest expectations like a high-flying kite on a windy day, wooing in new customers like it was a Sunday at the county fair. A total of 15 large enterprise patrons now rely on their voice-powered agentic AI platform, Amelia-a charming twist considering it barely left the starting gate just three months back!

The company’s repertoire doesn’t halt there; they found success in the restaurant realm, fresh ties with a Chinese automotive OEM, and substantial deals with four financial services behemoths. This concoction of fresh faces and renewed partnerships could indeed set the stage for a splendid future.

The good folks over at SoundHound seem blissfully optimistic, eyeing a whopping $140 billion total addressable market, as they amass over 190 patents for their voice AI contraptions, with another 110 on the horizon-like a garden of opportunity ready to bloom. Such a strong intellectual property portfolio stands to provide a competitive edge in the crowded tavern of voice AI, perhaps even yielding lucrative licensing revenue.

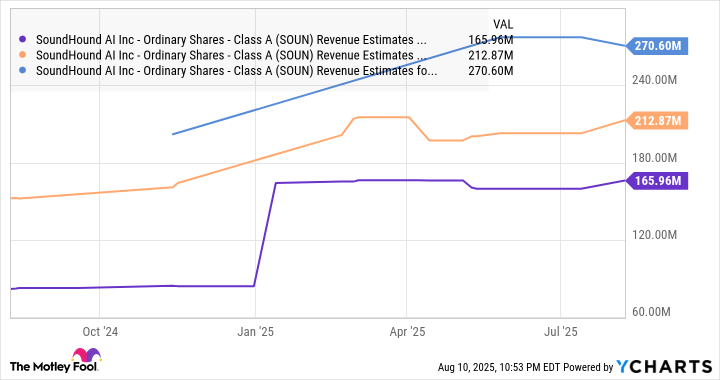

Confidence among the ranks is thick enough to slice, as the company has bumped up its full-year revenue predictions to a nifty $160 million to $178 million, a leap from an earlier estimation of $157 million to $177 million. That’s a remarkable jump, suggesting wild prospects, indeed-more than doubling the top line from last year’s $85 million.

But lo and behold, don’t be taken aback if they surpass these ambitious expectations come the morrow; this company has a knack for surprises!

Why the Doubled Stakes Might Just Pay Off

In a bustling marketplace that burgeons and sings with potential, SoundHound appears to be weaving its web deftly, significantly broadening its customer base. The likelihood of sustaining its dazzling revenue growth into 2026 is brighter than a sunflower on a sunny day. While consensus estimates anticipate a softening of those numbers next year before swelling again in 2027, there’s a curious undercurrent that suggests something might just be afoot.

Let’s throw caution to the wind: SoundHound’s total subscriptions and bookings backlog stood proudly at $1.2 billion at the close of last year. This nugget of insight into future revenue generation sparks intrigue, as it implies they may easily surprise the naysayers come 2026.

If we suppose that growth slows to a mere 50% in 2026-a significant drop from the exhilarating 100% they predict for 2025-then one might expect their top line to reach at least $253 million next year based on the midpoint of their 2025 revenue projection.

The stock is currently fetching a lofty 47 times its sales, and while that seems a touch extravagant, it’s well worth it when weighed against SoundHound’s staggering growth. After all, who wouldn’t pay a premium for well-baked bread in a land of dry crusts? And as we reckon with the nature of this wildly fickle market, it’s likely the premium could endure, especially for a company like SoundHound that seems to be the toast of the town.

A price-to-sales ratio of even 40 in 2026 could elevate the stock’s market cap above $10 billion-an enticing leap that could mean a doubling of its current worth. But mind you, should SoundHound manage to conjure a growth that outstrips even the wildest projections, the delights that await in the market could be far more lavish than anticipated. 🌾

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-13 14:45