In the murky world of crypto, where fortunes rise and fall like the tides, the tale of Sonic (S) is one that would make even the Devil himself chuckle with delight. 🤑

Sonic (S) has risen from the ashes, surging a whopping 31% after hitting an all-time low just three days ago. The token now trades at a dizzying $0.46, up almost 10% in the past 24 hours. 💸

The sharp rebound, my dear friends, is the result of traders seizing the opportunity to buy the dip, driving renewed demand for the token. It’s as if they’ve been possessed by the spirit of a Wall Street wolf, howling at the moon for more gains. 🐺

Sonic’s Trading Activity Heats Up, Leaving Us All Dizzy

The gradual uptick in inflows into Sonic’s spot markets on Thursday highlights the resurgence in demand for the altcoin. According to Coinglass, this totals a mere $215,000 at press time. 💰

While the figure may seem as insignificant as a speck of dust in the grand scheme of things, it marks a significant comeback from the two consecutive days of outflows from S’ spot markets. Spot inflows like this, my friends, indicate a growing demand for an asset and a surge in investor confidence, which can contribute to upward price momentum. 📈

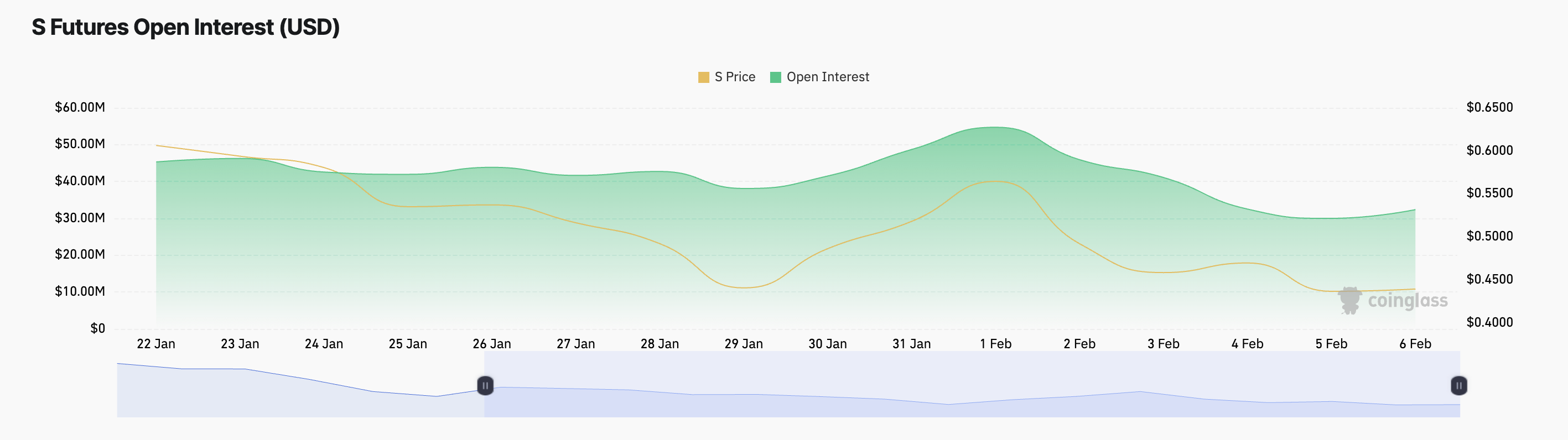

Additionally, S’ open interest is on an upward trend, confirming the steady rally in trading activity around the altcoin. At press time, it is $41.05 million, climbing 33% over the past 24 hours. 🤑

Open interest, my dear friends, refers to the total number of outstanding derivative contracts, such as futures and options, that have not been settled. When open interest increases during a price rally, it suggests that new money is entering the market, reinforcing the uptrend. This indicates stronger conviction among traders, as more participants are opening positions rather than closing existing ones. 🤑

A sustained rise in S’ open interest alongside its price would signal continued bullish momentum, but if it declines, it may suggest weakening demand or potential profit-taking. 💰

S Price Prediction: A Break Above This Level Could Fuel More Gains, or Send It Tumbling Down

On a 12-hour chart, S appears poised to break above its 20-day Exponential Moving Average (EMA), which has formed a major resistance level since the beginning of February. 📊

This key moving average, my friends, measures an asset’s average trading price over the past 20 days. It is a short-term trend indicator emphasizing recent price movements, making it more responsive to changes than a simple moving average. 🤖

When an asset’s price attempts to break above its 20-day EMA, it suggests potential bullish momentum, signaling that buyers may be gaining control and a trend reversal or continuation could be underway. 🚀

A successful break above the 20-day EMA would offer more credibility to S’ current rally. The price could climb in that scenario and extend its gains to $0.059. 💹

However, if profit-taking makes a comeback among traders, S

Read More

2025-02-06 22:11