Sonic (S) is zooming faster than a hedgehog on a sugar rush, with its price up nearly 15% in the last 24 hours and a whopping 53% over the past seven days. Its market cap is now a cool $2.6 billion, because apparently, everyone wants a piece of this blue blur. 🚀

Technical indicators are like, “Whoa, slow down, Sonic!” The ADX is at 51.6, which is basically the crypto equivalent of Sonic chugging a Red Bull. The RSI is at 78.4, meaning it’s so overbought it’s practically screaming, “Take a break, dude!” But hey, Sonic could still test resistance levels at $0.849 and maybe even $1.06. Because why not?

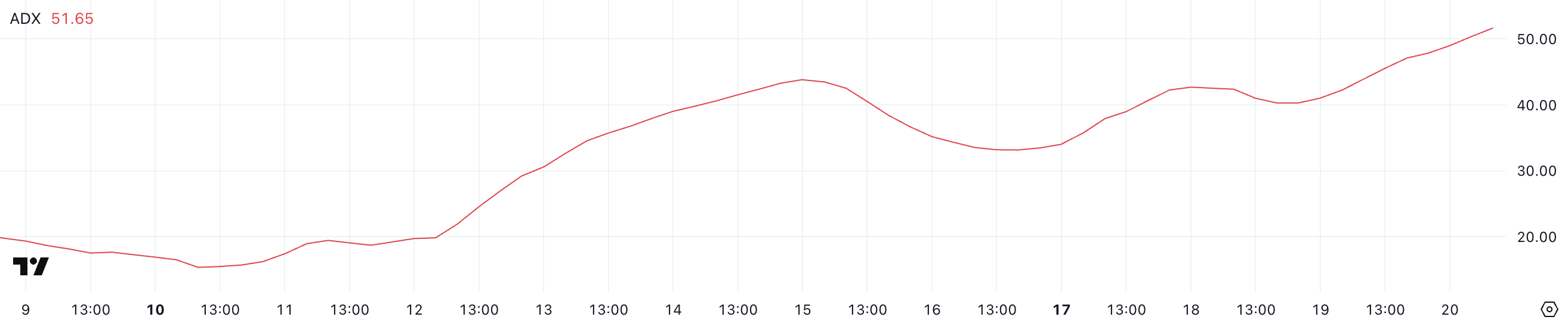

Sonic ADX: The Uptrend That Just Won’t Quit

Sonic’s ADX is currently at 51.6, which is up from 34 three days ago and a laughable 19.8 eight days ago. This is like Sonic went from a casual jog to breaking the sound barrier in a week. 🏃♂️💨

The rising ADX is basically the market’s way of saying, “We’re not done yet, folks!” This rapid upward movement suggests Sonic is either the next big thing or just really good at making people FOMO. Either way, the trend is strong, and it’s not slowing down anytime soon.

The Average Directional Index (ADX) is like the bouncer at the club, telling you how strong the trend is. Below 20? Weak sauce. Between 20 and 40? Getting there. Above 40? Strong like a double espresso. Sonic’s ADX at 51.6? That’s the crypto equivalent of a triple shot with extra foam. ☕

This momentum could lead to even more price appreciation, but traders should keep an eye out for signs of overextension. Because even Sonic needs to take a breather sometimes.

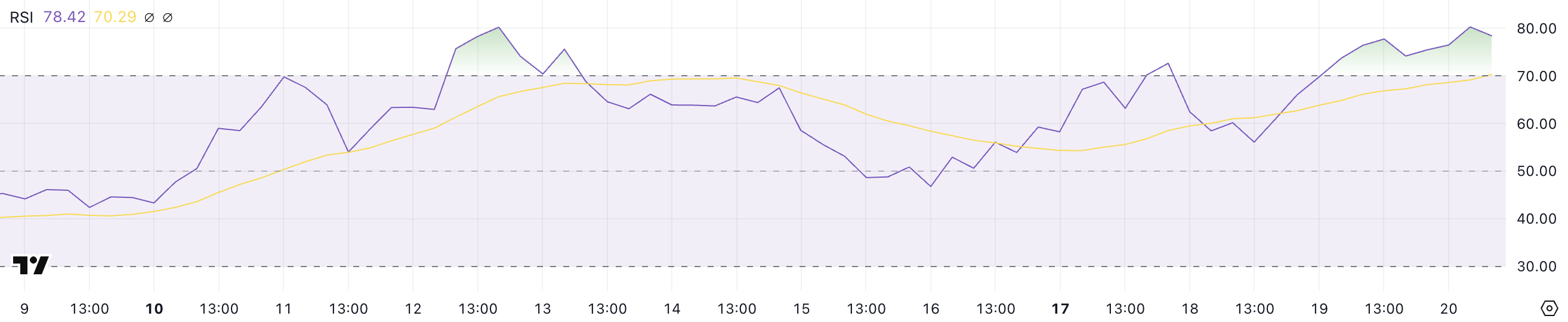

Sonic’s RSI: Overbought and Loving It

Sonic’s RSI is currently at 78.4, up from 56 just two days ago. It’s been above 70 for more than a day, which is like Sonic saying, “I’m not tired, you’re tired!” 🏋️♂️

The rapid rise in RSI reflects some serious buying activity, suggesting that the bullish sentiment is stronger than a toddler on a sugar high. An RSI above 70 typically signals overbought conditions, meaning Sonic might be due for a little nap. But in strong uptrends, RSI can stay overbought for a while, so don’t count Sonic out just yet.

The Relative Strength Index (RSI) is like the mood ring of the crypto world. Above 70? Overbought. Below 30? Oversold. Sonic’s RSI at 78.4 is basically the crypto equivalent of, “I’m fine, I don’t need sleep, I need answers!” But hey, in strong uptrends, RSI can stay overbought for a while, so Sonic might just keep on running.

Will Sonic Break $1 in February? Place Your Bets!

Sonic’s EMA lines have recently formed two golden crosses, which is like the crypto version of a double rainbow. 🌈🌈 If this bullish momentum continues, Sonic could test the resistance at $0.849. And if it breaks through that, the next target is $1.06. That would be its highest price since the end of December 2024, which is basically ancient history in crypto time.

But if the trend reverses, Sonic could face some serious downside risks. The first support levels are at $0.65 and $0.58, and if those break, Sonic could drop as low as $0.47. In the worst-case scenario, it could hit $0.37, which would be a correction of over 50%. So, you know, buckle up. 🎢

Read More

2025-02-21 01:43