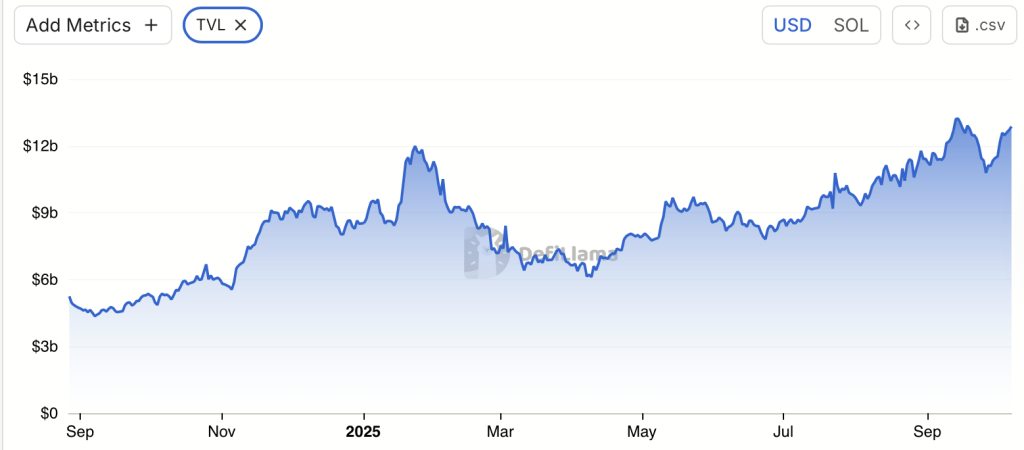

Let’s talk about Solana, shall we? The Total Value Locked (TVL) is strutting its stuff like it’s been hitting the gym, while SOL price is… well, let’s say it’s holding steady like your grandmother’s old rotary phone-stubborn but reliable. You’ve got this bizarre situation where the network’s been growing like crazy, but the token price can’t seem to decide if it’s going up, down, or sideways. You get the feeling there’s something deeper going on, but who knows? 😏

Rising Network Activity Amid Price Stagnation

While SOL’s price is off in its own little world, Solana’s decentralized finance (DeFi) scene is expanding faster than a balloon animal at a kid’s party. Jupiter, MarginFi, Kamino, and Solend are all pumping out record-breaking inflows, like they’re competing for the title of “Most Attractive DeFi Platform.” Meanwhile, people are staking, trading, and running liquidity pools like it’s a cash grab at a Vegas slot machine. 🚀

But here’s the kicker: despite all this hustle and bustle, SOL’s price is still chilling like it’s waiting for something to happen. Why? Well, it seems like traders are being cautious-perhaps too cautious-because of the bigger beast in the room: Bitcoin. It’s like Bitcoin’s the big kid on the block, and everyone else is waiting to see if it’ll let them play with the toys. 📉

A Sign of Ecosystem Maturity, Not Weakness

Before you panic and sell your SOL like it’s the hottest potato in the market, let’s calm down. This price stagnation? It’s not a bad sign-it could be a sign that the ecosystem is actually growing up, becoming more capital-efficient. There’s more than 65% of SOL staked, so there’s not a lot of tokens just floating around, waiting for someone to scoop them up. The liquidity that does exist is being recycled like the plastic bottles at an environmentalist’s dream house. 🌱

What does this mean for you? Well, we might be in what we call an “accumulation zone.” This is where the smart money swoops in, grabs the good stuff, and waits for everyone else to notice. In the past, networks with similar growth patterns have had a huge breakout once the world finally catches on. So, maybe don’t throw your SOL into the fire just yet. 🔥

Will SOL Price Rise Above $300?

Now, for the real juicy question: will SOL rise above $300? After an enthusiastic push earlier in the month, the bulls seem to be running out of steam. Since the April rebound, SOL has been making higher highs and lows, but now things are looking a bit wobbly. The bears are starting to make their move, and if the bulls don’t step up, we could see a 10% pullback. 😬

Looking at the daily chart, SOL’s price is still trading under bullish influence, but it could be in for a small dip. It’s been following a pattern of forming lower highs in an ascending channel (because who doesn’t love a good pattern?), which could lead to a drop to $210 if the bulls don’t protect the support at $220. On the other hand, if the bulls do their thing, we could see a rally above $260. Fingers crossed! 🤞

Looking Ahead

If Solana’s TVL keeps trending higher and more people start getting involved in the network, there’s a chance that market sentiment will finally catch up with the fundamentals. More network usage + more liquidity = SOL’s next big breakout. Who’s excited? 🙋♂️🙋♀️

For now, Solana is one of the few networks showing real, organic growth. So, even if its token price isn’t skyrocketing, that doesn’t mean it’s time to bail. Hold tight, folks. This might just be the calm before the storm. 🌩️

FAQs

Why is Solana (SOL) price not rising?

Despite the network’s strong growth, SOL’s price is stuck in neutral due to broader market uncertainty and Bitcoin’s continued dominance. So, it’s like watching a traffic jam-you know something is happening, but no one’s moving yet. 🐢

What is the Solana price prediction?

Well, analysts are saying that SOL could bounce back to $260 if it holds key support. But if it falls below $220, we might see a dip to $210. Basically, keep an eye on that support level-it’s like watching a suspense movie. 🎬

Is Solana a good investment?

Yes, it’s a solid long-term play. The fundamentals are strong: high TVL, lots of user activity, and overall growth. But the price action is like watching paint dry in the short term. So, be patient and maybe consider buying some popcorn. 🍿

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

2025-10-07 16:45