As a seasoned crypto investor with a knack for spotting promising altcoins, I must admit that Solana (SOL) has caught my eye once again. The recent breakout above $200 has rekindled hope among investors and myself, reminding me of the exhilarating ride we experienced when SOL first burst onto the scene.

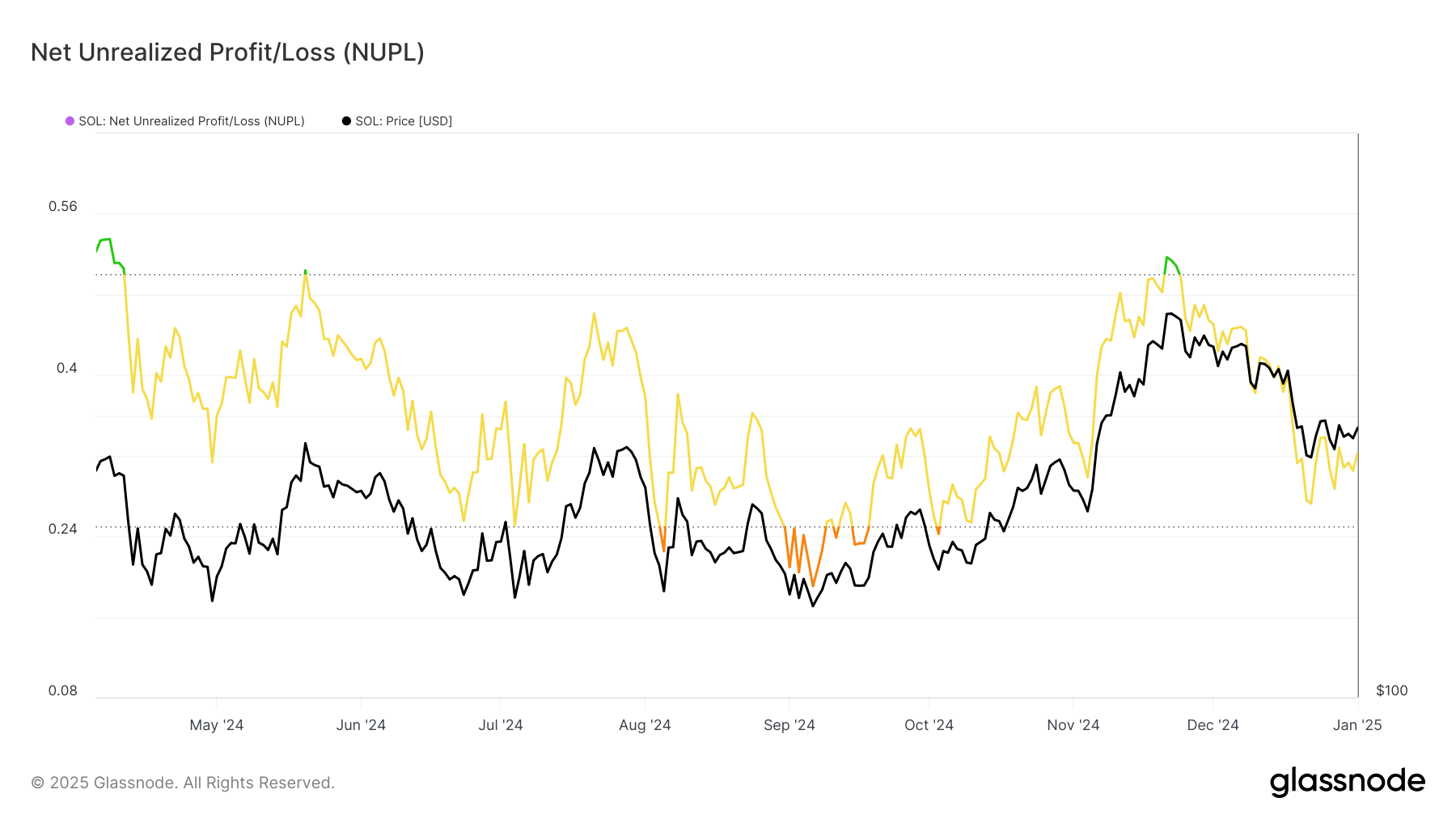

The optimism is palpable, with the NUPL indicator showing that despite some turbulence, Solana holders remain steadfast in their belief in its recovery potential. This confidence is instrumental in supporting the current uptrend and setting the stage for further growth. I’ve learned over the years that investor sentiment can be a powerful driving force behind market movements, so I’m excited to see what lies ahead for SOL.

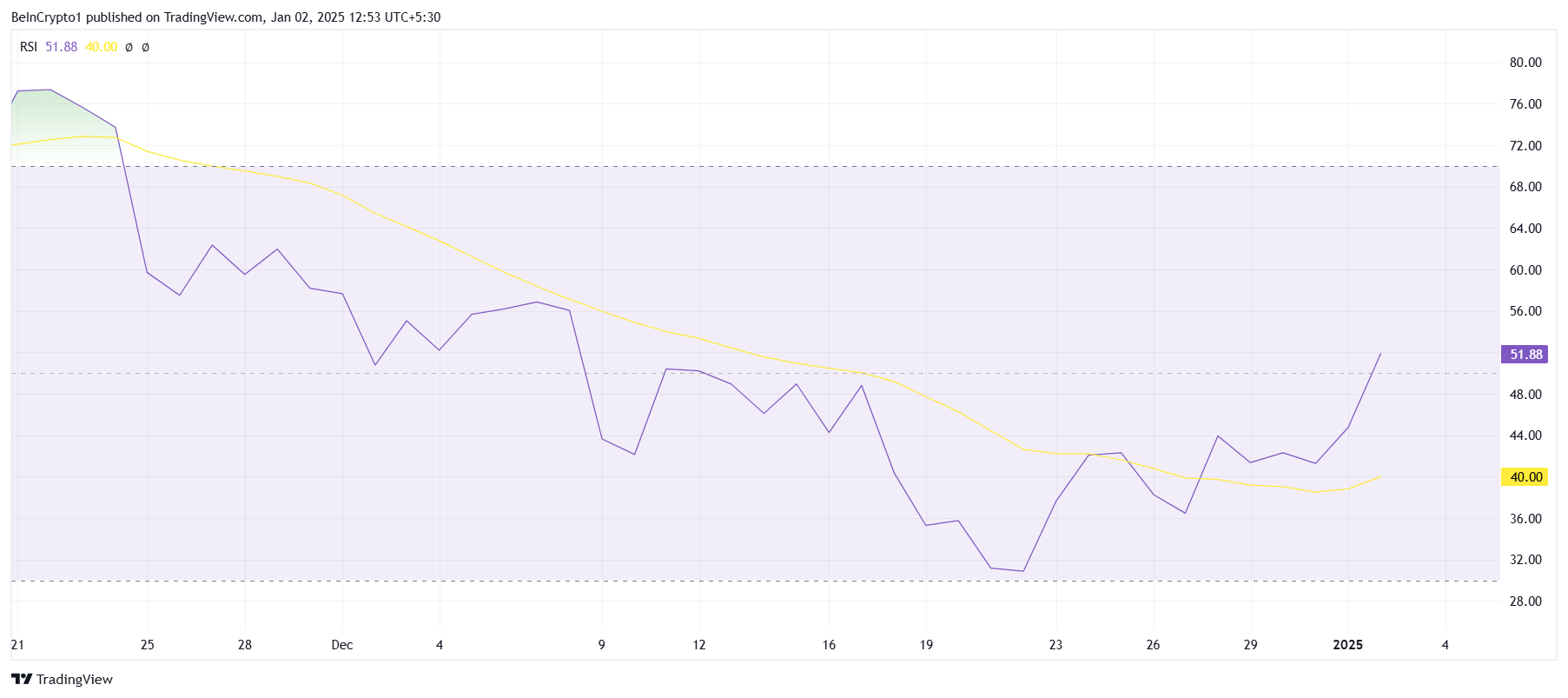

The macro momentum seems to be strengthening as well, with the RSI climbing back above 50. This suggests that bullish momentum is returning and could pave the way for even more price increases. However, as always in crypto, there are no guarantees, and we must stay vigilant for any potential pitfalls.

My personal prediction? I believe SOL has the potential to reclaim $221 and push toward $245 if it can hold the current support at $201. If that happens, we’ll be back on track for a significant recovery from recent setbacks. But as they say in crypto, ‘never invest more than you can afford to lose… and always remember, the market doesn’t care about your feelings.’ So let’s keep our eyes on the chart and our fingers crossed!

And now, for a little humor to lighten the mood: Did you hear about the crypto that was afraid of the dark? It kept asking its holder, “Are we in the bear market yet?

In recent times, Solana (SOL) has surged past a prolonged phase of neutral movement, successfully establishing the $200 mark as a new foundation following a lengthy stint where it remained beneath this price point throughout most of December.

This bullish trend is sparking renewed confidence among investors, implying that Solana (SOL) might keep climbing and reach even greater price goals.

Solana Investors Are Hopeful

The NUPL indicator for Solana suggests that investors continue to have faith in the altcoin’s rebound, even amidst recent market fluctuations. Instead of cashing out their investments, they are choosing to hold onto them, thereby alleviating excessive selling pressure. This optimistic outlook is bolstering the ongoing upward trend and providing a solid base for future growth.

As a researcher examining market trends, I can’t help but notice the significant impact investor confidence has in fostering sustained recoveries. By maintaining their positions, market participants alleviate supply-side pressure, providing a conducive environment for optimistic market movements to flourish. This situation puts Solana (SOL) in an advantageous position, ready to seize this positive sentiment and maintain its upward momentum.

Solana’s overall positive trend is getting stronger as its Relative Strength Index (RSI) surpasses the neutral 50.0 mark once more. This upward shift suggests that bullish power is resurfacing, possibly paving the path for additional price rises. Maintaining an RSI above 50.0 usually signals a positive context for further growth.

The restored bullish power might aid Solana in regaining important resistance points. If this energy carries on, SOL might keep climbing and hit even greater price achievements. The technical signs point towards Solana being robust enough to bounce back from its recent challenges.

SOL Price Prediction: Recovery Restarts

At present, Solana is being traded at around $205, marking an 8.7% increase over the past 24 hours. This significant rise has enabled Solana (SOL) to exceed and reverse the previous resistance of $201 into support. Maintaining this level will be vital for continuing the current recovery and potentially aiming for more growth in the future.

For SOL, the immediate aim is to restore $221 as a stronghold, an essential hurdle that could pave the way towards the desired level of $245. Overcoming this barrier at $245 would help Solana recoup a significant portion of its recent setbacks, strengthening its optimistic projection and invigorating investor confidence.

If the momentum for SOL isn’t maintained or if there are significant sell-offs, the $201 support level might be breached. In such a scenario, SOL could either consolidate at levels above $186 or even drop below this point, potentially negating the bullish outlook completely.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-02 13:04