As a seasoned crypto investor who has navigated through the tumultuous seas of the digital asset market for years, I find myself standing on the precipice of both fascination and caution regarding Pump.fun. The allure of potential gains in the meme coin space is undeniable, but the recent regulatory crackdowns and platform controversies have left me questioning if this particular ship is worth sailing on.

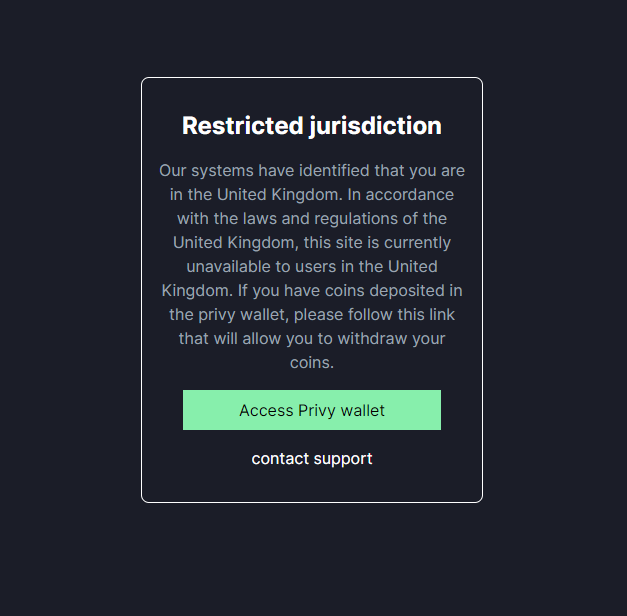

Pump.fun, a meme coin launchpad operating on the Solana blockchain, has barred UK residents from using its platform. The move was made public on Friday in response to escalating regulatory restrictions and warnings issued by the Financial Conduct Authority (FCA).

The FCA recently cautioned that Pump.fun might be operating without proper authorization.

FCA Continues to Probe Unregistered Crypto Platforms

After its debut earlier in the year, Pump.fun has experienced significant achievements with tokens such as PNUT and WIF. These ventures rank among the biggest meme coins at present, and it’s been reported that their creators have amassed a substantial sum of $250 million.

Despite its initial monetary growth, the platform’s success is now waning, and both regulators and the community are examining it closely. On December 3rd, the UK Financial Conduct Authority (FCA) declared that Pump.fun is not permitted to target users in the UK. They also advised that users who persist in accessing Pump.fun will not be covered by the FCA’s compensation scheme. After this warning, the platform has halted all services within the UK. As of Friday, the website is inaccessible from the country.

It’s not a new occurrence that warnings from the Financial Conduct Authority (FCA) have prompted cryptocurrency firms to suspend operations in the UK. In fact, last year, Binance halted the registration of new users following its withdrawal of registration with the regulatory body.

Simultaneously, the Financial Conduct Authority (FCA) is working towards providing clear guidelines for the cryptocurrency sector within the nation. Recently, they declared that they aim to establish definitive regulations for cryptos by the year 2026, with a significant emphasis on stablecoins.

In a post on X (previously Twitter), Mario Nawfal stated that Pump Fun’s operation focused on orchestrating group purchases to artificially inflate cryptocurrency prices. This strategy often resulted in common investors suffering losses when the market plummeted following these “pumps.” The FCA claims that Pump Fun was providing financial services without proper authorization, thus breaching UK laws, and potentially exposing users to fraudulent activities.

Pump.fun Continues to Face Challenges and Backlash

In recent times, Pump.fun has encountered numerous obstacles. Lately, the live-streaming aspect of the platform has attracted much criticism because it’s being exploited inappropriately.

At first, this feature was created as a tool for developers to showcase their projects. However, it has unfortunately been misused to disseminate harmful and threatening content. In some cases, individuals have made threats to harm animals or people if certain financial targets weren’t met.

Simultaneously, the data showed that more than 60% of traders on Pump.fun end up losing money, while only about 10% manage to make substantial profits. The majority, approximately 90%, either lose their investments or earn small returns, typically less than $100.

Moreover, the presence of regulatory and reputational hurdles has opened up opportunities for new players in the market. For instance, PancakeSwap unveiled SpringBoard, a meme coin launch platform, within the Binance Smart Chain network.

As a crypto enthusiast, I’ve been closely watching the surge of interest in the Virtuals Protocol, particularly their innovative approach to AI agent tokens. In the recent past, this platform has seen impressive growth, with over 21,000 tokens minted in November alone. This momentum has propelled its market capitalization beyond the $1.8 billion mark.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-06 21:41