Oh dear! Solana’s price has taken a rather alarming tumble since it reached the dizzying heights of $295.83 on January 18. As of this very moment, SOL is trading at a mere $171.81, which is a staggering 41% drop. One might say it’s having a bit of a crisis!

This cheeky little altcoin, which had been frolicking within an ascending parallel channel since the dawn of 2023, has now decided to dip below the lower line of said channel. This, my friends, is akin to a gentleman losing his monocle at a garden party—quite the scandal! 🥴

Bears Have Taken the Reins as Solana Breaks Its Multi-Year-Long Channel

Solana had been enjoying a lovely jaunt within an ascending parallel channel since June 2023, but alas, it has now broken below it for the first time in a year. One can only imagine the bears throwing a grand celebration! 🎉

This channel, you see, is formed when an asset’s price dances between two upward-sloping parallel trendlines, indicating a sustained bullish trend with higher highs and higher lows. The upper line is like a snooty butler, acting as resistance, while the lower line serves as support—though it seems to have taken a holiday!

As with our dear SOL, when the price tumbles below the lower line, it signals a break in the uptrend, suggesting that selling pressure has overwhelmed the buyers’ strength. It’s like a game of musical chairs, and the bears are winning! 🐻

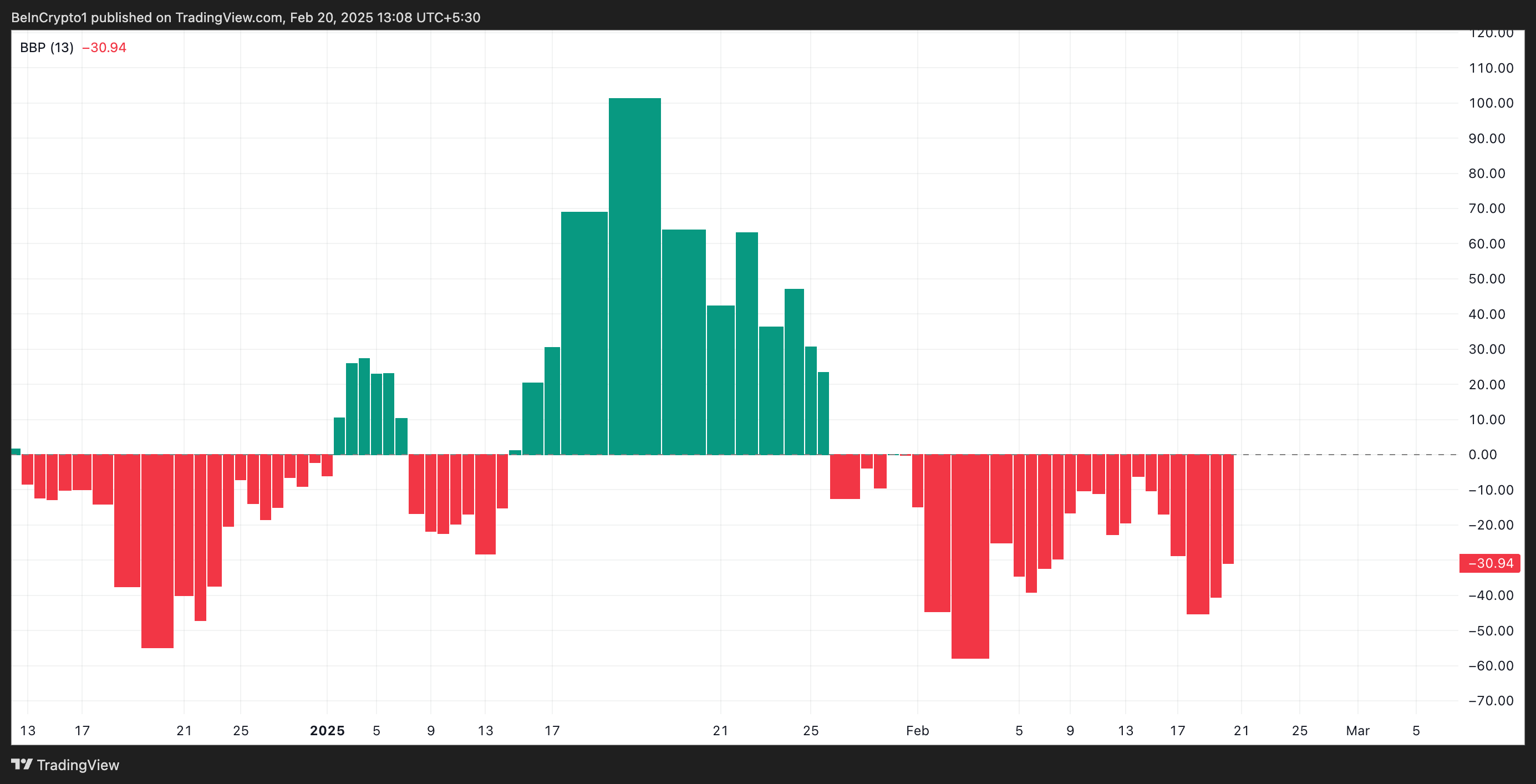

Moreover, the coin has been recording negative Elder-Ray Indexes since January 27, confirming the strengthening bearish bias against SOL. At this very moment, it stands at a rather dismal -30.4. Talk about a party pooper!

This indicator measures the strength of bulls and bears in the market. When the index is negative, bear power dominates, signaling strong selling pressure and potential further price decline. It’s like a bear market tea party, and no one’s invited! ☕️

SOL Sets Its Sights on $136 Amid Weak Buying Pressure

According to its Fibonacci Retracement tool (a rather fancy contraption, if I may say so), SOL’s price risks plummeting to $136.62 if buying pressure continues to wane. If the bulls fail to defend this support level, we could see the price dip to $120.72, a low it last reached in September. Oh, the horror! 😱

However, should a resurgence in demand for SOL occur, it would invalidate this bearish outlook. In such a delightful scenario, its price could attempt a retest of its breakout line. A successful retest could send its price soaring above the lower line of the ascending parallel channel and toward $220.58. Now that would be a plot twist worthy of a novel! 📈

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-02-20 14:53