Ah, Solana! The cryptocurrency that has all the stability of a three-legged giraffe on roller skates. Over the past week, its price has been more volatile than a hyperactive squirrel on espresso, thanks to some rather unfortunate market shenanigans. This has resulted in a futures market sentiment that resembles a deflated balloon—sad, droopy, and utterly lacking in enthusiasm.

With confidence plummeting faster than a lead weight in a swimming pool, SOL is now eyeing a dip below the $130 mark, which is about as welcome as a surprise visit from your in-laws.

Solana Struggles as Traders Exit Stage Left

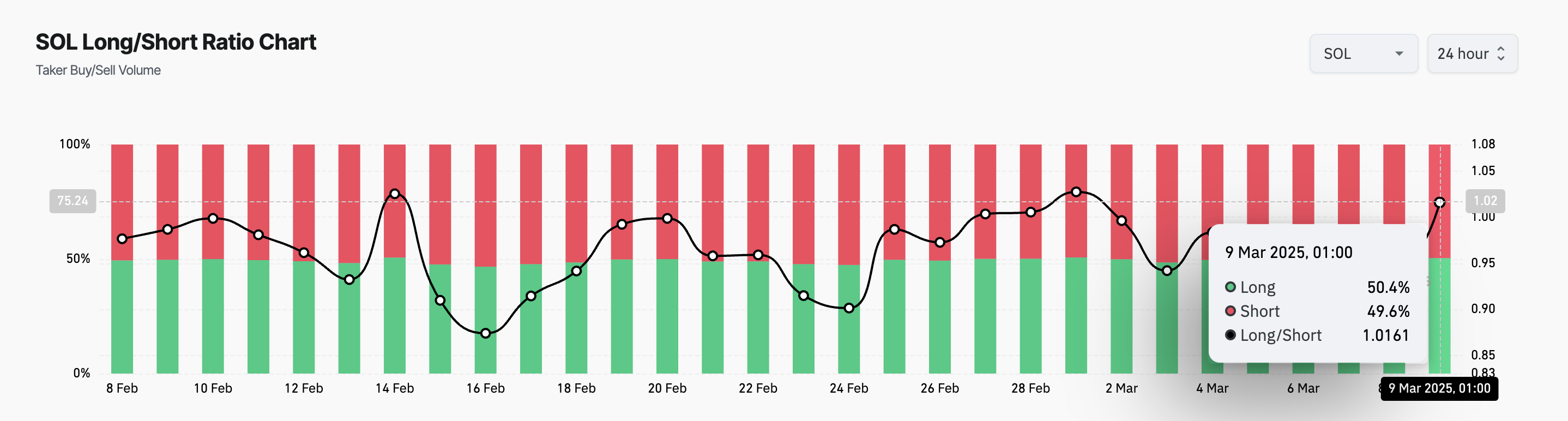

Our dear SOL has a negative funding rate, which is a fancy way of saying that traders are feeling about as bullish as a cat in a room full of rocking chairs.

According to the ever-reliable Coinglass data (which sounds like a fancy drink but is actually just numbers), SOL perpetual futures have been stuck in a negative funding rate for the last three days. This means short sellers are paying to hold their positions, which is like paying for the privilege of sitting on a sinking ship. At the moment, it stands at a thrilling -0.0060%.

The funding rate is essentially a periodic fee exchanged between long and short traders in perpetual futures contracts, designed to keep the contract price aligned with the spot market. Think of it as a bizarre game of financial musical chairs, where everyone is trying to avoid being the last one standing.

When this rate is negative, it means short sellers (those brave souls betting on a price decline) are paying fees to long traders, which is about as encouraging as a rain cloud at a picnic.

Thus, more traders are gearing up for a price drop, reinforcing the downward pressure on the coin’s price like a particularly heavy elephant sitting on a seesaw.

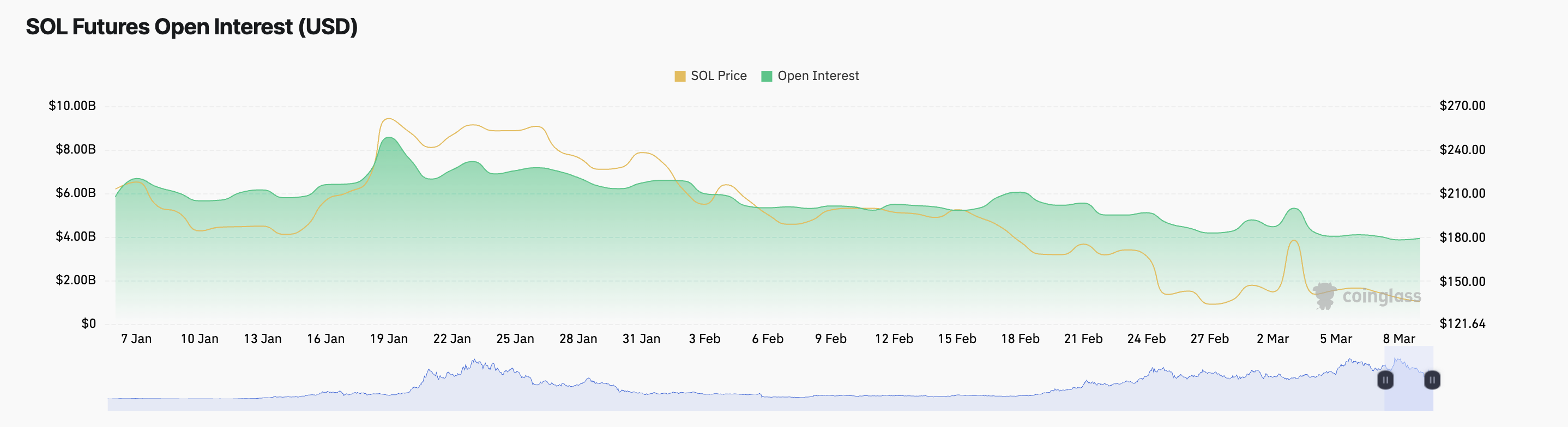

Moreover, the lack of confidence among SOL futures traders is reflected in its plummeting open interest. Currently, it sits at a staggering $3.94 billion, having fallen 19% since the beginning of March.

An asset’s open interest tracks the total number of active futures contracts that have not been settled. When this number falls, especially during a price decline, it suggests that traders are closing positions faster than a cat can knock over a glass of water. This confirms the reduced conviction in a short-term SOL price recovery among its futures traders.

Solana Bulls Weaken—Can They Prevent a Drop Below $130?

As of now, SOL is trading at $137.70, precariously perched just above the support floor of $136.62. As bullish sentiment wanes, this level risks being flipped into a resistance zone, which is about as comforting as a cactus in a balloon factory.

If this happens, SOL’s price could slip below $130, potentially exchanging hands at a bargain price of $120.72. What a steal! 🤑

On the flip side, if bullish momentum decides to make a grand return to the SOL market, this bearish projection will be invalidated faster than you can say “cryptocurrency.” In that delightful scenario, new demand could send the coin’s price soaring to $182.31, which would be a sight for sore eyes indeed!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-03-09 14:26