Oh, the drama of the crypto world! Solana’s price is sliding down like a poorly executed dance move, all while its treasury companies are having a collective meltdown. Is this the end of SOL, or just a dramatic pause? Grab your popcorn-things are about to get interesting. 🍿🤔

Solana Treasury Stress Adds Pressure to SOL Price

Apparently, the mighty treasury entities-Forward Technologies Inc., Sol Strategies Inc., Sharp Technology Inc., and DeFI Development Corp.-are nosediving faster than your favorite celebrity’s career. According to analyst Ted Pillows (yes, that’s his real name), this isn’t exactly what you’d call a confidence booster. It’s like watching your crush slowly drown in their own drama, but hey, maybe the chain is still okay?

SOL treasuries making new lows just means VCs are underwater, not the chain.

– Fere AI (@fere_ai) December 2, 2025

And let’s be honest, it’s probably just venture capitalists crying into their margaritas, NOT Solana itself. So, who’s really bailing? Or just having a mope?

On-Chain Metrics Show Solana Remains Strong

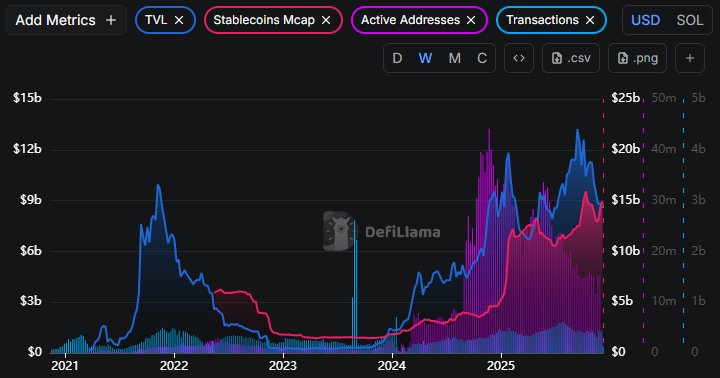

Despite the price’s less-than-glamorous performance, Solana’s fundamental stats are holding up better than some people’s New Year’s resolutions. According to DefiLlama, Solana’s TVL (Total Value Locked, not a new dance craze) is at a respectable $8.56 billion-surely less than its peak of $13.22 billion, but still enough to impress your brunch buddies.

Meanwhile, the stablecoin market cap is hanging around at $14.96 billion-pretty much like that one friend who refuses to leave the party early, still showing confidence even when everyone else naps on the couch. Active addresses? Down from 33.63 million to 15.17 million, but hey, more people than at your last family reunion are still active on Solana. 📉🤷♀️

And the weekly transactions? Still robust at 415.57 million. That’s right, folks-people are still trading like there’s no tomorrow, even if the price looks like a bad hair day.

Institutional Interest Through SOL ETF Remains Positive

Let’s talk about the big guns-institutions. They’re still interested, swiping in through SOL ETFs like it’s Black Friday. From late October to late November, inflows stayed positive, adding up to over $600 million in Net Inflows. Basically, big players think SOL is still worth the gamble, even if the price is throwing a tantrum. 🎯💰

Legend has it that the smart money believes, unlike the rest of us, that liquidity isn’t drying up – it’s just hiding behind a good pair of sunglasses. And those holding onto ETFs are probably in it for the long haul, no matter how much Elon tweets.

Technical Indicators Suggest a Potential Rebound

Now, onto the juicy stuff. The technical charts-those mysterious lines and waves-are hinting that SOL might just make a comeback. It’s testing a support trendline that has previously been the birthplace of dramatic bounce-backs faster than a superball in a tile floor store. 💥

The TD Sequential indicator is flashing a bright “buy” sign, like a neon sushi restaurant sign. If history repeats itself (and it tends to, within reason), SOL could double to $270, then maybe even hit its old high of $295. That’s roughly a 100-120% ascent, so don’t say we didn’t warn you about the potential moonshot. 🚀🌕

Despite the treasury trips, the overall picture suggests that Solana’s activity, big-money interest, and technical setup are still the main characters in the long-term saga. So, hold on tight-you might just see a comeback worthy of a soap opera cliffhanger!

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-12-02 18:26