As a seasoned crypto investor with a knack for recognizing potential, I find Solana’s recent surge intriguing and promising. Having closely followed the market since the early days of Bitcoin, I’ve witnessed numerous trends come and go, but Solana seems to be carving out its own niche.

In recent weeks, the value of Solana’s native token, SOL, has remarkably surpassed many other digital assets. It’s almost catching up with Binance‘s BNB to take the fourth spot as the largest digital currency in terms of market capitalization.

Based on current market statistics, Solana’s market cap currently sits at around $84.4 billion. This increase is due to a surge of over 6% in its value over the last seven days, which has resulted in each token being traded for approximately $179.5.

At this moment, Binance’s BNB holds a market capitalization of $88.5 billion, with each token trading at approximately $606. Notably, Solana appears to be dominating when considering the total value locked on decentralized finance (DeFi) protocols within each network.

As per DeFiLlama’s statistics, the Solana blockchain holds approximately $6.3 billion in assets within its decentralized finance system, contrasting with around $4.7 billion on the BNB Chain. Furthermore, data from the platform indicates there are roughly 6.5 million active addresses on Solana, as opposed to about 965,000 on BNB.

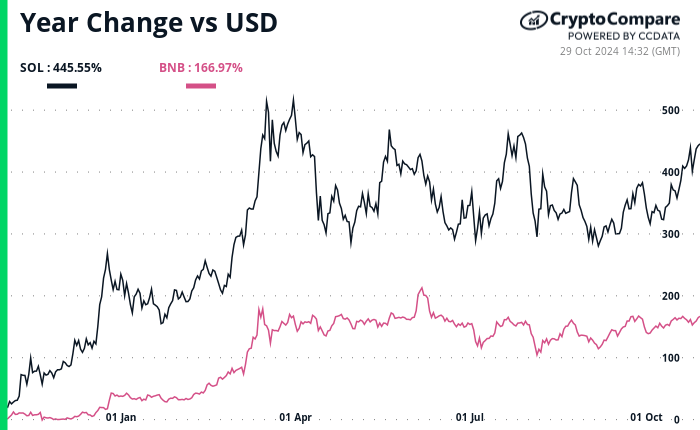

This year, Solana (SOL) has significantly outshone many other cryptocurrencies, as indicated by data from CryptoCompare. Specifically, SOL has seen a staggering increase of more than 445% in the last twelve months. In comparison, Binance Coin (BNB) has risen approximately 167% during the same period.

It’s important to note that despite the fact that these two cryptocurrencies operate within their respective blockchain ecosystems as gas tokens powering their decentralized finance systems, they each have unique methods by which their supply is managed.

In contrast to BNB, which has a built-in real-time burning mechanism (BEP-95) that burns a portion of the gas fees within each block to decrease its overall circulating amount, Solana lacks a capped supply and instead employs an inflation mechanism.

As a crypto investor, I’m sharing insights about Solana, an inflationary token that sees its supply growing at a fixed rate. Initially, when it was launched, the genesis block – the very first block on the blockchain – held 500 million SOL tokens allocated for distribution. Today, the total circulating supply of SOL has expanded to approximately 587 million.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- ALEO/USD

- DEXE/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Who Is Dafne Keen? All About Logan Star As She Returns As X-23 In Deadpool & Wolverine

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- The Last Of Us 2 Teaser: Pedro Pascal And Bella Ramsay Promise An Emotional-Tense Ride In The First Glimpse Of The Post-Apocalyptic Drama

2024-10-29 20:24