Get ready to roll in the dough, Solana fans! The CME has opened futures trading on Solana, and guess who made the first block trade? FalconX, that’s who! This could mean more liquidity and institutional legitimacy for our beloved Solana. And who knows, it might even help the case for a Solana ETF. 🤑

Remember when Gary Gensler’s SEC was considering Bitcoin and Ethereum ETFs? CME futures played a big role in determining approval. Now that Solana has this stamp of approval too, it could improve its chances with the Commission. 💼

CME Unleashes Solana Futures Contracts

After some rumors and back-and-forth, Solana, the leading cryptoasset, finally has a substantial market for futures contracts. In January, the CME hinted it might launch SOL and XRP futures but quickly clarified that no official decision had happened. Now, however, the CME debuted Solana futures and FalconX made the first trade:

“FalconX is proud to execute the first block trade in CME SOL futures with StoneX. This highly anticipated launch marks a historic moment for the Solana ecosystem, allowing institutional investors to manage risk and price exposure on a regulated venue,” said Josh Barkhordar, Head of US Sales at FalconX.

The CME is not the first market to offer Solana futures, as Coinbase began offering them in February after seeking CFTC approval. However, the CME is much bigger. It is very much a pillar of the TradFi ecosystem, with well over $100 billion in total assets. As Matthew Sigel, VanEck’s Head of Digital Assets Research, noted, this could be very important for a Solana ETF.

The Solana ETF recently suffered a few setbacks; the SEC delayed several applications, prompting sizable outflows from Solana spot trading. Experts have previously noted that a sizable futures trading market helped persuade the SEC to approve ETFs for Bitcoin and Ethereum. The CME’s new Solana futures market could serve a similar function.

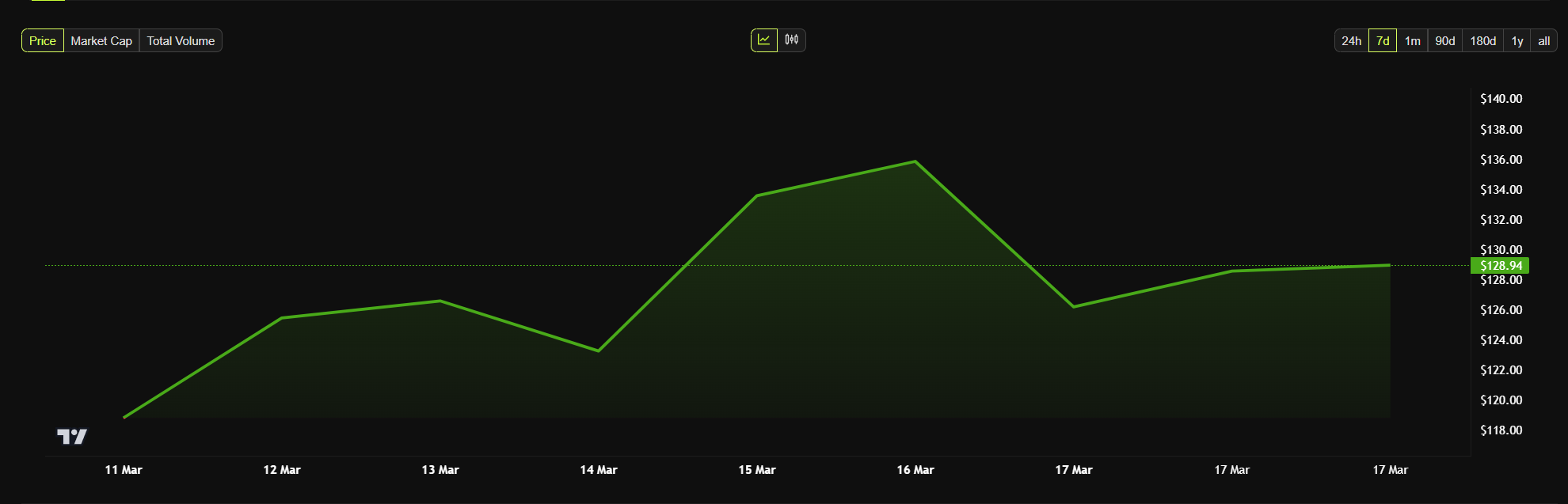

Besides that, the CME’s Solana futures market offers a few significant advantages. First of all, it provides a sense of institutional legitimacy, which may encourage institutional investment. Additionally, it will greatly increase liquidity in the market. This could have a huge impact on Solana’s future market behavior, but it hasn’t changed SOL’s price in the short term.

Even if the new futures trading didn’t immediately bump Solana’s price, that’s very understandable. A development like this will hopefully set up future successes, but that doesn’t always translate to a short-term price bump. 📈

If it encourages liquidity, institutional investment, or even a Solana ETF, then the CME could end up creating some very bullish outcomes. 🐂

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Oblivion Remastered: How to get and cure Vampirism

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Does Oblivion Remastered have mod support?

- 30 Best Couple/Wife Swap Movies You Need to See

- DODO PREDICTION. DODO cryptocurrency

- The Elder Scrolls: Oblivion Remastered Review – Rebirth of a Masterpiece

2025-03-17 21:59