Oh dear, Solana (SOL) is having a bit of a meltdown, trading at its lowest level in four months! In the last 24 hours, it’s dropped a cheeky 5%, which is just part of a dramatic 45% correction over the past 30 days. Talk about a rollercoaster ride! 🎢

With its market cap now a mere $70 billion (I mean, who even has that lying around?), the bearish vibes are palpable. The Ichimoku Cloud and EMA indicators are practically waving red flags, suggesting that more downside is lurking just around the corner. Yikes!

Solana Ichimoku Cloud: A Bearish Drama Unfolds

The Ichimoku Cloud for Solana is looking about as cheerful as a rainy Monday morning. The price is hanging out well below the cloud, which is like being the last kid picked for dodgeball. The ominous red cloud ahead is a clear sign of bearish sentiment, with Leading Span A (the green line) sulking below Leading Span B (the red line).

This gloomy setup suggests that the negative momentum is here to stay. The Tenkan-sen (blue line) is playing hide and seek below the Kijun-sen (red line), adding to the bearish pressure, while the Chikou Span (green lagging line) is also trailing behind like a lost puppy. 🐶

There was a brief moment of hope, a consolidation phase, but alas, SOL couldn’t muster the strength and fell flat on its face again. Currently, it’s stabilizing, but the bearish structure is still very much alive and kicking.

For any sign of a trend reversal, the price would need to leapfrog above the Tenkan-sen and Kijun-sen, followed by a daring dash through the cloud. But as long as it’s playing below these key Ichimoku levels, the bearish trend is likely to keep throwing tantrums.

SOL Whales: The Great Recovery Attempt

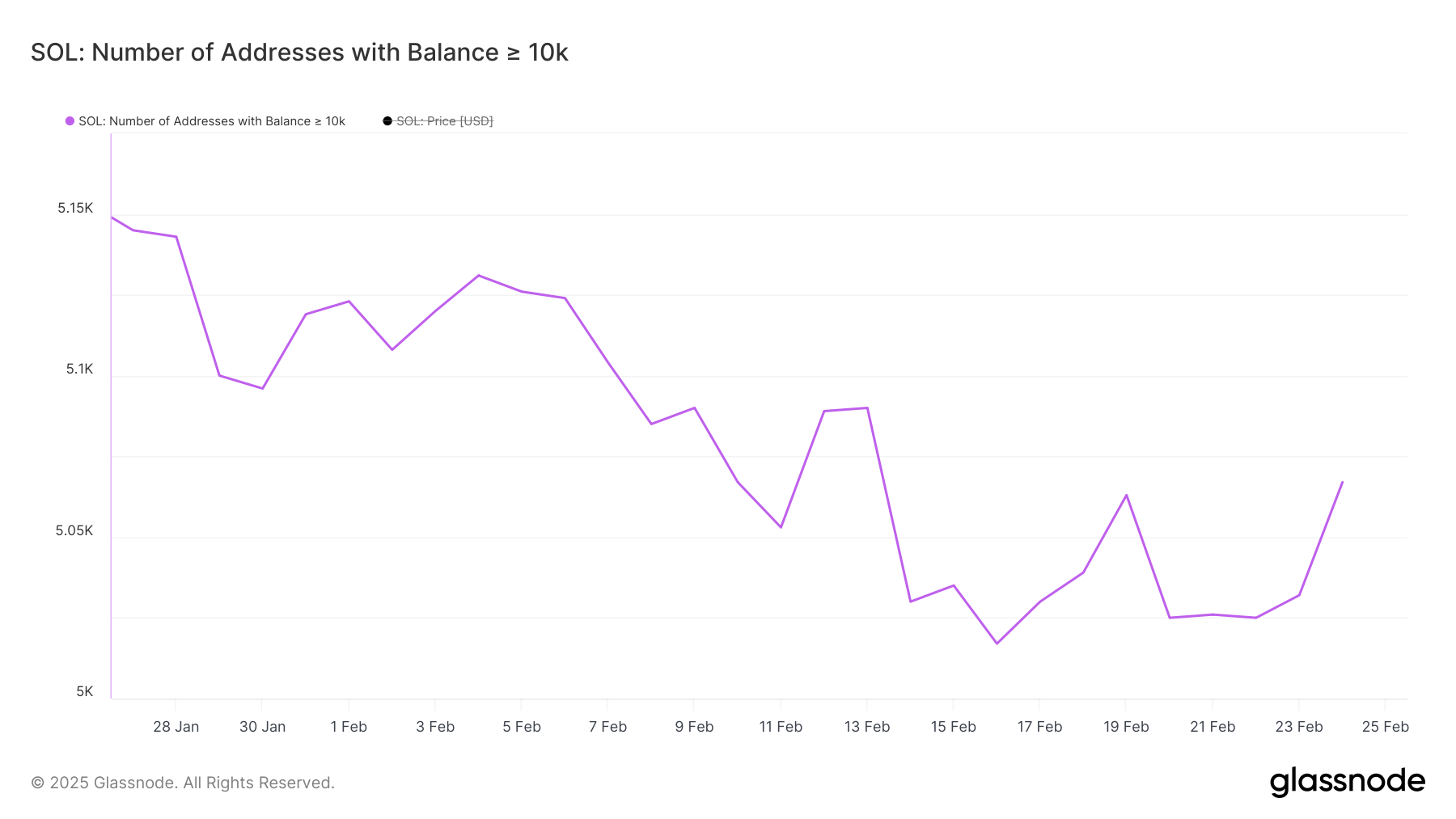

Now, let’s talk about the Solana whales—those addresses holding at least 10,000 SOL. Their numbers have been dwindling faster than my willpower at a dessert buffet, hitting 5,017 on February 16, the lowest since December 2024. 🍰

This mass exodus of large holders has been contributing to the bearish trend we see on the Ichimoku Cloud. When whales start selling, it’s like a stampede, increasing selling pressure and reinforcing the negative vibes in the market.

It’s all very dramatic and aligns perfectly with the overall bearish sentiment shown by the cloud indicators.

Keeping an eye on these whales is crucial because they can sway price movements like a diva at a concert. Their buying or selling can signal market trends, as they control a hefty chunk of the supply.

Recently, the number of Solana whales has shown a slight uptick, reaching 5,067. While it’s a glimmer of hope, it’s still lower than recent months but relatively high compared to historical values. So, it’s like finding a penny in the couch cushions—better than nothing, but not exactly a fortune!

Will Solana Hit Rock Bottom in 6 Months? 🤔

SOL’s EMA lines are looking as gloomy as a rainy day, with short-term lines hanging out below the long-term ones and a significant gap between them. This indicates strong downward momentum, suggesting that selling pressure is the reigning champion. If this downtrend continues, SOL could test the support at $133, and if that level goes poof, it could plummet to $120 or even $110—its lowest since August 2024.

The wide separation between the EMAs is like a neon sign flashing “bearish trend ahead,” aligning perfectly with the negative sentiment seen on the Ichimoku Cloud.

But wait! If the trend decides to do a dramatic U-turn, it could signal a potential shift in

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-25 23:47