In the dusty corners of the crypto market, Solana (SOL) finds itself gasping for breath, having recently tumbled below the $120 mark – a low not seen since the frost of February 2024. With a staggering 38% drop in the last month, it seems the bears are having a field day, and the bulls? Well, they’re probably hiding under a rock. 🐻

As the sellers tighten their grip, SOL stands at a crossroads, a critical test of support levels looming like a storm cloud. Any glimmer of recovery would need to smash through resistance zones like a bull in a china shop to signal a change in the winds. 🌪️

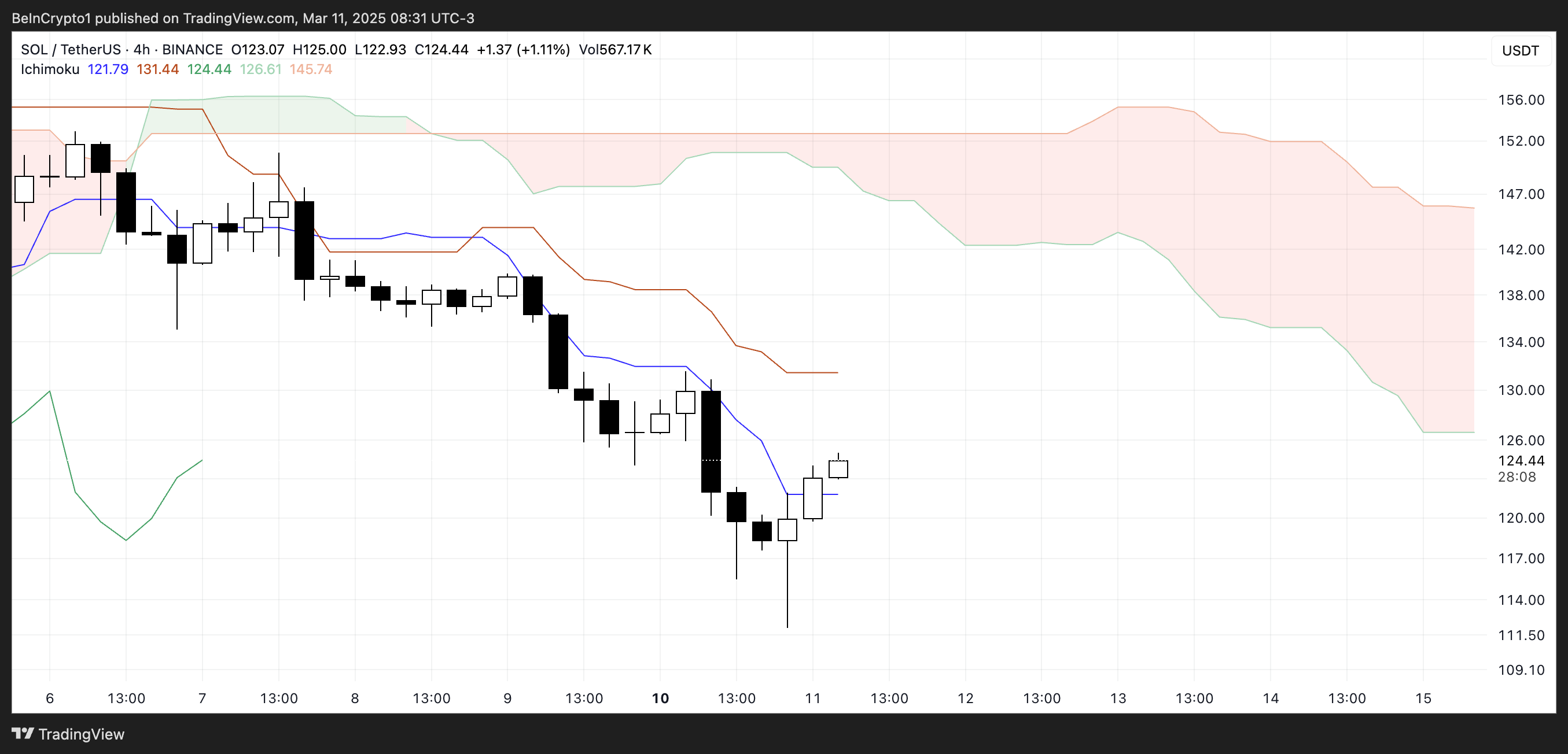

Solana Ichimoku Cloud: A Bearish Forecast

The Ichimoku Cloud, that mystical oracle of market trends, reveals that Solana is currently trading below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (base line). This is akin to a ship lost at sea, with the short-term trend firmly anchored in bearish waters. ⚓

Though the price has recently bounced from a local low, it hasn’t yet reclaimed those elusive resistance levels. The Ichimoku cloud ahead is painted a deep shade of red, echoing the bearish sentiment that hangs over the market like a thick fog. 🌫️

With the cloud hovering high above the current price, even a short-term recovery would likely meet fierce resistance in the $130 – $135 range. It’s like trying to climb a mountain with a boulder tied to your back! 🏔️

The Tenkan-sen’s position below the Kijun-sen only adds fuel to the bearish fire, as this crossover typically signals a downward spiral. For any hope of a trend reversal, SOL would need to break above both lines and ideally wade into the cloud, a sign of a potential neutral phase. Until then, the bearish cloud looms ominously, suggesting that any rallies might be as fleeting as a summer rain. ☔

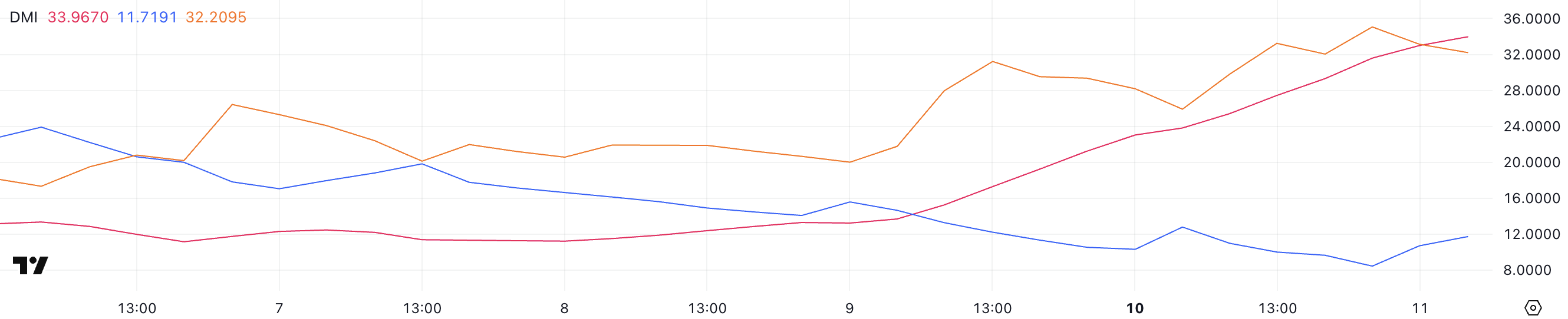

SOL DMI: The Sellers’ Stronghold

The Solana Directional Movement Index (DMI) chart tells a tale of woe, revealing that the Average Directional Index (ADX) has surged to 33.96, a significant leap from a mere 13.2 just two days prior. It’s like watching a tortoise suddenly sprout wings! 🐢✈️

The ADX measures trend strength, and a reading above 25 typically indicates a strong trend, while values below 20 suggest a weak or non-existent trend. This sharp rise confirms that SOL’s ongoing downtrend is gaining strength, much to the delight of the sellers. 😈

The +DI (positive directional index) has dipped to 11.71 from 15.5 two days ago but has managed a slight rebound from 8.43 yesterday. Meanwhile, the -DI (negative directional index) sits at 32.2, up from 25.9 two days ago, though it has slightly retreated from 35 just hours ago. It’s a rollercoaster ride of numbers! 🎢

The positioning of the +DI and -DI lines suggests that sellers are still in control, as the -DI remains significantly higher than the +DI. The recent dip in -DI from 35 to 32.2 could hint at some short-term relief, but with the ADX climbing like a cat up a tree, the prevailing downtrend remains intact. 🐱

The slight bounce in +DI suggests minor buying pressure, but it’s not enough to shift momentum in favor of the bulls. Until +DI rises above -DI or the ADX starts to decline, SOL’s bearish trend is likely to persist, with sellers dominating the price action like a stubborn mule. 🐴

Will Solana Plunge Below $110?

The Solana Exponential Moving Average (EMA) lines continue to paint a grim picture, with the short-term EMAs languishing below the long-term EMAs. This alignment suggests that downward momentum remains dominant, even as the price attempts a feeble recovery. If this rebound gains strength, Sol

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

2025-03-12 05:28