Oh dear, it seems Solana has taken a nosedive, plummeting below the all-important $200 mark. This unfortunate descent is like a bad sequel to a movie nobody wanted, mirroring the broader market’s dramatic plunge as Bitcoin decided to drop below $100,000. Who knew digital coins could be so dramatic? 🎭

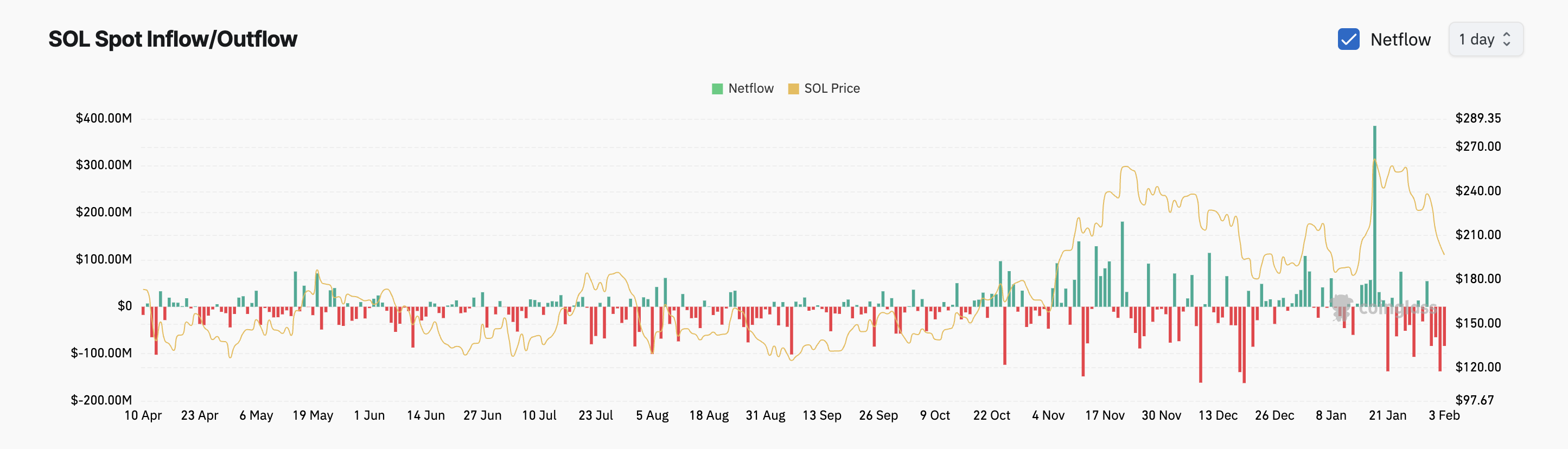

As if that wasn’t enough, the demand for SOL is evaporating faster than a snowflake in the Sahara, with outflows from its spot markets exceeding a staggering $365 million in just three days. Talk about a financial exodus! 🏃♂️💨

Solana’s Steady Spot Outflows: A Comedy of Errors

It appears that SOL has developed a rather unhealthy obsession with Bitcoin, as their fates are intertwined like a pair of star-crossed lovers. With Bitcoin’s recent weakness, traders have been selling SOL faster than you can say “cryptocurrency crash.” Since that fateful day on February 1, when Bitcoin dipped below $100,000, SOL spot traders have been retreating like a bad haircut. ✂️

According to Coinglass, the outflows from SOL’s spot markets have reached a jaw-dropping $367 million. That’s a lot of money to be running away from! 💸

When you see steady outflows from an asset’s spot market, it’s a clear sign that more traders are selling or withdrawing than buying. It’s like a party where everyone leaves before the cake is served—definitely a bearish sentiment! 🎂🚪

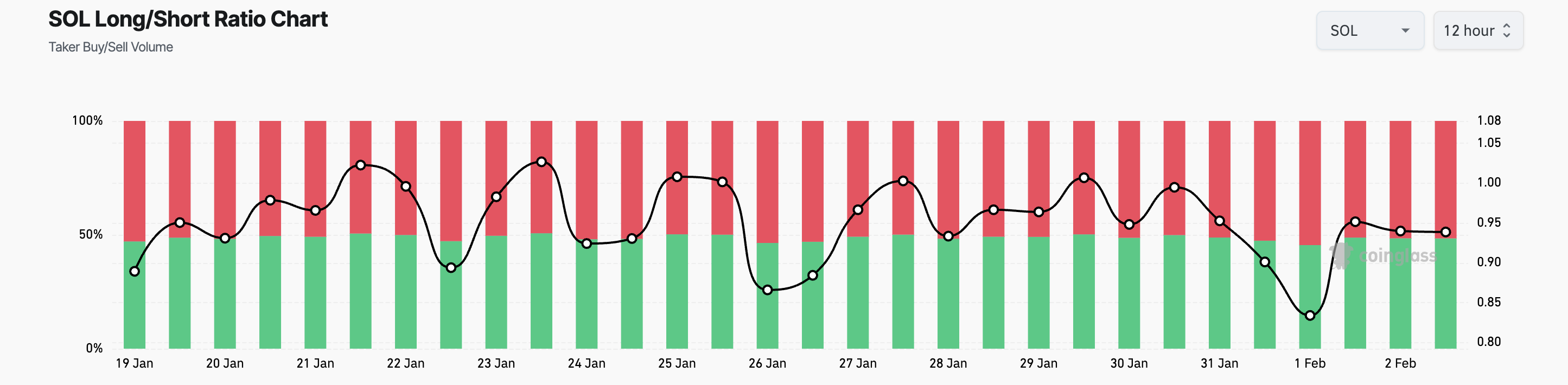

And just to add a cherry on top of this gloomy sundae, SOL’s long/short ratio on Monday morning is a dismal 0.93. That’s right, folks, it’s below one! This means there are more pessimists than optimists in the market, which is never a good sign. 😬

This ratio compares the number of long positions (those who think the price will rise) to short positions (those who think it will fall). With a ratio below 1, it’s clear that traders are betting against SOL like it’s the last horse in a race. 🐎💔

SOL Price Prediction: A Bearish Indicator That Could Lead to New Lows

Looking at the price chart, SOL’s Chaikin Money Flow (CMF) is hanging around the zero line, which is about as comforting as a lukewarm cup of tea. This indicator measures the money flow into and out of an asset, and right now, it’s signaling strong sell-offs among traders. ☕️

When the CMF dips below zero, it’s a sign that selling pressure is outpacing buying interest. If this trend continues, we might see SOL’s price tumble down to $187.71. Yikes! 😱

But wait! If there’s a sudden resurgence in demand for this beleaguered coin, we could see a miraculous recovery, with prices potentially rising to $229.03. It’s like a plot twist in a soap opera—will SOL rise from the ashes or continue its downward spiral? Stay tuned! 📺

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-02-03 17:18