Oh, look-Solana’s doing that thing again. You know, the one where it crawls out of the crypto gutter like a slightly damp raccoon and says, “Hey, remember me?” At press time, SOL is hanging around $142-up 4% in a day, down 1% in a week-because consistency is for people who don’t trade in digital monopoly money.

$130: The Floor, The Ceiling, The Holy Grail

Enter Crypto Patel, the man who’s seen more trendlines than actual trends, announcing that SOL has bounced off $130 like it remembered it left its dignity there. Apparently, this level isn’t just any number-it’s a magic confluence: horizontal support, rising trendline, ancient tribal markings from the Mayans (I may have made that last one up). But sure, let’s treat it like gospel.

$SOL reclaimed the $130 support with a clean bounce.

Sustained acceptance above $130 reactivates the $250 upside target.

Failure to hold converts structure bearish, opening downside toward the 0.382 Fib retrace at $75 and the 0.5 Fib level at $50.$130 remains the critical…

– Crypto Patel (@CryptoPatel) November 26, 2025

Oh good. So if we stay above $130, it’s off to the land of milk, honey, and $250. But if we dip? Well, hello, $75 and $50-the cryptoverse’s version of “starting over with nothing but a backpack and bitter life lessons.”

And speaking of dreams, enter CryptoCurb, who says they’ve spotted a giant Cup and Handle pattern. Not the kind that holds your overpriced oat milk latte, but a chart formation that allegedly predicts a move to $2,000. All we need is a breakout above $300 and-poof-Solana becomes the Lamborghini of blockchains. Sure, Jan.

Because nothing says “inevitable rally” like a symmetrical curve on a three-year-old chart. I can’t wait to print this out and wave it in my landlord’s face when he asks why I’m paying rent in JPEGs.

On-Chain Data Says “Nobody’s Happy” (Shocking)

Ali Martinez-presumably a full-time crypto detective and part-time therapist for devastated investors-drops in to say SOL has entered the capitulation zone on the NUPL indicator. Translation: everyone who bought at $200 is now crying into their cold ramen and questioning their life choices.

“Solana usually bottoms when investors capitulate-and that’s what we’ve seen over the past two weeks,” said Ali.

Fascinating. So the bottom comes when people give up? Like a bad relationship, but with more blockchain. And more hope. And worse customer support.

Still, history shows this has preceded actual bottoms before. So maybe this time it’s real. Or maybe it’s just the universe setting us up for another round of “Guess How Much You Lost This Week!”

The Big Boys Are In (Or So They Say)

Now, institutions are definitely involved this time. I know because someone named Upexi Treasury-with 2 million SOL and a name that sounds like a rejected Bond villain-is raising $23 million to “support operations” and “increase exposure.” In English: they’re doubling down because their last memo backfired.

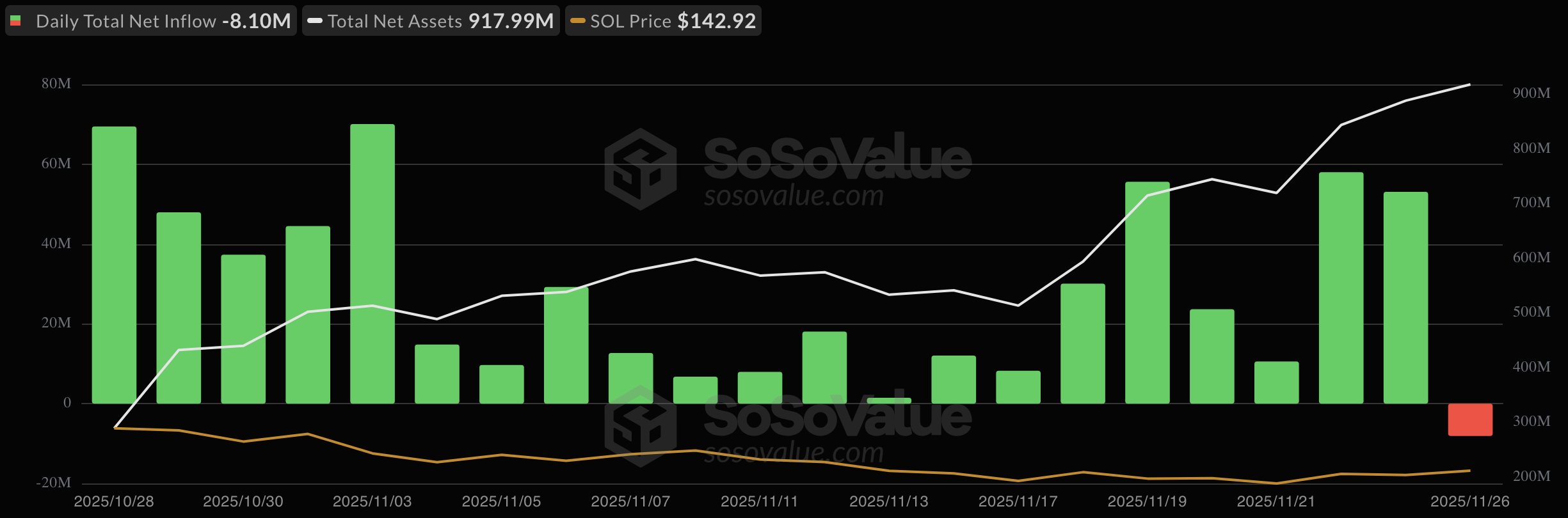

Meanwhile, SOL ETFs pulled in $531 million at launch-helped by a juicy 7% staking yield and fees lower than Bitcoin ETFs. But then, on November 26, the unthinkable happened: an outflow. $8.1 million vanished. Not a lot in the grand scheme, but enough to make someone in a button-up shirt panic and whisper, “Is it all falling apart?”

Total assets still sit near $918 million, which sounds impressive until you realize Apple spends more on snacks.

And yes, a spot Solana ETF got approved in Hong Kong. Because obviously, the future of American finance is being decided by regulatory bodies 7,000 miles away while we’re over here wondering if Doge will ever make a comeback. (Spoiler: it will. And I will lose money again.)

So where does that leave us? At the edge of glory or the cliff of shame? Will Solana soar to $2,000 like a diamond-encrusted phoenix? Or will we be auctioning off our graphics cards on eBay to pay for groceries?

Only time will tell. Or, more likely, only the next viral tweet will tell. Either way, I’ve already packed my emotional suitcase. 🔮🧳

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-11-28 07:51