As a seasoned crypto investor with a knack for spotting promising projects, I find myself increasingly intrigued by Solana (SOL). The recent surge in its price and market capitalization, coupled with its growing dominance in the decentralized finance sector, has piqued my interest.

Over the last seven days, Solana (SOL) has experienced a significant jump in value of over 7%, propelling it to become the fourth-largest cryptocurrency by market capitalization. At present, its total market cap stands at an impressive $88.28 billion, surpassing BNB‘s current market cap of $85.6 billion.

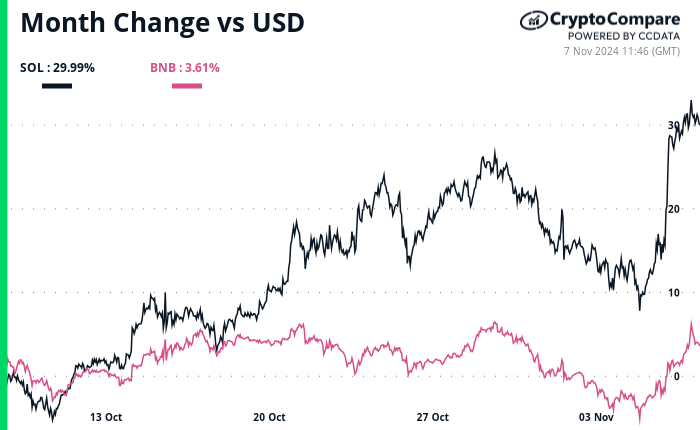

Over the past month, the price of Solana (SOL) has increased by approximately 30%, currently trading at about $187 per token, whereas Binance Coin (BNB) experienced a 3.6% rise and is now valued at around $594.

As for the world of Decentralized Finance (DeFi), as per DeFiLlama’s statistics, Solana boasts a total of $6.6 billion in value locked within its DeFi ecosystem, which is significantly more than the $4.6 billion found on BNB Chain. Furthermore, the data from the platform reveals that there are approximately 5.15 million active addresses on Solana, contrasted with about 871,000 active addresses on BNB.

The value of Solana has risen due to the expectation that Donald Trump’s win in the U.S. elections would positively impact Bitcoin‘s price, given his expressed enthusiasm for the cryptocurrency industry.

Donald Trump has pledged to dismiss Gary Gensler, the current head of the United States Securities and Exchange Commission (SEC), known for enforcing a string of regulations against the digital currency market.

As an analyst, I find it plausible that the potential victory of Trump could be contributing to the rise in Solana’s price. This is largely due to the increased likelihood of a U.S.-listed spot Solana Exchange-Traded Fund (ETF) becoming a reality, given recent developments such as Canary Capital Group’s initial move towards listing a spot Solana ETF in the United States.

As a researcher delving into the realm of digital currencies, it’s essential to note that while they share similarities as gas tokens within their respective blockchains, powering their decentralized financial systems, their supply mechanics are uniquely different from one another.

In contrast to BNB, which has a real-time burning feature introduced through BEP-95 and consequently burns a portion of gas fees in each block as part of an effort to decrease its overall circulating supply, Solana does not have a capped total supply. Instead, it operates with an inflation mechanism.

Solana operates as an inflationary digital currency, with its supply expanding at a fixed pace. Initially, when it was launched, the total supply was set to 500 million SOL within the genesis block – the first block in the blockchain’s creation. As of now, the total circulating supply has grown to approximately 587 million SOL.

Read More

- ONT PREDICTION. ONT cryptocurrency

- AI PREDICTION. AI cryptocurrency

- MOVR PREDICTION. MOVR cryptocurrency

- Dune Actress Rebecca Ferguson Joins Studded Cast Of The Magic Faraway Tree Alongside Andrew Garfield And More

- EUR ZAR PREDICTION

- T PREDICTION. T cryptocurrency

- What to Watch on Prime Video: 5 Best Movies and Series to Catch This Week; Featuring My Fault London, Elevation and More

- FWOG PREDICTION. FWOG cryptocurrency

- RSR PREDICTION. RSR cryptocurrency

- RAY PREDICTION. RAY cryptocurrency

2024-11-07 19:52