In a move that could make even the grumpiest bear crack a smile, dYdX, the kingpin of decentralized exchanges, dropped a bombshell announcement that might just catapult Solana (SOL $136.8 🤔) into the stratosphere of US adoption. 📈🎢

According to CoinDesk, dYdX is rolling out its very first spot trading product. This isn’t just any ol’ update-dYdX Labs claims it’s part of a grand plan to dive headfirst into the Solana ecosystem and lure in a fresh batch of users. 🐟🪝

The exchange, which has already racked up a staggering $1.5 trillion in cumulative trading volume since its debut, sees spot trading as its golden ticket to the US market. And with regulatory winds shifting favorably, the timing couldn’t be better. 🎟️💨

To sweeten the deal (because who doesn’t love freebies?), dYdX is waiving trading fees for the entire month of December. 🎁🎄

dYdX insists this expansion isn’t just about trading-it’s about boosting market depth, deploying fancy new trading tools, and staying true to the holy trinity of decentralized finance: transparency, self-custody, and a pinch of chaos. 🌪️✨

Coincidentally (or not), this move aligns perfectly with centralized exchange Robinhood, which also announced some shiny new product launches for US residents last week. 🤖💼

Can Solana Bulls Smash Through the $147 Liquidity Wall? 🐂🧱

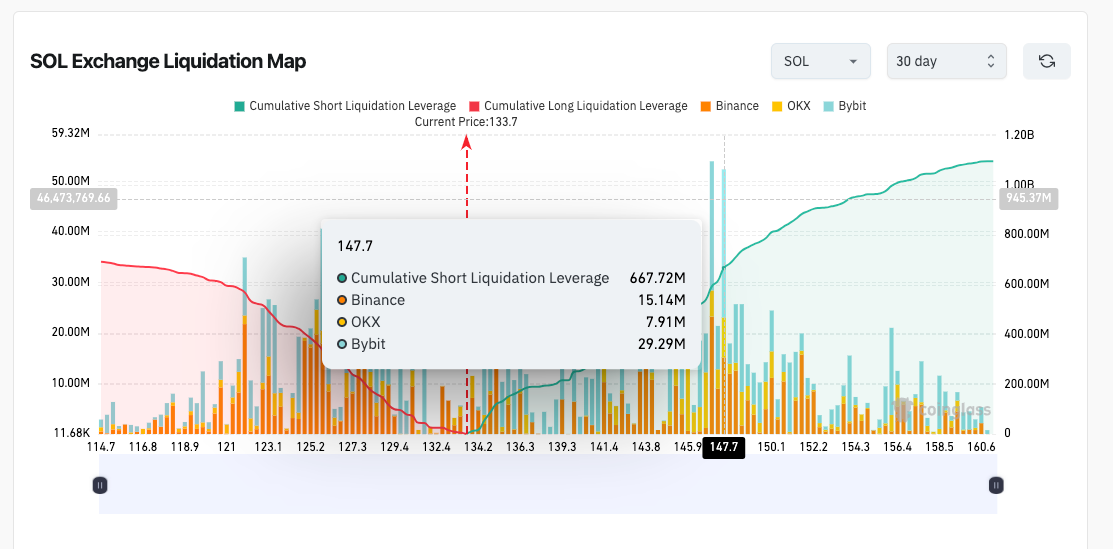

Solana derivatives positioning remains as bearish as a grizzly on Thursday, with traders scaling back their bullish bets across the board. Coinglass’ liquidation map data paints a grim picture, highlighting the bearish brigade’s dominance. 🐻📉

Solana Liquidation Map shows $667 million overhead leverage cluster at $147 | Coinglass, Dec. 11.

At press time, SOL long positions have dwindled to $692 million, while short positions loom ominously above the $1 billion mark. 😱💥

The $147 level is shaping up as the battleground for Solana traders-a $667 million liquidity pocket that could spark a short-squeeze rally toward $200 if breached. 📈🚀 But with long positions trailing shorts by nearly 30%, Solana’s rebound prospects are about as reliable as a chocolate teapot. 🍫☕

On the flip side, traders are eyeing $125 as the next support level if the market continues its downward spiral. Bulls have positioned $337 million in leverage there, but if that crumbles, Solana could tumble toward the $100 psychological zone, where buyers might finally dig in. ⛏️🛡️

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-12 03:53