The price of Solana (SOL) has dropped by 20% over the past week, reducing its market capitalization to approximately $85 billion. Technical analysis tools such as the Ichimoku Cloud and Directional Movement Index suggest a significant bearish trend. At present, SOL is trading below crucial support levels and experiencing heavy selling activity.

Should the present declining trend persist, Solana (SOL) might encounter support levels at around $159 and $147, with a possible further slide down to $133 – representing a 22.6% correction. On the flip side, if recovery occurs, SOL could aim for resistance levels at $183, and if successfully breached, it may surge towards $203 – giving optimism for bullish energy to resume.

Solana Ichimoku Cloud Confirms a Bearish Setup

In simpler terms, the Ichimoku Cloud chart suggests that the price of Solana is likely to decrease. At present, the price is moving lower than the Ichimoku Cloud, which implies a dominant downward trend. Additionally, the cloud’s color is red and growing larger, suggesting a strengthening bearish trend and potential resistance in the near future.

Furthermore, both the converting line (in blue) and the base line (in red) are decreasing, with the converting line sitting beneath the base line. This arrangement underscores a persistent bearish trend, as there’s currently no indication of an imminent change in direction.

From my perspective as an analyst, it’s evident that the green lagging span falls short of both the current price and the cloud, which underscores a predominantly bearish sentiment. However, should there be any potential for recovery, the Solana price must surmount the cloud barrier first.

SOL Current Downtrend Is Still Strong

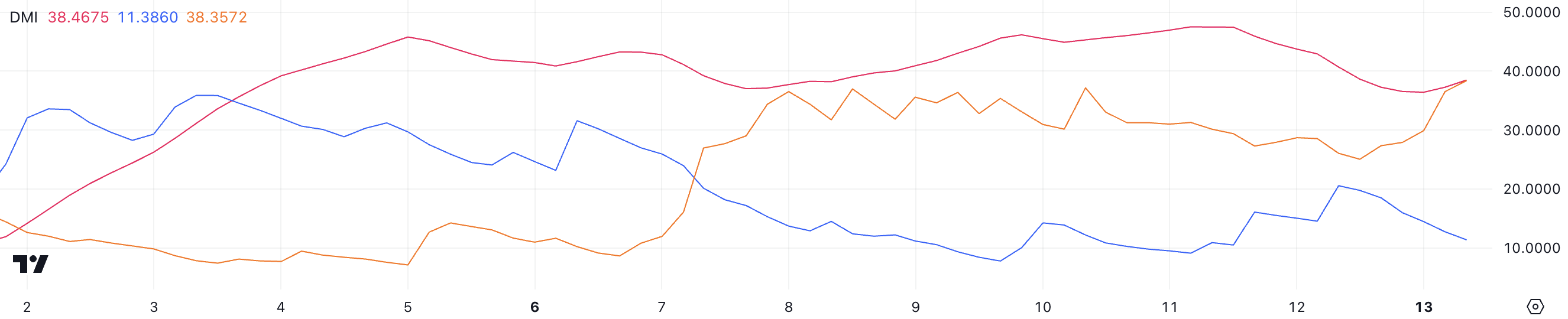

A SOL DMI chart’s ADX value stands at 38.4, suggesting a robust and undetermined direction for the ongoing trend. The ADX (Average Directional Movement Index) evaluates the intensity of a trend regardless of its specific direction.

As a diligent researcher, I’ve observed that values surpassing 25 in my analysis often signify a robust trend. Interestingly, when the Average Directional Index (ADX) surges beyond 40, it underscores exceptionally strong trend strength, regardless of whether the trend is upward (bullish) or downward (bearish).

The directional signals underscore the growing bearish influence on SOL. The strength of the bullish trend, as indicated by the positive directional indicator (DI+), has noticeably decreased, dropping from 20.5 to 11.3, suggesting a substantial decline in bullish energy. Conversely, the negative directional indicator (DI-) has escalated from 26 to 38.3, underscoring an intensifying bearish control.

In unison, these markers clearly show that Solana (SOL) is currently experiencing a steady decline, and the robust ADX indicates this downtrend could persist for some time yet. However, if the +DI shows signs of improvement or -DI weakens significantly, it might suggest relief for SOL’s price in the immediate future.

SOL Price Prediction: Can Solana Go Below $140 In January?

If the ongoing bearish trend continues, the Solana price might reach its next potential support at approximately $159. If this level doesn’t prevent a fall, it could slide further to around $147, and if the downtrend remains robust, there’s a possibility of a decline to roughly $133. This represents about a 22.6% correction from current prices.

If the price of SOL regains its strength, it might test the resistance at $183. Overcoming this barrier could open up a path for a surge towards $203, indicating a substantial price rise.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

2025-01-14 03:29