As a seasoned researcher who has navigated through countless market cycles, I find myself cautiously observing Solana (SOL) at this juncture. The all-time high of $264 on November 22 was indeed an exciting milestone, but the subsequent correction is raising concerns among many in the crypto community.

On November 22, Solana (SOL) hit its highest price ever at $264, but it has since experienced a correction, declining approximately 10% over the last 24 hours. Analysis tools like BBTrend and DMI suggest an increase in bearish trends.

The EMA lines, although maintaining a positive trend, signal a possible impending crossover known as a “death cross,” which could strengthen the downtrend if it materializes. As Solana (SOL) nears significant support areas, its capacity to regain bullish strength will decide whether it retests the $248 resistance or experiences additional drops towards $194.

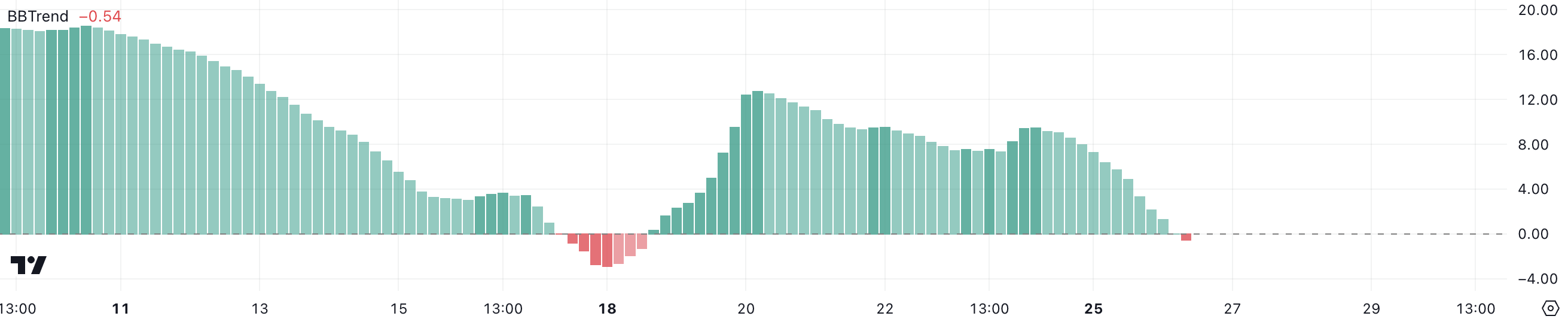

SOL BBTrend Is Negative for the First Time in 8 Days

For the first time since November 18, Solana’s BBTrend has dipped below zero, reaching -0.54. The BBTrend, short for Bollinger Bands Trend, is a tool that gauges the rate and direction of price changes in comparison to the Bollinger Bands. Positive values signal an upward trend while negative ones indicate a downward trend.

Moving towards lower values indicates a growing trend of pessimism, which is quite different from the optimistic surge seen only days ago when SOL hit an unprecedented high of 10.8 on November 20.

Despite -0.54 not appearing substantial at first glance, it signifies a noticeable shift in market opinion, as Solana (SOL) has dropped approximately 10% over the past day.

If the BBTrend persists in dropping, it might intensify the downward push for SOL, potentially leading it into a more significant slump. Consequently, we may witness additional price adjustments as selling activity increases and the market’s trust in its immediate rebound wanes.

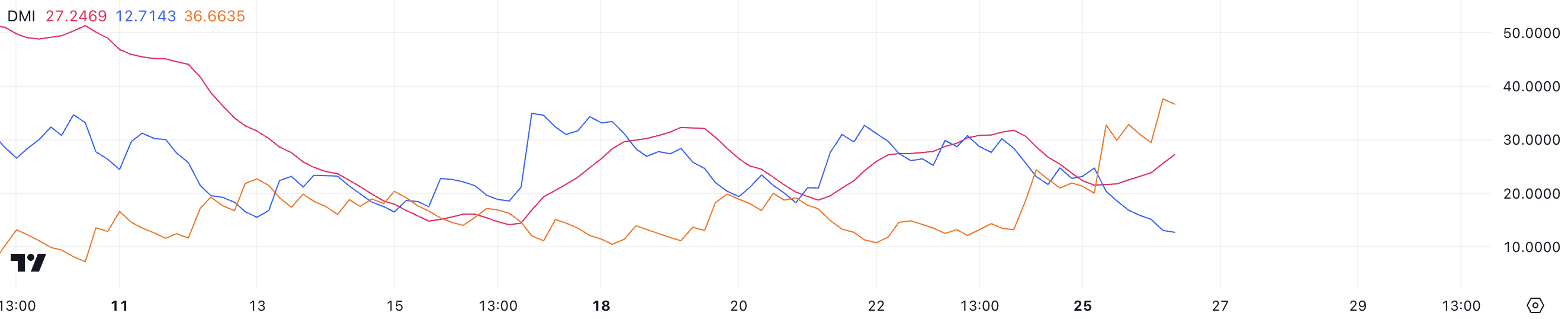

Solana Downtrend Is Getting Stronger

The SOL DMI chart demonstrates an increase in its ADX from 21 to 27.24, implying a more powerful directional momentum in the market. The ADX, or Average Directional Movement Index, gauges the intensity of a trend, with figures over 25 suggesting a substantial trend, whether positive (bullish) or negative (bearish).

For Solana, the growing ADX indicates a strengthening momentum within its ongoing downward trend, hinting that selling forces are becoming more pronounced.

The DMI indicators strengthen the negative trend, as D+ stands at 12.7 and D- at 36.6. This substantial difference indicates that the dominant force is the bearish one (D-), far surpassing the bullish forces (D+).

A rising ADX above 25 during a downward trend suggests that the selling pressure is strengthening. If this persists, it’s possible that the price of Solana may experience additional drops as the market increasingly favors buyers over sellers.

SOL Price Prediction: No New All-Time Highs For Now?

The current configuration of SOL EMA (Exponential Moving Average) lines offers a crucial situation. At this moment, the shorter-term EMAs are situated above the longer-term ones, which suggests that the optimistic (bullish) setup is yet to subside.

On the other hand, the fastest moving Exponential Moving Averages are descending and getting close to crossing paths with slower ones, which could suggest a “death cross” formation. This pattern usually signals a change from optimistic to pessimistic market conditions, causing traders to exercise caution.

If a “death cross” occurs with SOL, its downward correction might become more pronounced, causing the price to approach its closest support around $204. If this support doesn’t hold, the SOL price may fall even lower, potentially reaching $194.

If Solana manages to regain its upward push and reverse the current trend, it might face resistance at approximately $248. Overpowering this barrier could drive the SOL price beyond $264, establishing a new peak and bolstering optimistic feelings among investors.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-11-26 20:58