As a seasoned crypto investor with a decade of market experience under my belt, I’ve seen my fair share of bull runs and bear markets. The recent pullback in Solana (SOL) doesn’t faze me, especially considering its impressive year-to-date performance.

Currently, Solana’s (SOL) price is 12% lower than its record high, which it achieved on November 22. However, this recent dip hasn’t slowed down SOL’s impressive performance this year, as it has already gained a substantial 275.85%.

As I analyze the current market trends, it appears that technical indicators such as the BBTrend, DMI, and EMA lines are pointing towards a potential consolidation phase. This consolidation might pave the way for Solana (SOL) to test significant support and resistance levels in preparation for its next major price movement.

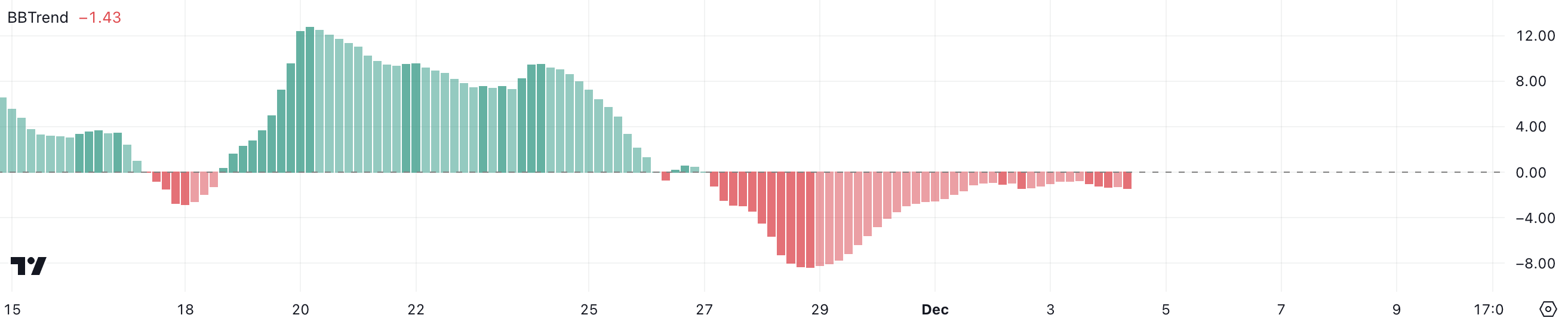

SOL BBTrend Is Negative, But Far from Its Peak

The current BBTrend value for Solana is -1.43, which represents a recovery from its most negative point of -8.34 on November 28. Despite staying negative since November 27, this slightly moderated value hints that Solana might be transitioning into a period of stabilization or consolidation.

SOL price could now stabilize within a narrower range as the bearish pressure appears to be easing.

BBTrend evaluates the directional movement of prices in relation to Bollinger Bands. A value less than zero suggests a downward trend, while a value greater than zero indicates an uptrend.

Currently, the Bearish Trend Level on Solana is less intense compared to its past minimal points. This could indicate a period of uncertainty, where the market is hesitating before making its next significant decision.

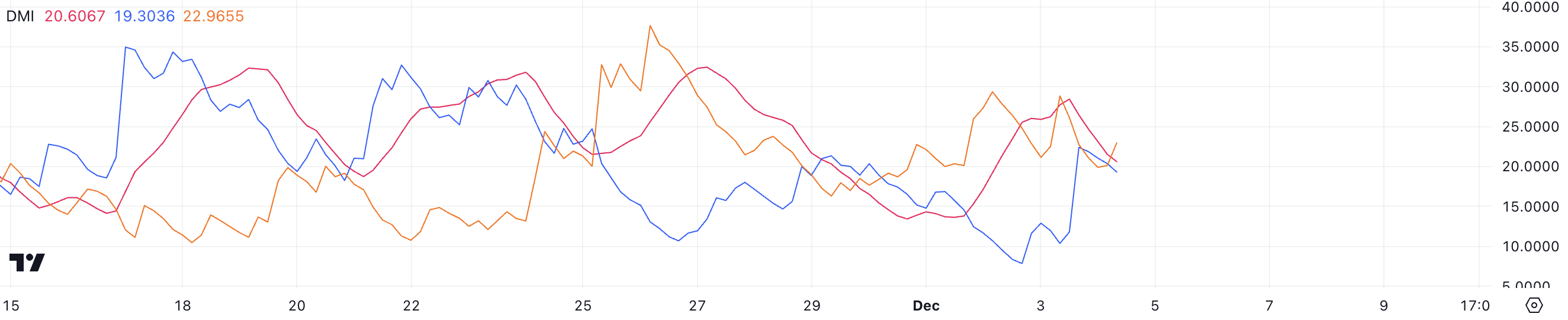

Solana Trend Isn’t Strong

The ADX value on SOL’s DMI chart has decreased from around 30 to 20.6 within a day, which could be an indication of lessening trend power, possibly hinting at a decrease in market thrust.

Currently, the D+ stands at 19.3, while the D- is slightly elevated at 22.9. This suggests that there’s a slight tilt towards bearishness, as it appears that sellers are managing to keep the upper hand over buyers.

The ADX (Average Directional Index) measures trend strength, regardless of direction. Values above 25 indicate a strong trend, while values below suggest a weak or consolidating market.

Translating the given text into simpler terms: The SOL’s DMI (Directional Movement Index) readings show that the market is still more bearish than bullish, though the difference between buying and selling pressure has decreased. This could signal a period of consolidation or possibly a change in market direction.

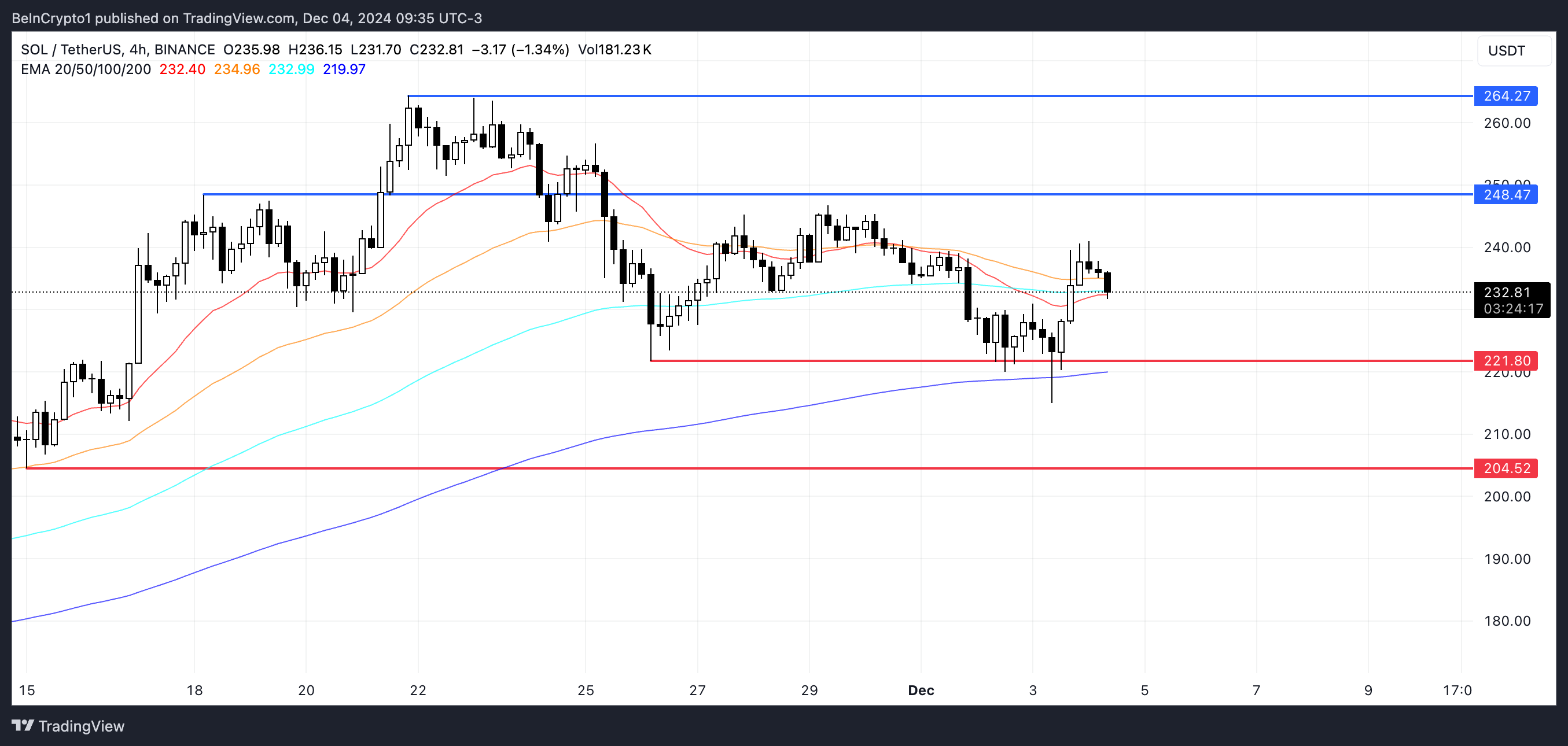

SOL Price Prediction: A Consolidation Before Trying New All-Time High?

In simpler terms, the Exponential Moving Averages (EMAs) on Solana have shown a bearish indication because the short-term EMA has dropped beneath the long-term one. But the small difference in their positions indicates that the price action is more about consolidation or stabilization, rather than a significant downward trend.

This could indicate a pause in market direction as traders await further cues.

In case a downward trend emerges, it’s possible that the price of SOL could reach a support point around $221. If this support is broken, there might be an additional drop to approximately $204. Conversely, if we see a recovery, Solana could potentially move towards a significant resistance level at $248.

Breaking this level could open the path to retesting its previous all-time high near $264.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Zenless Zone Zero 2.0 – release date, events, features, and anniversary rewards

2024-12-04 19:25