As a seasoned analyst with over a decade of market experience under my belt, I find myself intrigued by Solana’s (SOL) current predicament. The platform’s robust ecosystem and impressive user activity are undeniable indicators of its potential for growth, yet its recent 17% decline has cast a shadow over its $90.6 billion market cap.

The value of Solana (SOL) remains popular among users, as seen by high activity and transaction numbers on platforms like Raydium, Pumpfun, and Jito. However, over the last month, SOL has experienced a 17% decrease in price, causing it to lose its $100 billion market capitalization and now stand at approximately $90.6 billion.

Signals like BBTrend and ADX hint at a lessening downtrend, possibly followed by an upswing in momentum. Crucial points at $183 for support and $194.99 as resistance will decide if SOL finds stability and recovers toward $200 or continues to decline further.

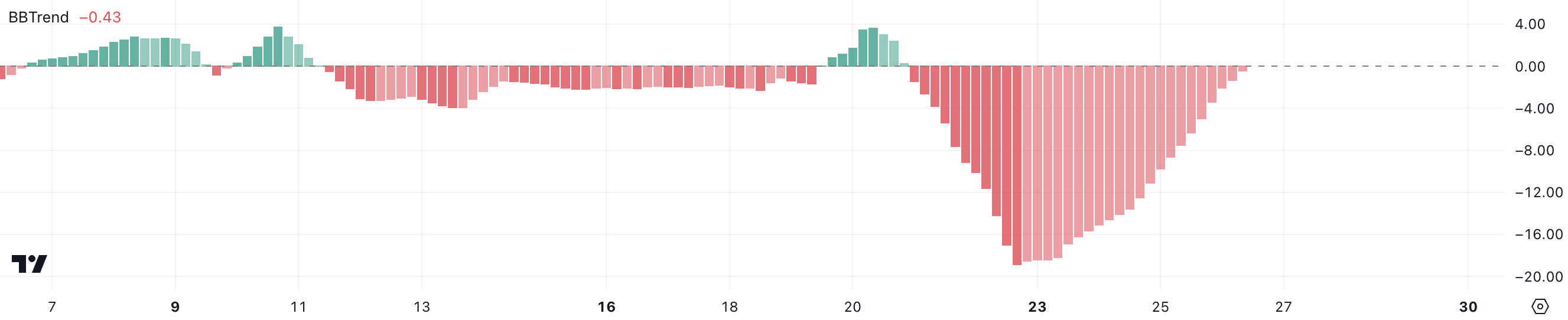

Solana BBTrend Is Almost Positive After 5 Days

Solana BBTrend is currently at -0.43, its highest level since December 21. This marks a significant recovery after hitting a low of -18.89 on December 22. This steady upward movement suggests that bearish momentum is weakening, and buying pressure has been gradually increasing over the past few days.

Even though SOL BBTrend remains negative at present, its movement towards neutral or even slightly positive territories suggests a change in market sentiment. This shift might foster price stability or potentially trigger an upward trend within the immediate future.

The term “BBTrend,” or “Bollinger Band Trend,” refers to an indicator based on Bollinger Bands that gauges how a price moves relative to the midpoint of those bands. When the BBTrend value is positive, it suggests bullish momentum; conversely, negative values indicate bearish tendencies.

As a researcher, if SOL’s BBTrend were to turn positive again, as it did on December 20th, it would serve as a strong confirmation of a complete reversal of bearish sentiment and possibly reinforce an ongoing upward price trend for Solana (SOL). In the short term, this persistent recovery in BBTrend offers a promising indication, implying that the SOL price might experience additional growth if the buying momentum maintains its current trajectory.

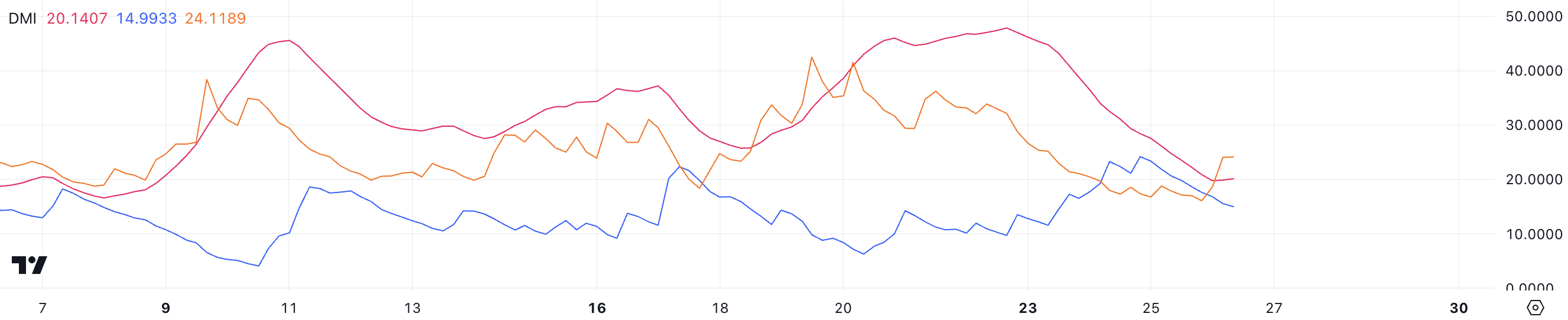

SOL Current Downtrend Isn’t that Strong, But It Could Recover

The Directional Movement Index (DMI) chart of Solana shows that its Average Directional Index (ADX) has dropped to 20.14, down significantly from around 50 only three days prior. This decrease suggests a marked reduction in trend intensity, with Solana still in a downtrend.

Two days ago, the D+ (indicator of buying pressure) dropped from 24 to 14.99, suggesting a decrease in buyers’ influence. Meanwhile, the D- (indicator of selling pressure) climbed from 17.3 to 24.11, indicating an increase in sellers’ activity. This pattern indicates that sellers are currently more active than buyers in the market, although a weakening ADX suggests that the bearish trend might be starting to fade out.

The ADX (Average Directional Movement Index) assesses the strength of a trend on a scale ranging from 0 to 100, without distinguishing between upward or downward trends. Values below 20 signal a weak trend, while those above 25 suggest a strong one. At present, Solana’s ADX stands at 20.14, indicating that the ongoing downtrend is gradually decreasing in intensity, despite the fact that selling activity continues to outweigh buying activity.

For a while, it’s possible that the Solana (SOL) price might find some balance or pause in its movement due to the absence of a clear trend, offering potential buyers a chance to rejoin the market. Yet, if the downward trend persists and sellers continue to have power, there’s a risk that prices could drop further.

Solana Price Prediction: Can SOL Rise Back to $200 Soon?

At the moment, Solana’s trading value is confined between two significant points: a floor at around $183 (a point expected to provide strong support) and a ceiling at approximately $194.99 (a point of potential resistance). If the support at $183 were to give way, the price of SOL might encounter extra downward pressure, possibly leading it to the subsequent key level situated around $175.

In this situation, if the trend of selling continues, the price of $183 becomes a crucial boundary that must be upheld to ensure short-term stability.

If the price of SOL overcomes its current resistance at $194.99 and starts to gain strength again, it might pave the way for additional growth in the future.

The next targets would be $204 and $215, marking a potential 14% upside from current levels.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-12-27 00:25