The value of Solana (SOL) has seen a significant drop, decreasing approximately 11% over the past week, following an unsuccessful attempt to surpass the $220 price barrier. After this rejection, SOL dipped below the crucial $200 mark, indicating an increase in bearish pressure.

In spite of the current slump, there are indications that whales are gradually building up their holdings again, as seen over the past five days with larger investors increasing their stakes. This trend suggests a possible price recovery, though Solar’s short-term prospects continue to face downward pressure.

SOL Whales Keep Accumulating

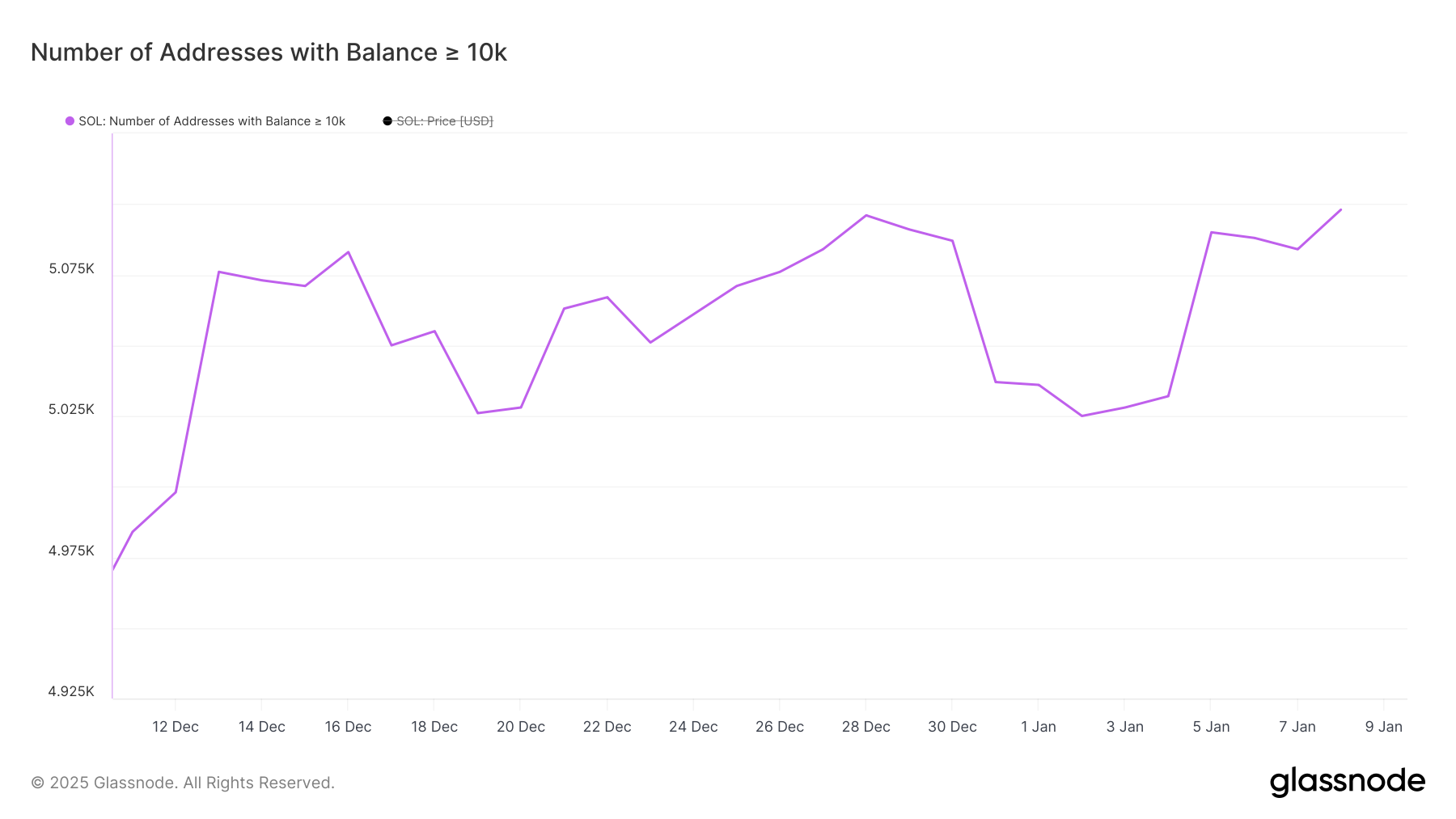

The count of wallets containing 10,000 SOL or more dropped noticeably from 5,096 to 5,025 over the course of December 28 through January 2, suggesting that major holders were offloading their assets during this timeframe. Keeping tabs on these “whales” is essential since their buying and selling actions can significantly influence market trends.

Reducing their investments may signal reduced confidence or the desire to cash out profits, which could increase the demand for selling and potentially cause prices to decrease.

As a researcher, I’ve observed an uptick in the number of whale addresses. The count increased from 5,025 on January 2 to 5,098 as of January 8. This resurgence could indicate that big investors are amassing more assets, potentially signaling a promising outlook for Solana’s price stability or recovery in the near term.

As a crypto investor, I’ve noticed Solana (SOL) experiencing a 14% drop over the past two days, which is certainly concerning. However, the escalating whale activity might be indicative of an improving sentiment and a potential basis for a price rebound if the trend persists. Historically, such market movements have hinted at shifts in investor confidence that could underpin SOL’s mid-term price stability.

Solana DMI Shows Sellers Are In Full Control

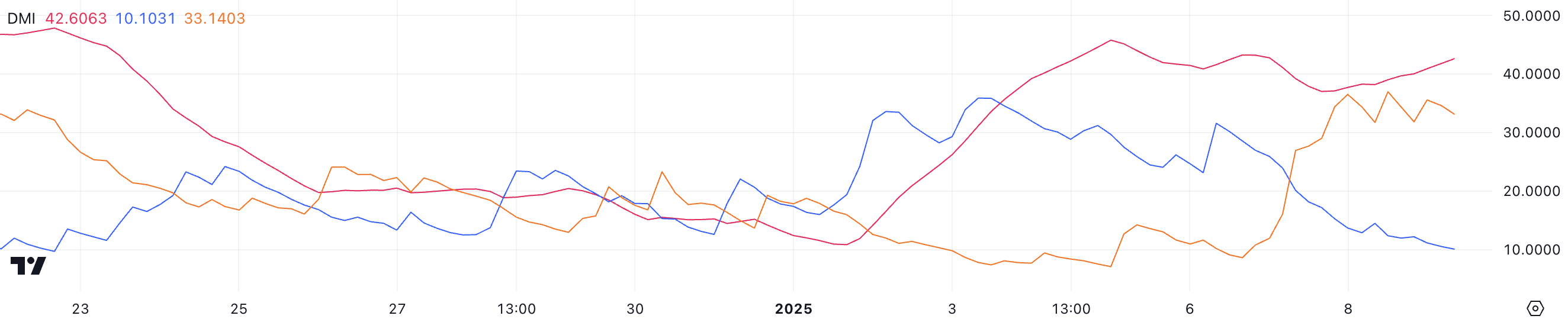

The Average Directional Index (ADX) for Solana (SOL) has risen to 42.6 today, up from 37 yesterday, suggesting a growing trend strength. This index measures the strength of trends regardless of direction, with scores between 0 and 100. Values exceeding 25 indicate a robust trend, while numbers below 20 hint at weak or non-existent momentum.

The increasing ADX indicates that the ongoing drop in SOL’s price is becoming more pronounced, implying that negative momentum is prevailing over the market.

Over the past three days, the directional indicators suggest that buying pressure (represented by +DI) has dropped dramatically from 31.5 to 10.1, implying a sharp decrease in bullish actions. In contrast, selling pressure (tracked by -DI) has spiked from 8.6 to 33.1, suggesting an increase in bearish trends.

These changes underscore the ongoing decline (or downtrend) and hint that the cost of Solana may experience further reductions if the purchasing activity doesn’t significantly improve to combat the prevailing pessimism.

SOL Price Prediction: Can It Recover the $200 Threshold?

Yesterday, the Exponential Moving Averages (EMA) on Solana showed a bearish trend, as the short-term EMAs dipped below their longer-term counterparts. This crossover, known as a death cross, is often interpreted as a strong bearish sign. Interestingly, this event comes at a time when there was a steep decline in price from $200, reinforcing the bearish sentiment.

Should the ongoing downward trend continue, the Solana (SOL) price might approach a vital support point around $185. If this level isn’t maintained, there’s a possibility of additional drops, with $176 emerging as a potential new low.

On the other hand, the latest behavior of whales offers a hint of hope. These significant investors have been gradually purchasing Solana (SOL) in recent times. This accumulation might suggest increasing faith among key players, possibly paving the way for a turnaround.

Should optimistic market pressure resurface, the Solana (SOL) price might strive to surpass the barrier at around $197. A successful breach above this point could open up possibilities for growth towards approximately $211, which would symbolize a potential 12.8% climb from its present position.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-10 03:17