As a seasoned analyst with over two decades of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The current trajectory of Solana (SOL) has me slightly concerned, especially given its impressive growth throughout 2024. However, it’s essential to remain objective and data-driven when analyzing market trends.

On November 22nd, Solana’s (SOL) price hit a record peak and climbed an astounding 208% in the year 2024, demonstrating remarkable growth. However, SOL has experienced some turbulence lately, dropping approximately 10% over the past month as pessimistic signals have started to impact the market.

The indicators like BBTrend and DMI show continuous selling activity and a decrease in the strength of the trend, which keeps Solana (SOL) in a watchful area. If SOL manages to maintain crucial support levels or bounce back to challenge new resistance points, it will decide its direction for the next few weeks.

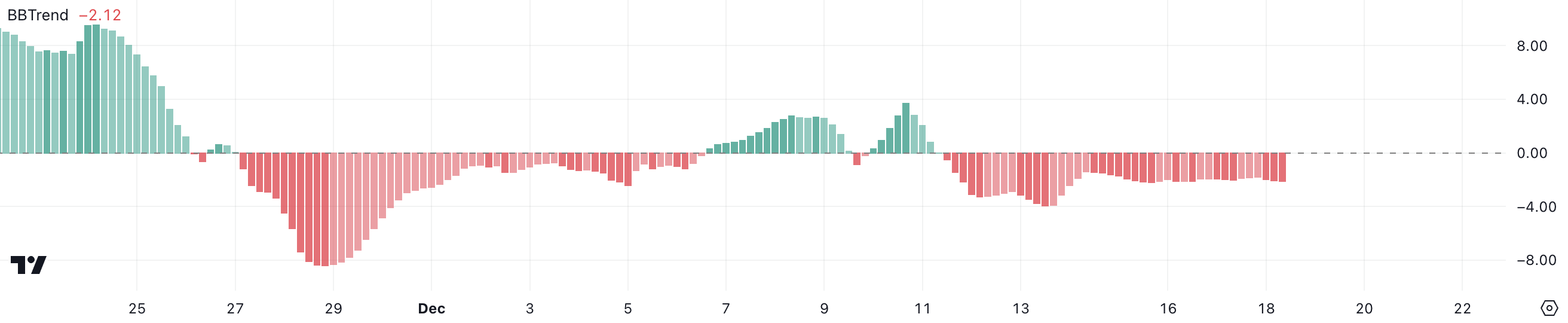

Solana BBTrend Is Still Negative

The SOL BBTrend is sitting at a level of -2.12 as of now, and it has been below zero since December 11, dipping to a low of -3.94 on the 13th of that month.

Starting from December 15, the value has stayed close to -2, suggesting a prolonged downtrend with few hints of an upturn. This implies that the selling force remains dominant, keeping Solana in a cautious investment climate.

The BBTrend is an indicator that gauges the power and movement of a price trend, originating from Bollinger Bands. When it shows a negative value, it suggests a downtrend or bearish momentum. A continuous stretch around -2 signifies a market experiencing difficulty in rebuilding its upward momentum.

For the price of Solana, it may suggest a possible prolonged period of horizontal movement (sideways) or continued decrease (downtrend), unless there’s a change in direction (shift in momentum) that would encourage a price increase (reversal).

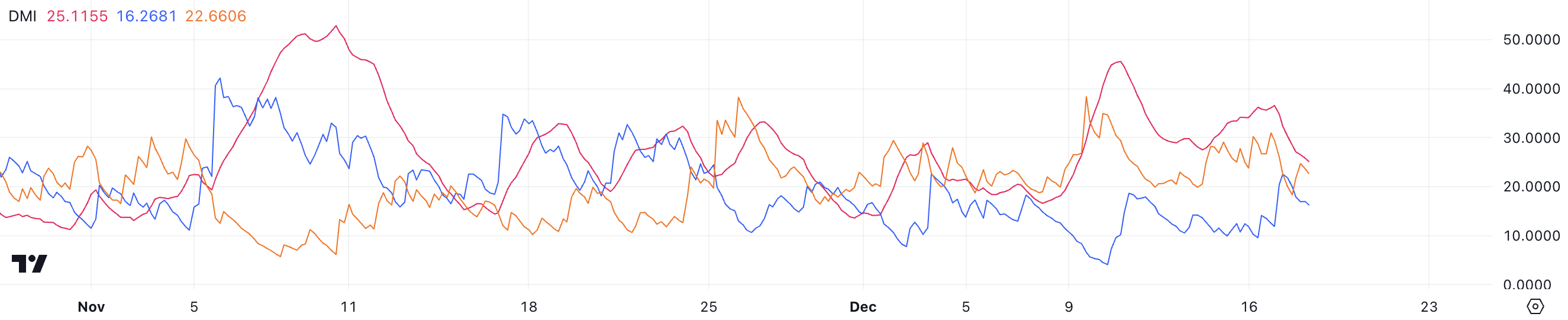

SOL Trend Isn’t That Strong Anymore

According to SOL’s DMI chart, its ADX has dropped noticeably from approximately 39 two days back to 25.11 now. This decrease suggests that the intensity of the ongoing trend, be it bullish or bearish, is becoming less powerful.

When the ADX value exceeds 25, it signals a somewhat robust trend. However, the current decline implies that the market’s momentum might be weakening.

The Average Directional Index (ADX) determines the intensity of a financial instrument’s price movement regardless of its direction. A reading higher than 25 signifies a robust trend, whereas a value less than 20 suggests a weaker or nondirectional market.

In the Solana scenario, the D+ at 16.2 and D- at 22.6 imply that there’s more bearish influence than bullish energy right now. This imbalance could indicate potential short-term decreases for SOL unless the buyers manage to overpower the sellers and drive the D+ value above the D-.

Solana Price Prediction: Can SOL Fall Back to $180?

At the moment, the Exponential Moving Averages (EMA) lines for Solana are arranged in a bearish fashion, as the short-term EMAs are situated beneath the long-term EMAs. This setup is known as a “death cross,” which was confirmed on December 15. Historically, this configuration usually indicates ongoing downward momentum. If this trend continues, it’s possible that Solana (SOL) could challenge the $203 support level.

If we can’t sustain this level of support, it might trigger additional declines, possibly pushing the price down to around $183 – a drop that would amount to nearly 15%. In simpler terms, if things don’t go well here, we could see a significant decrease in price.

If Solana’s price recovers its upward trajectory, it may attempt to surpass the resistance at $221. A successful breach above this level could open up opportunities for further growth, with Solana’s price possibly aiming for $234 and even $246 in the short term.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-18 20:59