As a seasoned analyst with over two decades of trading experience under my belt, I have seen market cycles come and go, bull runs and bear markets alike. The current sentiment among Solana (SOL) traders seems to be one of optimism, as they are betting on a swift recovery from the recent decline in the altcoin’s price.

Traders who deal with Solana (SOL) seem optimistic that the recent drop in its price is merely temporary rather than a prolonged period of volatility. This optimism can be seen in the long positions on Solana that have been established since the broader market’s liquidation, which resulted in losses amounting to hundreds of thousands of dollars.

However, does the current outlook align with general opinions on SOL’s price trend? Let me walk you through an in-depth examination of possible SOL price fluctuations.

Solana Traders Confident in the Altcoin’s Recovery

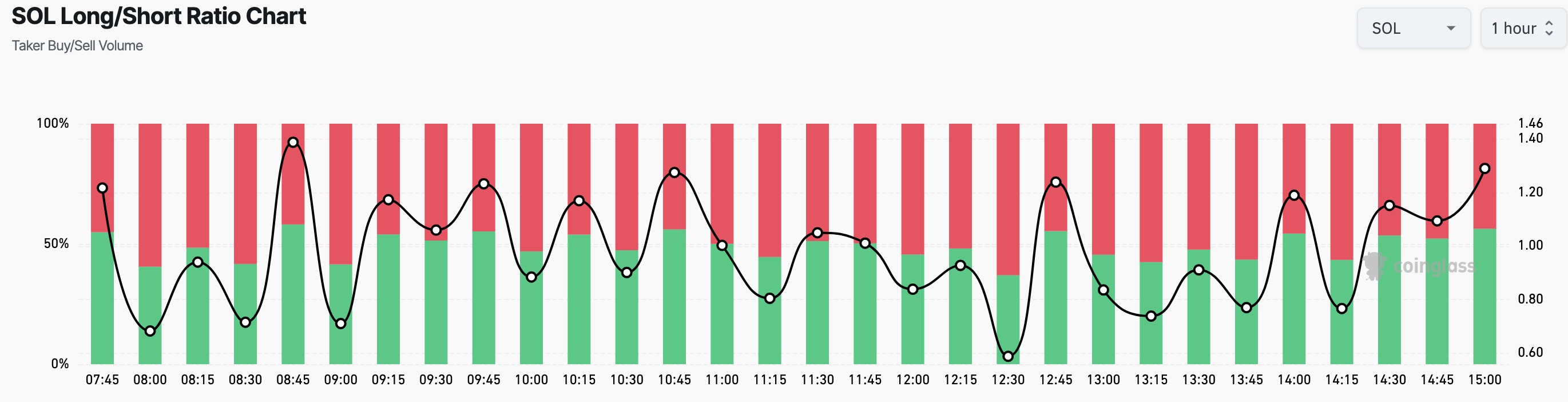

Based on data from Coinglass, the Solana Long/Short Ratio stands at 1.14. Essentially, this ratio functions like a weather vane for trader sentiment in the market. A value less than 1 suggests that short positions are more prevalent compared to long positions within the market.

In my study, a value surpassing 1 indicates a higher number of long positions compared to short ones. To clarify, long positions refer to traders who hold a belief that the price will rise, while short positions represent traders who predict a fall in the price.

Consequently, it appears that long positions on Solana are more prevalent in the market, suggesting a generally optimistic outlook. If this trend continues, it could prove beneficial for traders. Notably, this situation arises amidst the market experiencing its highest number of liquidations in recent times.

In the last 24 hours, around $60 million worth of SOL liquidations took place, with long positions contributing over $57 million and shorts accounting for the remaining balance. Liquidation happens when a trader’s collateral falls below the required level, causing the exchange to automatically close their position to prevent additional losses.

The drop in Solana’s price below $215 initiated a chain reaction of liquidations, leading to numerous margin calls and compulsory closure of positions.

SOL Price Prediction: Not Yet Time for a Rebound

Looking at the daily graph, the Sol price has fallen beneath both the 20-day and 50-day Exponential Moving Averages (EMA). These technical markers help determine the direction of the trend.

In simpler terms, when the cost exceeds the Moving Average (EMA), it indicates a positive or bullish trend. Conversely, if the cost falls beneath the Moving Average, it suggests a negative or bearish trend, as we’re seeing with Solana (SOL).

“A significant pattern on the graph shows that Solana’s price is currently below its key demand level at around $210. If this altcoin doesn’t manage to rebound above this point, the downtrend might strengthen, potentially causing the token’s value to drop to approximately $189.36.

If there’s a surge in demand for Solana, the price direction may flip, potentially causing it to rise towards $264.66.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-11 00:03